US trade tariffs have dominated public conversations in the past weeks, spooking investors away from areas of the world that might be more impacted. But sometimes, risks are overplayed and what sounds scary in name isn’t in practice.

That is the case for China, according to Dale Nicholls, manager of the Fidelity China Special Situations fund, who said all the negative press it receives – whether it be macro or geopolitical – is precisely what makes China a “really great market”.

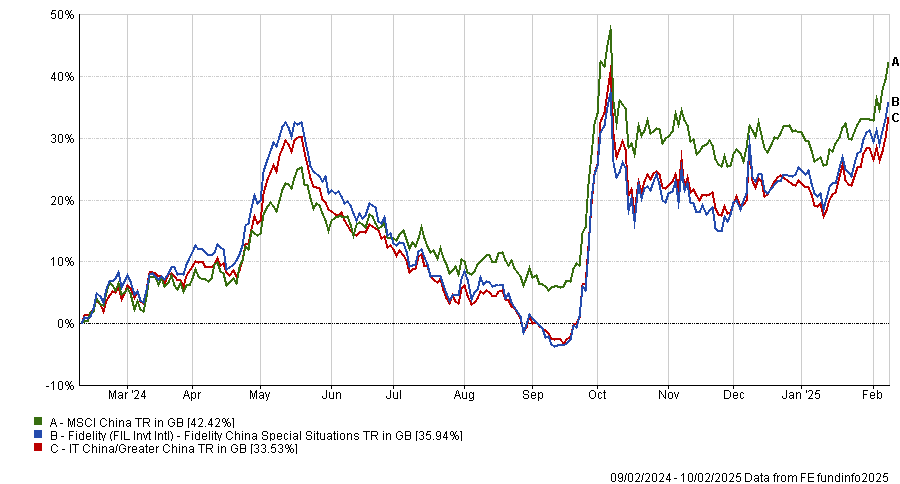

Performance of fund against sector and index over 1yr

Source: FE Analytics

“Despite all the talk about 60% tariffs on China, which has circulated since Donald Trump started running for US president, the vast majority of revenues that most Chinese companies produce are within China, not outside,” he explained. “In the MSCI China index, the portion of revenues that goes to the US is less than 3%.”

Nicholls is a bottom-up stock picker, whose view of the market is based on companies’ fundamentals rather than top-down considerations. One of the key point to his investment strategy is understanding what is priced in by the market, as he recently told Trustnet.

“It’s very interesting seeing the market the way I do. It's not like these risks around tariffs aren't well flagged – in fact, they are very well flagged, and a lot of fears about China are well priced in,” he said. “They are also well understood not only by investors but also companies. My focus is on companies, and they are getting on with it, growing their earnings and increasingly giving capital back to shareholders.”

The idea of tariffs isn’t new either, the manager pointed out, with many Chinese companies that having paid 25% tariffs since the first Trump administration. Many have adapted by moving production offshore, for example, or by compounding their research and development spend, which has grown by about 20% over the past decade.

“Chinese companies are well used to operating in this type of environment. They have had lots of time to adjust and have grown more competitive,” Nicholls said.

“This increase in competitiveness is not well appreciated. Many companies have expanded market share, including in the US [although] obviously, they're growing faster outside of the US.”

Whole new industries have been created, such as the electric vehicle (EV) sector, which China dominates, producing 60% to 70% of global EVs.

The launch of AI chatbot DeepSeek also sent shockwaves in the technology market two weeks ago and raised awareness of China’s competitiveness.

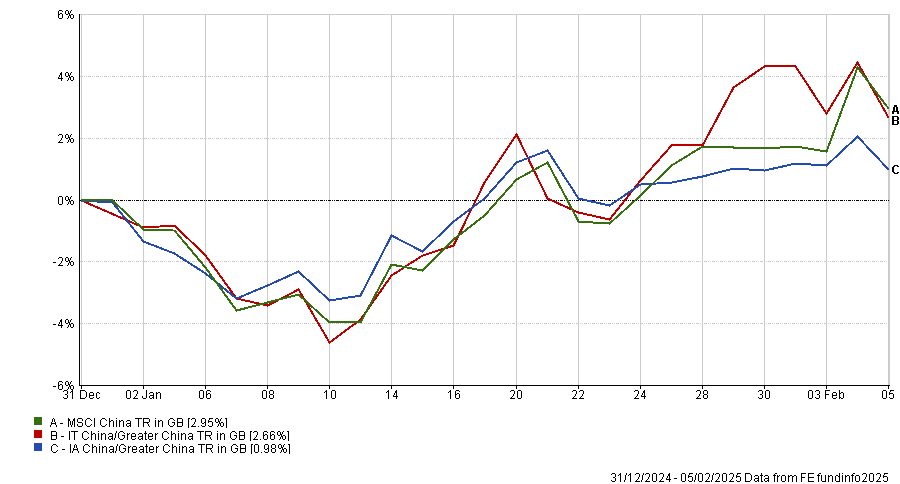

Performance of sectors and index over the year to date

Source: FE Analytics

Some fund selectors are becoming more positive on China. Darius McDermott, managing director of FundCalibre, recently wrote on Trustnet that if the stimulus from the Chinese government proves more meaningful, “there is no doubt China looks an attractive prospect”.

“Clearly China is not without risk, but it does appear the policy pivot is a meaningful one. With Chinese equities trading at a huge 55% discount to US equities, China could offer an attractive entry point for medium to long-term investors,” he said.

To harness this potential, McDermott suggested Nicholls’ Special Situations fund, among four others.

Nicholls is based in Singapore and Fidelity’s first-hand resources in the region are one of the reasons why his fund is one of Fidelity’s best-known vehicles.