Capital Group has reduced its forecasts for equity returns due to high valuations, increasing market concentration and strong performance over the past two years, during which price appreciation has outstripped earnings growth.

Long-term investors still have everything to play for, however, with stocks set to deliver mid- to high-single digit annualised returns and bonds on course for low- to mid-single digits.

The manager expects US equities, which are supported by earnings growth, innovation and productivity gains, to return an average of 6.3% per annum for the next 20 years. US equities also have the highest Sharpe ratio of the major stock markets.

The forecast for global equities is also 6.3%, while non-US developed market equities – which have more reasonable valuations and higher dividend yields than the US – are pegged at 6%.

Capital Group predicts that Japanese and emerging market equities will outperform, returning 7% and 6.8%, respectively.

Japan is benefitting from better corporate governance, wider profit margins and earnings per share growth. A meaningful appreciation of the yen against the dollar would be a further tailwind.

In emerging markets, faster economic growth and attractive valuations should drive returns. Nonetheless, Capital Group is concerned about corporate governance in some countries, a lack of labour participation, weak infrastructure and unstable politics. Companies are expected to issue more stock than they buy back to fund growth, which could dilute earnings per share.

Continental European stocks are the laggard with an annualised return forecast of 5.7%. Europe faces multiple headwinds, including tariffs, trade tensions, slower exports and muted economic growth.

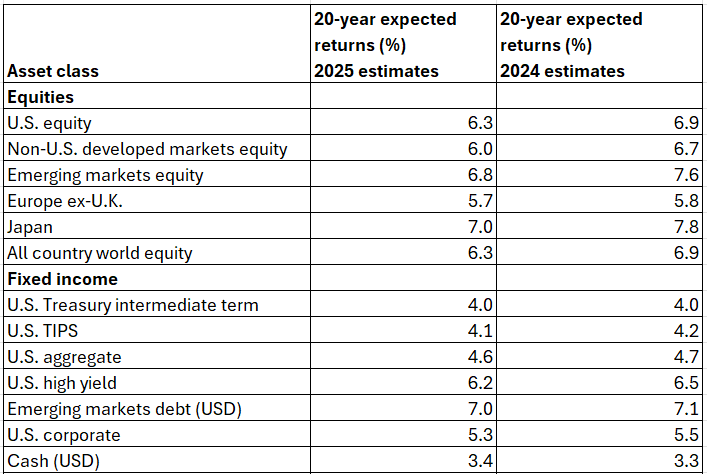

These return forecasts have all been revised downwards since the manager last published its Capital Market Assumptions a year ago, as the table below shows.

Asset class return expectations

Source: Capital Group

Maddi Dessner, head of asset class services at Capital Group, said: “While we’ve lowered our return expectations for global equities, we expect to continue to see bright pockets of opportunity driven by structural and cyclical factors.”

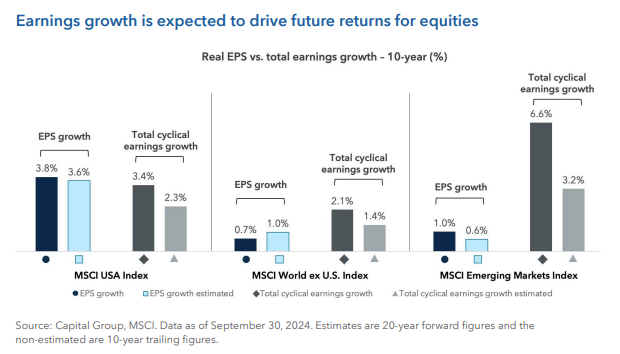

Going forward, Capital Group believes earnings growth will drive returns. It expects price-to-earnings (P/E) multiples to contract in most regions and expand only modestly in emerging markets.

Growth stocks are the most expensive and therefore, their multiples are likely to contract the most. Tech giants will continue to deliver profits on the back of artificial intelligence and innovation but at a slower pace and magnitude than in the past year or so.

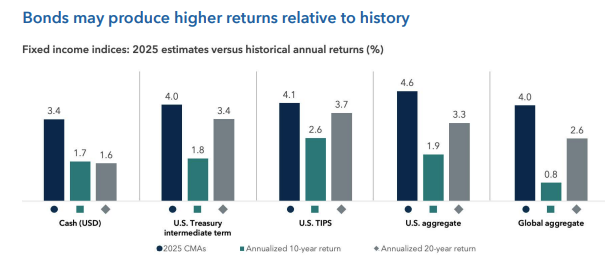

While equities are unlikely to match their impressive performance over the past two decades, the future looks brighter for fixed income. Bonds are expected to perform better going forward than in the recent past, as the chart below shows. However, Capital Group has revised its expectations slightly downwards since last year because starting yields are modestly lower and spreads have compressed.

Source: Capital Group

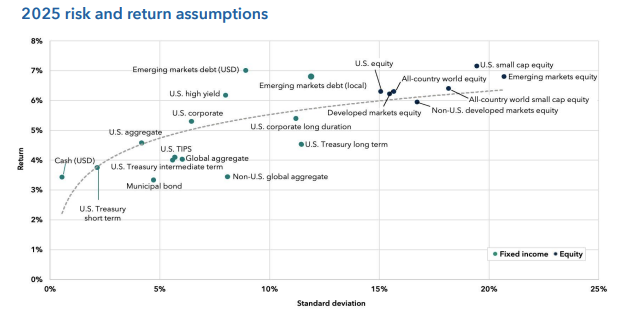

US high yield and emerging market debt have the potential to generate higher income for investors and rank well on a risk-adjusted basis – as illustrated in the chart below, which compares risk and return assumptions for a range of asset classes.

Source: Capital Group; data to 31 Dec 2024 with valuations as of 30 Sep 2024

Meanwhile, US Treasury yields could experience upward pressure due to record issuance, a growing public debt burden and a shift to more price-sensitive buyers.

Staying in the US, the dollar is likely to fall against a broad basket of currencies, although Capital Group now expects the pace of depreciation to be slower than it anticipated last year because the gap in productivity between the US and other countries has widened.

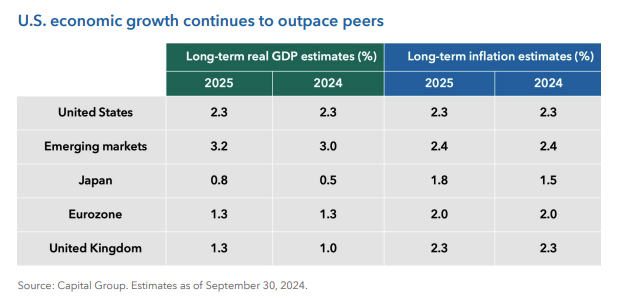

On the economic front, the US economy is on track to continue outperforming other regions, as the table below shows. Under the new Republican administration, the tailwinds of lighter regulation, more fiscal spending and corporate tax cuts are counterbalanced by the headwinds of tariffs, reduced immigration and higher inflation.

Elsewhere, Capital Group has increased its estimate for the UK’s growth rate by 25 basis points to 1.25% due to stronger-than-expected migration flows post-Brexit, which are offsetting the UK’s low fertility rate.

Lastly, although most major central banks have started to ease monetary policy, Capital Group expects the pace of cuts will be gradual with higher interest rates persisting across major markets, amidst relatively robust economic growth.