It is notoriously difficult to beat the US market but investors might be surprised that funds investing in Europe have found it equally challenging to top their domestic market too.

So much so, the only European fund to beat the market every year over the past decade was a passive fund, while several other trackers and ETFs beat the market over nine or eight years.

In theory, passive products should match or slightly underperform the market when accounting for fees, not beat it, although this is not always the case.

It can depend on the index the fund is tracking and, additionally, as Darius McDermott, managing director at FundCalibre, said recently, stock lending is commonly practised by passive funds, allowing them to boost their performance.

In the next part of an ongoing series, Trustnet looks at the most consistent funds of the decade. We have done this by comparing each fund's performance to the most common benchmark in their sector. Today, we look at the IA Europe Including UK and the IA Europe Excluding UK, comparing funds to the MSCI Europe index and MSCI Europe ex UK indices respectively.

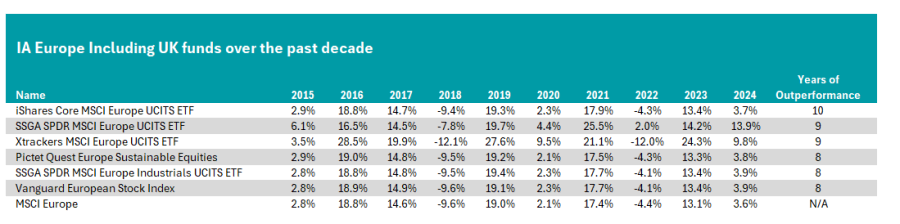

IA Europe Including UK funds

The iShares Core MSCI Europe UCITS ETF was the only fund in the IA Europe Including UK sector to consistently outperform the most common benchmark – the MSCI Europe – over the past decade.

Source: FE Analytics

Passive funds consistently delivered index-beating returns over the past decade, with two more strategies making more than the market in nine years: SSGA SPDR MSCI Europe UCITS ETF and Xtrackers MSCI Europe UCITS ETF.

If we broaden our scope to include funds that outperformed in eight years, the SSGA SPDR MSCI Europe Industrials UCITS ETF and the Vanguard European Stock Index also outperformed the market.

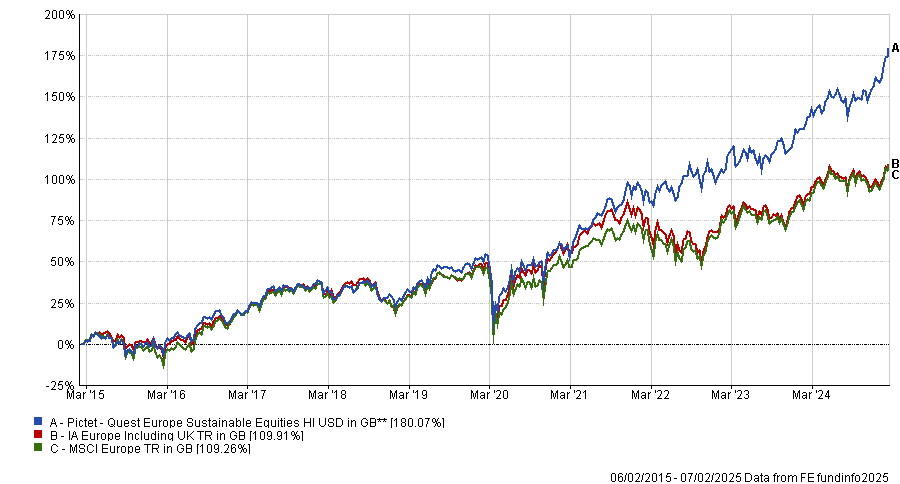

It is here, however, where we find our only active fund from this sector in the study: Pictet Quest Europe Sustainable Equities. With a 10-year return of 180.1%, it was the third-best-performing fund in the sector and also delivered top-quartile results over one, three and five-year periods.

Performance of funds vs sector and benchmark over the past 10yrs

Source: FE Analytics

Over the past decade, it only failed to beat the benchmark in 2016 and 2017, which were both bull markets for global equities. Relatively low volatility and Donald Trump's first term as president encouraged a pro-business agenda that benefited many equity markets. For example, the MSCI Europe was up by 18.8% and 14.6% in 2016 and 2017, a result many funds found difficult to beat.

Over the past decade, the fund's volatility was 14.2%, while its downside risk was 14.9%, both first-quartile results suggesting it took relatively few risks while achieving supranormal returns and adding to the rationale behind its underperforming years during strong markets. With a 10-year alpha of 4.2, it also delivered some of the best “bang for investors’ buck” in the sector over this period.

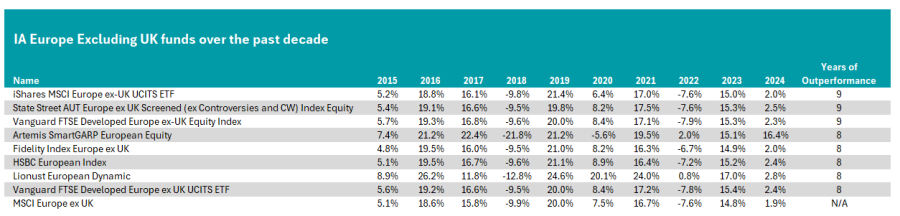

IA Europe Excluding UK funds

While no fund outperformed the MSCI Europe Ex UK market in each calendar year, three passives beat the market in nine years. These were iShares MSCI Europe ex-UK UCITS ETF, State Street AUT Europe ex-UK Screened (ex-Controversies and CW) Index Equity and Vanguard FTSE Developed Europe ex-UK Equity Index.

Source: FE Analytics

Lowering the bar to eight years, three more passive funds qualified, including Fidelity Index Europe ex UK, HSBC European Index and Vanguard FTSE Developed Europe ex UK UCITS ETF.

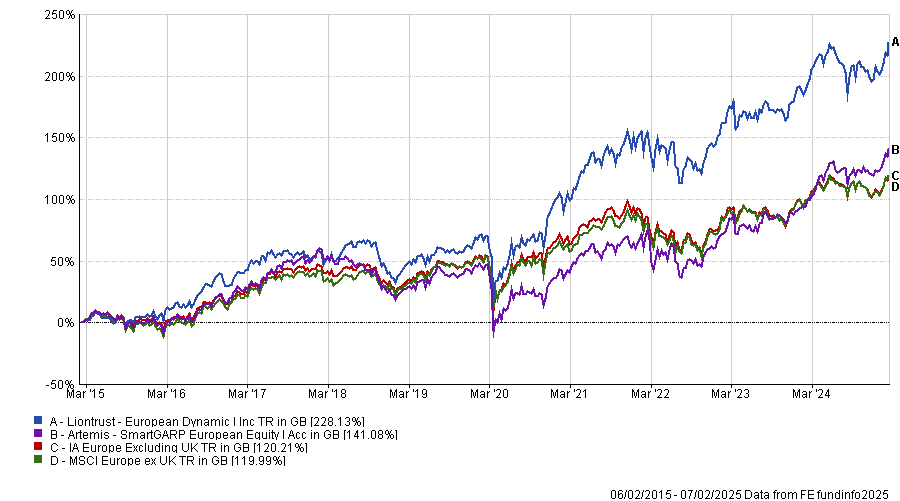

However, two actively managed funds also stood out. The first was the £1.7bn Liontrust European Dynamic fund. The fund was up by 228.1% in the past 10 years, the second-best performance in the peer group. Over the past five years, it was the best-performing fund in the peer group.

It faltered against the index in 2017 and 2018, the latter of which was a generally poor year for equity markets, with a global trade war and Brexit negotiations causing the MSCI Europe ex-UK to fall by 9.9%.

Managed by James Inglis-Jones and Samantha Gleave, it is a favourite of analysts at Square Mile Investment Consulting and Research, who gave it an ‘A’ rating. They said: “The managers believe that cashflow is the primary, long-term determinant of shareholder returns and think investors frequently undervalue free cashflow, which the pair consider as a fundamental building block of long-term growth, in favour of shorter-term, less reliable profit forecasts.

“There is a high representation of quality companies in the portfolio and the long-term performance record of the fund is excellent and suggestive that the managers are identifying anomalously priced securities. It should be noted that this strategy is unlikely to suit investors who are looking for brief forays into Europe or for those seeking indexlike returns.”

Performance of funds vs sector and benchmark over the past 10yrs

Source: FE Analytics

The other fund to achieve this feat was the Artemis SmartGARP European Equity fund, led by Philip Wolstencroft, who has been in charge of the fund since 2001, although lost long-time co-manager Peter Saacke after he retired from fund management last year.

The five-crown-rated fund had a second-quartile performance of 141.1% over the past decade and beat the benchmark every year except 2018 and 2020, both years when markets were volatile. It uses the firm’s growth-at-a-reasonable-price model (known as SmartGARP) to pick stocks, which screens for companies growing faster than the market but on lower valuations.

It means the fund can look very different from the index and will lack some of the expensive growth names that have dominated in recent years, which will be screened out on valuation grounds.