The sustainable investment industry has been accused of over-complicating matters, not least because there are so many different definitions of what sustainable means.

Hamish Chamberlayne’s approach, as head of global sustainable equities at Janus Henderson Investors, boils this down to two questions: is the world a better place because of this company and is this company going to grow wealth?

Meta Platforms doesn’t pass the first hurdle, he said, whereas Microsoft and Nvidia are “driving enormous amounts of positive progress”.

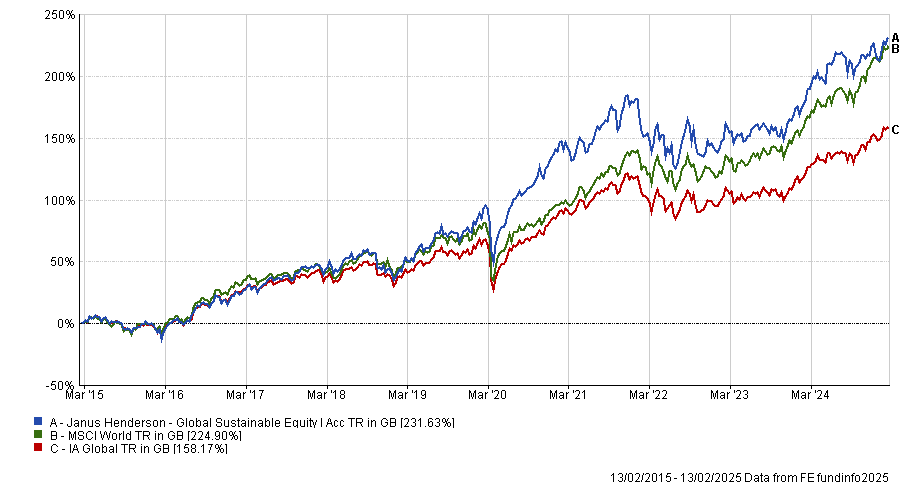

Chamberlayne helms the £1.9bn Janus Henderson Global Sustainable Equity fund, whose exposure to Microsoft and Nvidia has been a tailwind to performance. The fund is top quartile within the IA Global sector over a decade to 10 February 2025 and second quartile over three and five years (i.e. above the peer group average). It has slipped to third quartile over 12 months, however.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Chamberlayne explains below why he has taken profits from Microsoft and Nvidia, and where he has found better near-term free cashflows.

Describe your investment process

Our number one objective is to grow and compound our clients’ wealth and we think the best way to do that is to find companies which are aligned with the transition to a more sustainable economy, which we think is a multi-year trend.

So our investment process is really simple. It's based on answering two key questions, a sustainability question and a financial question. Is the world a better place because of this company? And is this company going to grow wealth?

We’ve got 10 themes: cleaner energy, water management, efficiency, environmental services and sustainable transport on the environmental side; and on the social side, knowledge and technology, sustainable property and finance, safety, quality of life and health. We believe businesses aligned with those themes are more likely to have growing and compounding revenues, so it's an alpha generation framework.

Why is Microsoft your largest holding?

We've held Microsoft for a decade and it is split between our knowledge and technology, and cleaner energy themes. It has one of the most attractive business models in the world, with a high degree of recurring revenue.

Performance of Microsoft over 5yrs

Source: Google Finance

I compare Microsoft to a utility. When you wake up in the morning, you hit the light switch or turn on a tap without thinking about it and Microsoft is similar. You turn on your computer and start using business productivity tools such as Outlook or Teams without giving it a second thought.

Another interesting thought exercise is to imagine if Microsoft didn't exist. If you woke up one morning and Microsoft was no longer there, you’d certainly notice.

Microsoft has positioned itself as a leader in the decarbonisation of computing. It wants to become net-zero carbon by 2030 and carbon negative by 2050. Microsoft is able to make these ambitious commitments because it is investing directly in renewable energy. Over the past decade, up to 50% of renewable energy investment, if not more, has been made by technology companies.

We also believe Microsoft can generate stronger revenue growth by bringing artificial intelligence (AI) to its customer base with tools such as Copilot.

However, we have taken some profits because of Microsoft’s enormous capital spending on AI. It has struck a deal with Constellation Energy to restart the Three Mile Island nuclear power station in Pennsylvania, which is going to take at least three years to get back online, so we think there might be risk around the pace at which this infrastructure build-out happens.

What’s your investment thesis for Nvidia?

Nvidia is in our efficiency theme and we’ve held it for more than four years. It invented the GPU [graphics processing unit] computing chip so it really is at the heart of the AI revolution. The impact of more efficient GPUs has been extremely visible.

According to research by the International Energy Agency, global data centre energy consumption remained flat between 2010 and 2020, despite a 12-fold increase in internet traffic and an eight-fold increase in data centre capacity globally, which is quite astonishing.

Performance of Nvidia over 5yrs

Source: Google Finance

Training large language models used to be prohibitively expensive but GPUs such as Hopper and Blackwell have brought the cost down to a more affordable level, which has resulted in an explosion in demand.

We reduced our Nvidia position over the course of last year. We still like it but we've taken some profits because the implications for power demand and its impact on the grid are eye-catching.

Where have you reallocated capital?

One of our recent investments is Taiwan Semiconductor Manufacturing Company (TSMC), which manufactures more than 50% of the world's semiconductor chips. It uses incredibly sophisticated equipment from ASML, in which we also invest.

TMSC expects its revenues to grow at a 20% annualised rate for the next five years thanks to the growth in demand for AI chips.

We also like it because it's got a diversified book of business. About 20% of TSMC’s business is in AI, and we see that growing to become roughly 50% over the next five years, but the rest of the business includes high performance computing, smartphones, the internet of things and the automotive sector, so it’s not putting all its eggs in the AI basket.

It's trading on a price-to-earnings multiple below 20x with 4.5% free cash flow yield and it is growing at more than 20%.

We've also been investing in electric cabling companies such as Prysmian because we see a massive need for grid infrastructure improvement.

What were your best and worst performing investments over the past year?

Last year was all about AI and we benefitted from holding Nvidia and Microsoft, but we didn't have the full complement of Magnificent Seven stocks. Prysmian was another good name.

Performance of Prysmian over 1yr

Source: Google Finance

Aptiv, the automotive technology supplier, was one of our worst performers. It makes wiring harnesses for electric vehicles (EVs) and provides advanced driver assistance systems. Car sales have been slowing in Europe and the US, although Aptiv does have supplier relationships in China.

Performance of Aptiv over 1yr

Source: Google Finance

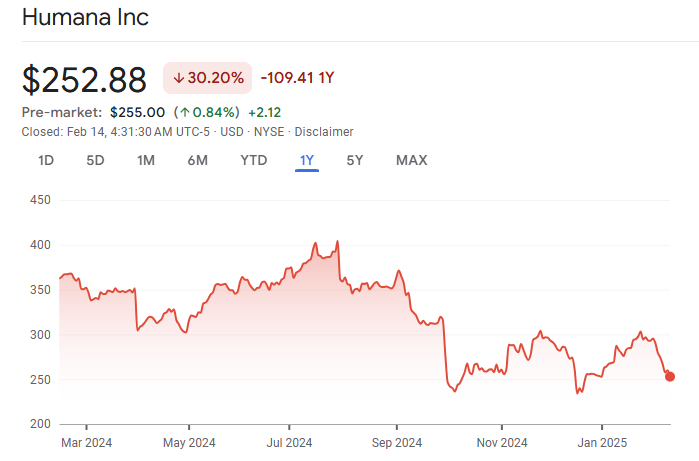

Also, some of our healthcare names were on the wrong side of politics last year, such as Humana, which is the leading provider of Medicare Advantage insurance plans in the US.

The Democrats were quite harsh on health insurance companies, whereas we see them as part of the solution for America's healthcare system. US president Donald Trump has picked Mehmet Oz to lead Medicare and Medicaid Services, who has written about insurance companies being a key solution provider, so we expect the regulatory approach to become more constructive.

Performance of Humana over 1yr

Source: Google Finance

What do you enjoy doing outside of investing?

My children keep me busy and I've been playing a lot of chess with them. Sea swimming is one of my great pleasures, all year round.