Gold reached a new record high last week after breaking through the $2,900 per ounce (oz) barrier for the first time, leading investors to question how much higher the yellow metal could go in the current uncertain climate.

Several factors have converged to start a gold rally, including US president Donald Trump’s threat of a trade war, his calls for lower interest rates (which are generally supportive for the metal) and ongoing geopolitical tensions in the Middle East and Ukraine.

AJ Bell investment director Russ Mould said gold could be in its third major bull market since 1970.

The first came after US president Richard Nixon pulled the US out of the gold standard in 1971, which saw the metal rally from $35 an ounce in 1971 to peak above $700 in late 1980.

The second gold bull market was in the early part of this millennium, when the metal went from $250 an ounce in 2001 to a new high of almost $1,800 by early 2021 as investors looked for safe havens after the global financial crisis.

Performance of gold spot price over 1yr

Source: FE Analytics

“Now we have what looks like a third era in which gold is really starting to shine,” he said.

“The metal dipped below $1,200 an ounce in late 2018 but has since marched inexorably higher. Covid-19 and more quantitative easing, more interest rate cuts and, above all, more government deficit accumulation all combined to persuade investors to warm to gold once more, as supply of the metal grew so much more slowly than the supply of money.”

Nitesh Shah, head of commodities and macroeconomic research at WisdomTree, noted that although gold has been hitting fresh highs recently it has not yet reached its all-time inflation-adjusted high from 1980.

However, the gap has narrowed significantly and stands at just 22%, which is the closest it has been in 40 years.

“This impressive performance reflects a combination of factors, including economic uncertainty, inflation concerns and central bank policies, which have driven demand for gold as a safe-haven asset. With such momentum, will 2025 be another record-setting year for gold?” he asked.

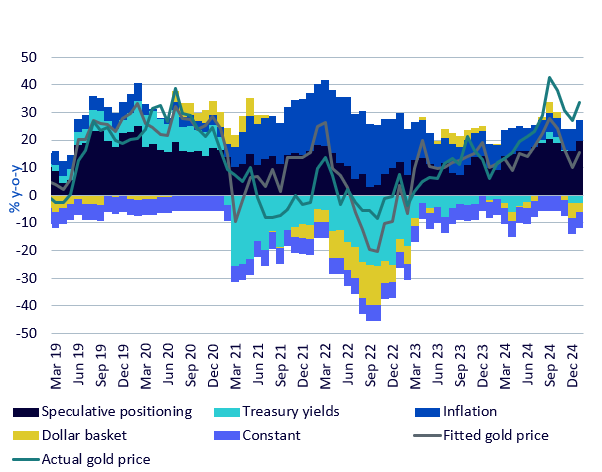

Gold price attribution

Source: Bloomberg, WisdomTree price model, data as of Jan 2025

In WisdomTree’s model framework above, the ‘fitted gold price’ is the price the model would have forecast but the actual gold price is currently exceeding this. The model suggests speculative positioning has become the biggest driver of gold prices over the past year.

“Our model indicates a fair value for gold at the end of January 2025 of approximately $2,370/oz, representing a 15% year-on-year gain. However, gold prices rose nearly 33% year-on-year to $2,740/oz by the end of January, significantly exceeding this fair value,” Shah explained.

“This suggests potential for a pullback. The additional strength in gold may reflect strong sentiment towards the asset, which is not fully captured by the speculative positioning indicator.”

But Nigel Green, chief executive of deVere Group, thinks the gold rally has some way to run yet as two additional factors look poised to give it “unstoppable” momentum.

Firstly, he pointed to a potential revaluation of America’s gold reserves. The US’ gold holdings are currently valued an outdated $42/oz but there is speculation that the Treasury will revalue them at market prices.

This would inject an estimated $800trn into the Treasury General Account, Green explained, which would reduce the US government’s reliance on bond issuance and strengthen confidence in gold as a monetary asset.

“Re-marking gold to its real market value could be a transformative financial event,” he added.

Secondly, China has approved a pilot programme to allow insurers to invest in gold. This could allow billions to flow into the yellow metal, on top of the significant buying already being carried out by the Chinese central bank.

Green argued these two factors alone would be sufficient to push gold prices higher but they could arrive at a time when the macroeconomic backdrop is highly supportive of a precious metals rally.

“Inflationary pressures remain stubbornly high, exacerbated by Trump’s tariff policies, which threaten to drive prices even higher. The imposition of new tariffs on China and other key trading partners is not only stoking fears of a broader trade war but also fuelling a run on safe-haven assets like gold,” he said.

“At the same time, central banks around the world are accelerating their purchases of gold at a pace unseen in decades. China, in particular, has been steadily increasing its reserves, with the People’s Bank of China expanding its holdings for a third consecutive month in January.”

WisdomTree’s Shah said the consensus case for the gold price sees inflation falling initially but rising again by the year-end, the dollar depreciating slightly and bond yields declining marginally, with the Federal Reserve’s base rate falling from 4.5% to 4%.

Gold reaches US$3,070/oz by the fourth quarter of 2025 in WisdomTree’s consensus case scenario, although “prices may moderate a little in coming months before we get there”, Shah added.

In the bear case scenario – where the Federal Reserve does not make any interest rate cuts, bond yields rise to 5.6%, the dollar appreciates and investor sentiment improves as conflict in the Middle East and Ukraine eases – the gold falls to $2,300/oz by the end of the year.

Finally, WisdomTree’s bull case has inflation stuck at a higher level but the Fed continuing to cut rates, elevated geopolitical risks and investors worried about policy errors. This scenario has gold ending 2025 at $3,450/oz.

However, Hargreaves Lansdown head of money and markets Susannah Streeter suggested investors maintain a cautious stance on the perceived safe haven.

“In an uncertain world, gold remains in demand and fresh records are within sight. But investors still should be wary, as investing in gold is far from a one-way bet. It’s often risen in times of economic or political crisis, it has also a history of losing its lustre,” she finished.

“After a strong run in the ‘70s and early ‘80s, it took over 23 years to get back to its 1983 high. Given the volatility associated with gold, it usually should only make up a small portion of a diversified investment portfolio.”