Investment trusts have traded at double-digit discounts for a record 29 months with an average discount of 15% currently (excluding venture capital trusts and 3i Group). Wide discounts, underperformance and, in some cases, board inaction have provoked the ire of activist investor Saba Capital Management, which earlier this week launched a new campaign to persuade four trusts to convert to open-ended funds.

The stubborn persistence of discounts, Saba’s so-far failed attempt to unseat the boards of seven trusts, as well as other investment managers engaging more constructively with boards behind the scenes, have prompted boards to take action.

Trusts have pursued a variety of measures, with varying levels of success. These include share buybacks, tender offers, mergers, continuation votes, liquidation, rolling into similar open-ended strategies, fee changes, increasing the dividend, swapping investment managers, altering the investment strategy, rejigging the portfolio and improving communications with shareholders. Many trusts have adopted several of these solutions in a concerted effort to create value for shareholders.

Last year there were 10 mergers, seven liquidations, seven acquisitions, fee changes at 32 investment trusts and a record volume of buybacks, with £7.5bn of shares repurchased (almost double the previous record of £3.9bn set in 2023, according to the Association of Investment Companies).

Even so, Matt Ennion, head of investment fund research at Quilter Cheviot Investment Management, thinks boards should be doing more. “We question boards’ proactivity around discounts,” he said. “They’ve all dragged their feet a bit.”

Quilter Cheviot has been engaging with the boards of several trusts. “We’ve been encouraging more proactivity, particularly as the size of discounts across the sector has persisted for the past three years, so it can’t just continue,” he said.

“We’ve been challenging boards to be proactive and think outside the box about what they can do and challenge the status quo.”

For instance, he has suggested selling lower performing assets and recycling capital into better performing areas, rather than holding onto assets through the cycle.

Patria Private Equity did this in October by selling 14 older vintage and non-core investments, worth 13% of its net asset value (NAV), into the secondary market at a 5% discount.

As another example of shareholder-friendly action, Greencoat UK Wind changed its fee structure to be based on its share price rather than NAV, which Ennion said provides a greater incentive to the trust’s investment managers to address the discount because they are “taking the hit” alongside shareholders.

Buybacks programmes, meanwhile, have had mixed results because they are highly dependent on the exit environment; in other words, trusts need to be able to sell assets to raise cash to buy back shares, he explained.

Discounts are a double-edged sword; they can be a source of frustration for shareholders or a buying opportunity for new investors. Indeed, some funds and trusts such as MIGO Opportunities specialise in investing in discounted trusts with a catalyst for share price recovery.

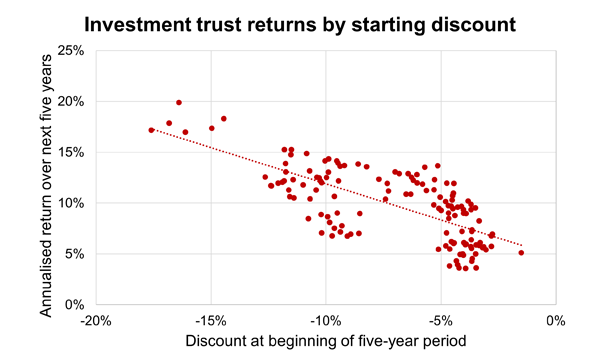

Nick Britton, research director at the AIC, said: “If you’re interested in the opportunity to bag a bargain, then now looks like a good time to go shopping. Our research demonstrates what will be obvious to any investment trust aficionado: that investing at deeper discounts produces better returns over the following five years.”

Sources: AIC and Morningstar, based on 139 overlapping five-year periods starting in June 2008 (beginning of cum fair discount history)

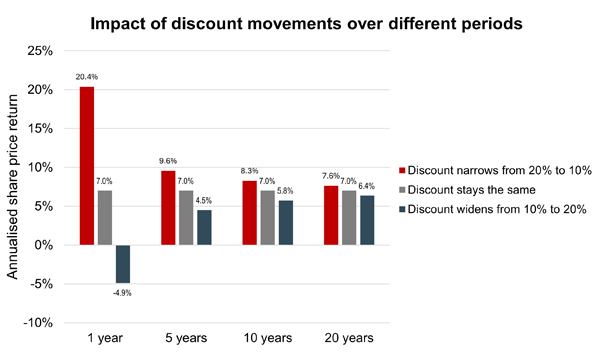

However, the impact of discounts on performance lessens over time. The chart below illustrates how a discount widening or narrowing affects returns over different time periods, for a trust whose NAV grows at 7% per annum.

Source: AIC

Furthermore, persistent and stable discounts theoretically have no impact whatsoever on returns. “Take an investment trust where the NAV grows at 7% a year over a 10-year period. Invest at a 20% discount and sell at a 20% discount, and your return is – you’ve guessed it – 7% a year. If the trust pays an income, investing at a stable discount produces a better return,” Britton explained.

“Of course, discounts don’t usually stay the same. But their effect on your return fades as your time horizon increases [as the chart above illustrates]. Long-term investors should be more concerned about what’s going on inside the portfolio.”