For an investor planning to live off their savings, the first question is how much they can safely withdraw each year.

Financial advisers sometimes use a ballpark figure of 4%, which is known as the financial independence (FI) number. It stems from a study by academics at Trinity University, who calculated an individual could withdraw 4% of their savings annually over 30 years without running out of money – based on returns from equities and bonds between 1925 and 1975.

There are two ways to do this. Either by investing in assets that pay an income or by drawing down the pot. The latter makes portfolios vulnerable to sequencing risk, however. If a large part of the portfolio is invested in equities and a severe market downturn occurs at the beginning of the journey when the portfolio is largest, an investor’s money will run out much sooner.

Today, achieving a 4% income from dividends, bond payouts and cash is achievable. As such, Richard Philbin, chief investment officer (investment solutions) at Hawksmoor Investment Management, created a portfolio that should provide an income while also producing some capital returns so that investors can dip into reserves if required.

He suggested combining investments that pay a high yield today with those offering a smaller initial income but greater potential for dividend growth. The caveat, however, is that investors would need to hold onto those assets for a long time to reap the rewards of dividend growth.

He suggested putting 50-60% in equities, 30-45% in fixed income, 5-15% in infrastructure and zero to 10% in other assets, such as alternative investments and multi-asset funds.

“That would easily get you a 3.5% to 4% yield and it would give you a very diverse yield as well. It allows you to look at different markets so you can diversify your portfolio and, over time, it could give you both capital growth and income growth,” he explained.

Investors could tweak the above asset allocation, for instance by increasing their fixed income or infrastructure exposure to boost the yield.

Equity income funds that Philbin rates include Redwheel UK Equity Income, Man Income, M&G Global Dividend, Zennor Japan Equity Income and Pacific North of South EM Equity Income Opportunities.

There was one firm, however, where he selected two funds: Guinness Global Equity Income and Guinness Asian Equity Income.

Both have a similar approach to portfolio construction, with a flat, concentrated portfolio of 30-35 holdings and a low starting dividend with a focus on dividend growth over time. “Therefore, patience (from an investor’s perspective) is needed,” he said.

“They have proven themselves over the medium-to-longer term and the risk/reward trade-off is impressive. Portfolio volatility relative to portfolio return – compared to the peers – makes the numbers massively impressive. As we are longer-term investors, we like to invest in managers with similar philosophies and Guinness has proven that.”

For investors who want to juice up their income stream, he suggested Schroder Income Maximiser, which aims to deliver a 7% yield by using derivatives to boost the income. This could help offset other funds where the starting yield is lower.

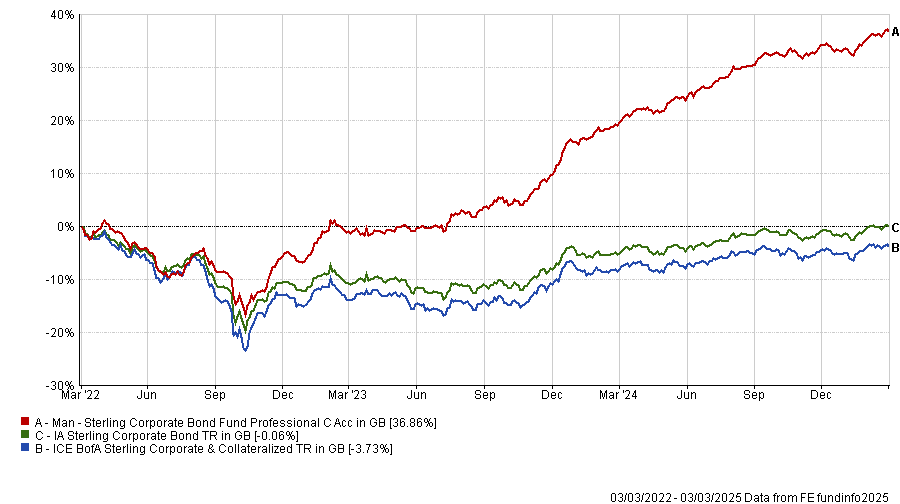

Within the fixed income space, Philbin highlighted Man Sterling Corporate Bond and Premier Miton Strategic Monthly Income Bond. They are complementary because Man Group has more exposure to high-yield bonds whereas Premier Miton focuses on investment-grade credit. “They provide a good spread of risk and have both consistently outperformed their peer groups,” he noted.

Both funds pay out income every month, which savers could spend, reinvest or use to rebalance their portfolio. “If you are retired, it's nice to know you've got some money coming into the bank each month,” he added.

Performance of fund vs benchmark and sector over 3yrs

Source: FE Analytics

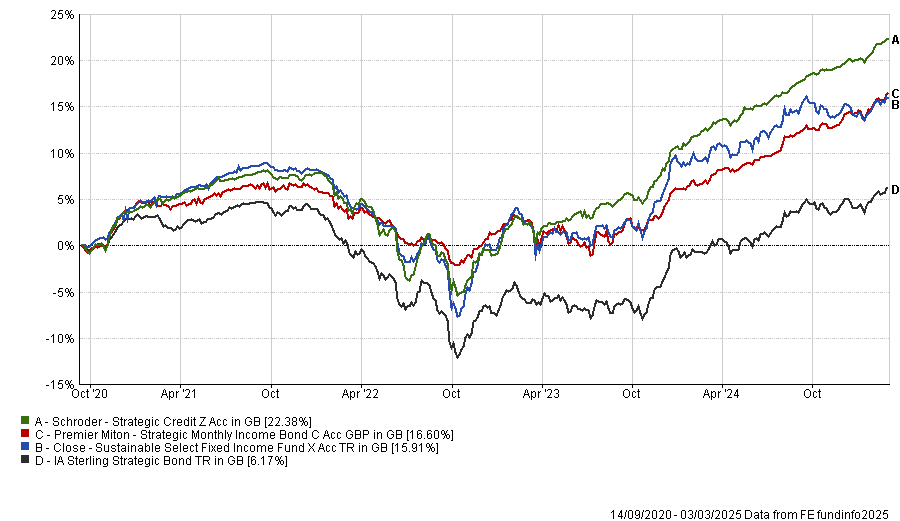

In the strategic bond space, Philbin also likes Schroder Strategic Credit and Close Sustainable Select Fixed Income.

To turbocharge the income, Royal London Short Duration Global High Yield Bond is another option. High-yield bonds can be used to boost a portfolio’s overall yield but they can be volatile so opting for shorter-dated bonds helps to mitigate default risk and interest rate risk, he explained.

Performance of strategic bond funds vs sector over 5yrs

Source: FE Analytics

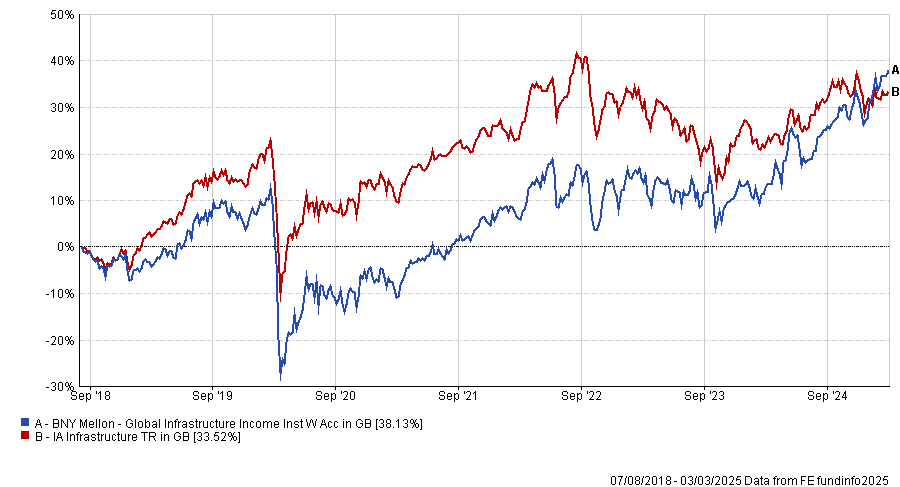

Moving onto infrastructure, Philbin has carved out a sizeable allocation here as assets such as roads and railways have long-term contracts that are government-backed and inflation-linked, possess natural monopolies and can raise prices every year, for example.

He has invested in James Lydotes’ BNY Mellon Global Infrastructure Income fund since launch. “The first couple of years were a little bit scary for us but the past couple of years have more than made up for it and the fund manager’s doing a brilliant job,” he said.

Performance of fund vs sector since inception

Source: FE Analytics

Some investment trusts in the infrastructure space such as Gore Street Energy Storage have double-digit yields and wide discounts, with the potential for capital appreciation.

“Some of these infrastructure products are screaming buys. Yes, there's a bit of volatility with them, but you're getting a good starting yield and you are going to get the closing of that discount,” he said.

Real estate investment trusts (REITs) also have the potential to deliver capital growth and income, Philbin added.

Finally, other assets for the remaining 10% allocation might include esoteric investment trusts such as Tufton Assets, which invests in ships. It has a yield close to 10%, pays dividends quarterly and its dividend is covered 1.8x, he said.

Partners Group Private Equity, which used to be known as Princess, has a 6.6% dividend yield and was trading on a 28.8% discount as of 31 December 2024. Its private equity exposure provides an element of diversification and the potential for capital growth, he noted.

Investors could also use multi-asset funds here. Philbin likes the Aegon Diversified Monthly Income fund, which pays a monthly income amounting to 5% per annum.