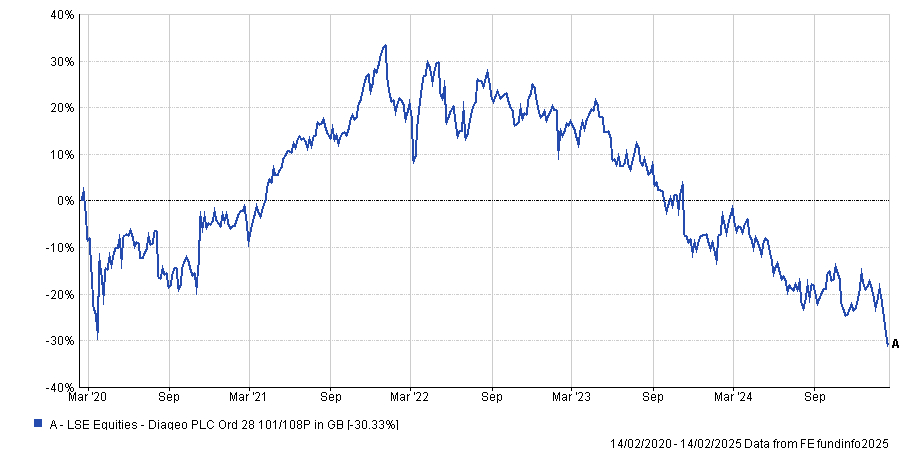

Guinness and Johnnie Walker whisky maker Diageo has left investors with a nasty hangover in recent years, with shares down 30% in the past half-decade. The figures are even harder to swallow if investors put their cash in post-2021, when the stock had its best year during the period.

Outside of 2021, when shares were up 43.4% the stock has made a loss in four of the five years, undoubtedly disappointing investors.

So far in 2025 shares are down 15.5% on recent tariff concerns and Diageo's announcement that it had scrapped its medium-term guidance. So much has the stock disappointed that veteran stock picker Terry Smith removed it from his Fundsmith Equity portfolio.

However, it is still one of the most prominent companies in the FTSE 100 with a 2.8% weighting in the index. While some investors have retreated from Diageo, others remained convinced, with one global manager describing it as a “screaming buy” in 2024.

Share price performance over 5yrs

Source: FE Analytics

Below, we asked UK and Global stock pickers if spirits were still high for this drinks company.

Finsbury Growth & Income Trust’s Train – Focus on the structural advantages

While Terry Smith may have sold out of Diageo, other household names, such as Nick Train, have stayed firm. While the manager of the Finsbury Growth & Income Trust said Diageo’s share price was facing several headwinds, “to us, these are predominantly cyclical, not structural”.

Structurally, he argued the business has several advantages that have allowed it to maintain appeal. For example, Diageo’s scotch, stout and tequila products feature world-class brands such as Guinness, which gives the company “growth opportunities not available to competitors”.

Train explained, while long-term trends indicate a decline in alcohol consumption, customers have replaced it with a tendency to drink “higher quality alcohol”. This provides a tailwind for Diageo, as one of the world's most well-known premium alcohol providers.

Ninety One’s Needham – A tasty cocktail

Ben Needham, manager of Ninety-One UK Equity Income, was also optimistic. Diageo is currently the largest holding in his portfolio at an 8.7% weighting, an overweight of almost six percentage points.

Needham said recent underperformance was due to a “post-pandemic hangover” and short-term consumer pressures, which led to investors underestimating the company’s fundamentals.

He said: “It is hard to disaggregate the noise from reality in spirit companies.”

Needham argued the business has retained value because of its “centuries of heritage”. For example, the company owns several different spirit brands, combining "hard-to-replicate physical assets and huge distribution advantages”. This has made it extremely difficult for competitors to challenge the firm’s market position.

Despite these advantages, share prices are approaching an “all-time low” outside of the global financial crisis. Needham concluded this combination of valuations and fundamentals made Diageo a “tasty cocktail” for long-term investors.

VT Tyndall’s Scrope – A company back on track

While Richard Scrope, manager of the VT Tyndall Global Select fund, said tariffs weighed heavily on Diageo, he was another confident about its future. “Once the market has more clarity on the impact of tariffs, we expect the quality of Diageo's brands will be rewarded,” he said.

Scrope said Diageo has an “unparalleled portfolio of brands” catering to premium and super-premium customers. Additionally, the lengthy ageing process for products such as Whisky means there is a high barrier to entry for other competitors. This gives Diageo “plenty of opportunities to continue to take market share”.

He added it had long-term growth potential because names such as Guinness have remained strong, growing faster than the European market average and expanding into the low-alcohol space. Scrope also praised the company leadership for efforts to improve its operations and production process.

“After the problems Diageo has faced since its Covid-induced hangover, the company seems to have steered itself back on track”, Scrope concluded.

Aegon’s Scott – Praying for a larger audience is not a long-term strategy

Not all managers were as positive about Diageo’s future. Douglas Scott, manager of Aegon UK Equity, has been underweight Diageo for years despite conceding it “can and will recover at some point”.

On the one hand, brands such as Guinness have traded well and Diageo has an impressive leadership team with the new chairman, Sir John Manzoni, bringing a “strong reputation” from past roles at BP and the Civil Service.

Nevertheless, he said Diageo’s decision to withdraw medium-term top-line guidance, “should not be surprising” for investors. Premium whisky providers have “taken too much in price” over the years and are now feeling the effects. He argued premiumisation is a macro trend that does not work in the current “softer macro environment”.

“Focusing on growth with Crown Royal Blackberry and praying for a larger audience for Buchanan’s Pineapple Flavoured Whisky cannot be seen as a long-term strategy”, Scott argued.