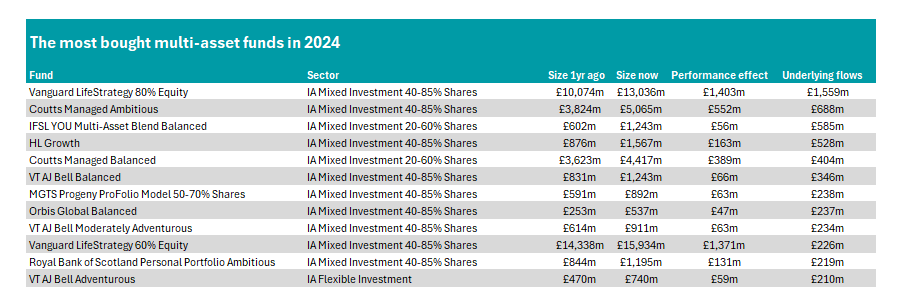

Vanguard LifeStrategy 80% Equity was the most popular fund among all multi-asset sectors last year, according to data from FE Analytics, as the behemoth portfolio raked in more than £1.5bn from investors.

Managed by the passive team at Vanguard, the fund started the year with assets under management (AUM) of £10bn but this climbed to £13bn by the end of the year thanks to broadly equal uplifts from net new inflows and performance, as the below table shows.

The fund invests in Vanguard’s own suite of index funds and is split 80% in equities and 20% in fixed income. Within the former, around 25% is in the UK with 75% overseas, including the US, Europe, Japan, and a small exposure to emerging markets. Within bonds, the broad mix is 30% UK and 70% overseas.

Analysts at interactive investor included the fund in their Super 60 best-buy list. They said: “The fund employs a straightforward, diversified and low-cost approach, making it a sound long-term option.”

It has been the fifth-best performer in the IA Mixed Investment 40-85% Shares sector over the past decade, while it is in the top-quartile of the sector over one, three and five years as well.

Source: FE Analytics

In this study, we looked at funds with the largest net inflows and outflows in the Investment Association Mixed Investment sectors, as well as the IA Flexible Investment sector. We capped the minimum at £200m in net additions and withdrawals.

Vanguard LifeStrategy 80% Equity was joined on the most-bought list by its sister portfolio Vanguard LifeStrategy 60% Equity, which resides in the same IA Mixed Investment 40-85% Shares sector. Its AUM rose from £14.4bn to £15.9bn over the course of the year, although this rise was more performance-based than due to net inflows.

The second most-bought multi-asset fund of the year was Coutts Managed Ambitious, followed by IFSL YOU Multi-Asset Blend Balanced, HL Growth and Coutts Managed Balanced.

There were no funds on the list from IA Mixed Investment 0-35% Shares sector, while VT AJ Bell Adventurous was the only member of the IA Flexible Investment to make the list, with net inflows of £210m.

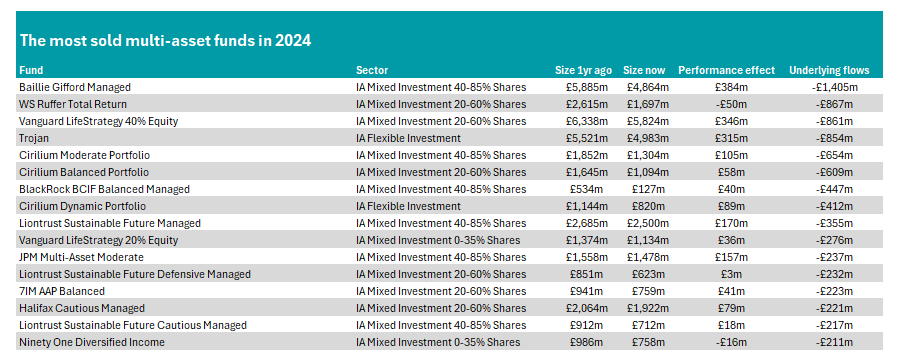

On the opposite side of the equation, investors pulled some £1.4bn from Baillie Gifford Managed. The fund, run by Iain McCombie and Steven Hay, has been a top 10 performer in the IA Mixed Investment 40-85% Shares sector over the past decade and recent 12-month performance has also been strong.

However, its three-year numbers have been less impressive, with the portfolio sitting in the fourth quartile of the peer group over this time, following back-to-back poor years in 2021 and 2022 – the latter of which it was the worst fund in the sector, down 24.3%, as rising interest rates hammered the growth stocks synonymous with Baillie Gifford’s investment approach.

Despite this, analysts at Hargreaves Lansdown continue to back the portfolio, including it in their Wealth List of recommended funds.

“The managers think shares will be the main driver of returns over the long run and they invest in businesses they feel possess exceptional growth potential. Shares tend to make up more of the fund compared with others in the same sector, so we think this is a more adventurous option,” they said.

“It could boost the growth of a more defensive investment portfolio with a focus on bonds or add a little stability to a portfolio focused on shares.”

Source: FE Analytics

The second most-sold multi-asset fund of last year was WS Ruffer Total Return, which resides in the IA Mixed Investment 20-60% Shares sector. Run by FE fundinfo Alpha Manager Steve Russell alongside Alexander Chartres and Matt Smith, the fund invests in a mix of inflation-protecting assets such as gold and index-linked bonds, defensive assets (cash, derivatives and short-dated bonds) and growth, such as stocks and commodities.

WS Ruffer Total Return is a defensive portfolio and has proven its worth during difficult markets such as in 2022, but has failed to keep up with the rising tide in more prosperous years. As such, it has been a bottom-quartile performer over one and three years, as well as over the past decade.

Investors pulled £867m out of the fund last year. Alongside a negative return, this caused the AUM to fall from £2.6bn at the start of the year to £1.7bn by 31 December.

From the same sector, Vanguard LifeStrategy 40% Equity had the third-largest withdrawals as investors pulled £861m from the behemoth fund – a stark contrast to its riskier sister portfolios, although this could be a reflection of investors switching between different Vanguard funds to take on more risk. Similarly, Vanguard LifeStrategy 20% Equity in the IA Mixed Investment 0-35% Shares sector, also made the most-sold list.