Ben Whitmore – the high-profile fund manager who left Jupiter Asset Management last year to start Brickwood Asset Management – has launched his first fund.

TM Brickwood UK Value will be co-managed by Whitmore and Kevin Murphy, who previously led Schroders’ global value team, with support from his brother Dermot Murphy, who ran the Jupiter Global Value strategy alongside Whitmore.

The trio will identify undervalued stocks and wait for the market to recognise their value. In so doing, they will endeavour to beat the FTSE All Share, net of fees, over rolling five-year periods.

Whitmore said: “Our long history of value investing combined with the low valuations we are currently seeing makes it an opportune moment for the fund launch.”

Now that Brickwood has unveiled its inaugural strategy, current and former investors in Whitmore’s flagship Jupiter UK Special Situations fund have a clear choice: stay in the fund, now under the stewardship of FE fundinfo Alpha Manager Alex Savvides and renamed Jupiter UK Dynamic Equity; or jump ship to Brickwood.

The merits of Brickwood

Brickwood’s three fund managers have impressive pedigrees and 60 years of combined experience in the asset management industry.

Whitmore and Kevin Murphy both led value equity teams with £10bn in under management apiece at Jupiter and Schroders respectively and they have a shared history. Whitmore managed the Schroder Recovery fund before moving to Jupiter in 2006, whereupon Murphy and Nick Kirrage replaced him.

Paul Angell, head of investment research at AJ Bell, said Brickwood’s three fund managers “bring many decades of collective experience investing in undervalued UK equities and should combine to good effect as the new challenger in the UK equity sector”.

“Long-term holders of Whitmore's UK Equity funds may well feel confident enough to get invested right away in the TM Brickwood UK Value fund, while others may prefer to allow the team, and indeed the business, to bed in a little before investing,” he observed.

“The new fund is, in most cases, likely to only be considered as a possible replacement candidate for Whitmore’s prior UK funds which are still managed at Jupiter, with it still to be seen whether Brickwood will similarly launch a global equity strategy to compete with Jupiter's global funds.”

Angell believes investors should compare Brickwood and Jupiter across the ‘six Ps’ of people, philosophy, process, parent, performance and price, noting that “the bulk of the performance history on the Jupiter funds could feasibly be credited to Brickwood given the personnel change”.

Jason Hollands, managing director of Bestinvest, described Whitmore and Murphy as “two of the most notable proponents” of value investing in the UK and thinks the timing of their new fund’s launch could prove “prescient”.

“If you are a manager with a focus on undervalued opportunities, the UK market is certainly one with plenty to go for given the discount it trades on versus global equities,” he explained.

Generally speaking, when talented fund managers start their own high-conviction boutiques, the results can be rewarding, added Simon Evan-Cook, fund manager at Downing Fox.

“We like good, genuinely active fund managers, and we like managers who have the gumption to go out on their own and set up a new fund. When you have experienced and highly motivated managers running a fund that isn’t hamstrung by being too big, exceptional results can follow,” he said.

Stick with Jupiter

On the other hand, Ben Yearsley, director of Fairview Investing, thinks investors should hold off from backing the new venture just yet. “It’s a new boutique and jumping in on day one seems a bit precipitous,” he said.

He believes investors would be better off keeping their money with Jupiter, which he said has “recruited excellent managers in Adrian Gosden [on the Jupiter UK Income and UK Multi Cap Income funds] and Alex Savvides”.

Gosden and Chris Morrison joined Jupiter from GAM in November 2023 and took over Whitmore’s £1.4bn Jupiter UK Income fund in April 2024. They have maintained their predecessor’s stellar performance; the fund is top-quartile within the IA UK Equity Income sector over one year.

Yearsley, meanwhile, has invested with Savvides since 2010 via J O Hambro Capital Management’s JOHCM UK Dynamic fund and is happy to continue backing him at Jupiter.

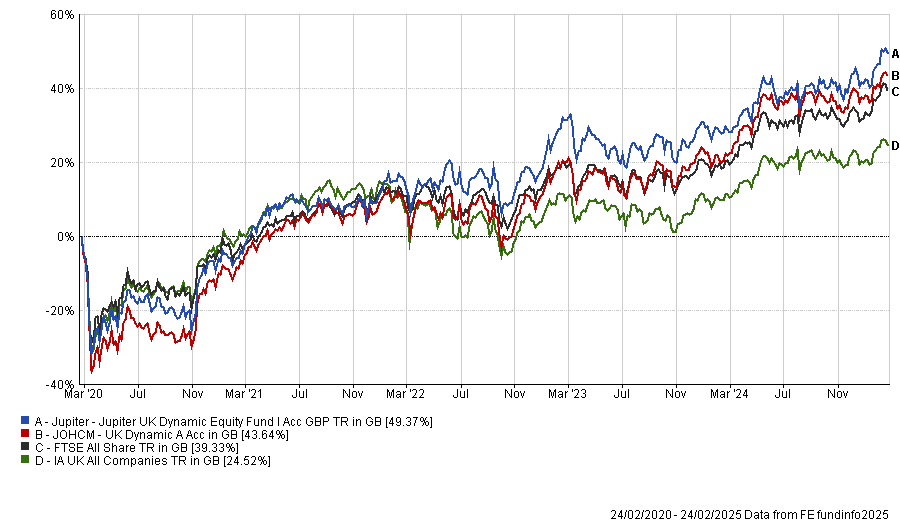

Performance of Whitmore and Savvides’ former funds over 5yrs

Source: FE Analytics

Hollands agreed that Savvides “has a good reputation and did a sound job in over two decades at J O Hambro”. “In my view there isn’t a cut and dried case for moving away from this fund in a hurry and so the most logical decision is to wait and see,” he explained.

Chelsea Financial Services held Jupiter UK Special Situations and JOHCM UK Dynamic before they changed hands and is sticking with Savvides and the rebranded Jupiter UK Dynamic Equity fund. Managing director Darius McDermott said he had also been close to making an allocation to Jupiter Global Value but Whitmore’s departure put an end to that process.

For Jack Driscoll, UK fund analyst at FE Investments, Brickwood UK Value and Jupiter UK Dynamic Equity are both attractive options.

“It is clear that both Whitmore’s new fund and a Savvides-run Jupiter UK Dynamic Equity have excellent value managers at the helm. Those worried about Whitmore’s departure can rest assured they are getting a consistent fund manager taking over and those wanting to take advantage of the lower charges at Whitmore’s new fund should feel no trepidation about doing so either,” he explained.