Twitchy investors are often blamed for reacting too quickly to news and for making portfolio changes at the wrong time – selling low when in a panic and buying when spirits (and prices) are high.

That cannot be said of Vincent McEntegart, manager of the Aegon Diversified Monthly Income fund, who admitted that the last significant change he made to the portfolio was three years ago.

“It is not that often you have to do something very significant. Most of the time over the past 11 years managing this fund, the changes that we made have been gradual. The last big shift was in 2022 into 2023,” he said.

Until 2022, bond yields were gradually coming down, but when inflation jumped on the back of Covid, yields shot up from 1% to 5%.

“That was the last time we had to respond in the fund and we made some significant changes to the allocations. Any changes we have made since then have been modest.”

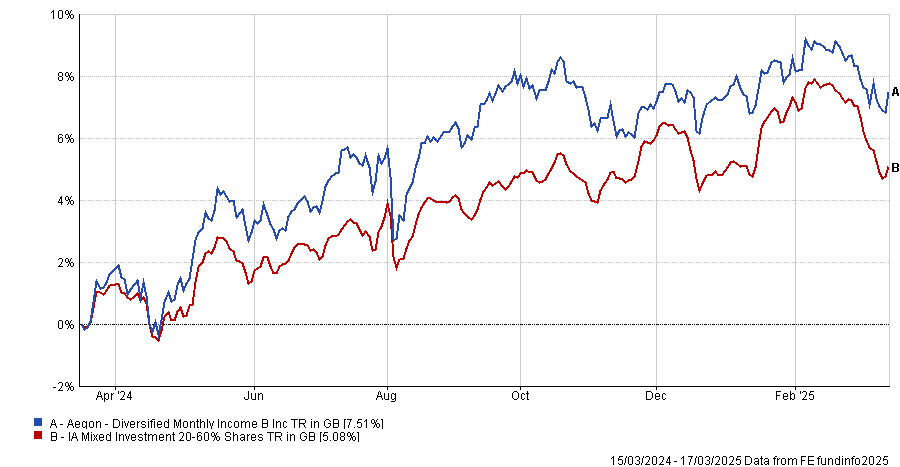

This prudent strategy has been working well, with the fund maintaining a top-quartile performance within the IA Mixed Investment 20-60% Shares sector over the past 10, five, three years and one year.

Analysts at Square Mile, who have awarded the fund an A rating, said: “Our conviction in the multiasset team and in the lead manager has strengthened over time. Since launch, the manager has navigated what at times has been a volatile market environment well and in a sensible and thoughtful manner.

“Whilst investors should not expect to see significant asset allocation changes quarter on quarter, over time, changes across asset classes have been within a relatively broad range, indicating a willingness to adapt and be pragmatic, and leaning into investments where the best income and total return opportunities can be found.”

Performance of fund against index and sector over 1yr

Source: FE Analytics

The geopolitical situation in the developed world is front and centre of investors’ minds, including McEntegart, who said the world stage today is his main source of worry.

“At times like this, you feel like your head is exploding, with all of the things that you have to think about,” he said. “But the first thing to do is to pause and think. How much do I actually need to change? Because if you react to every bit of news, you would be selling all your equities to reduce risk one day and then having to buy them back the next day.”

The most recent change the manager made has been to sell about 2% of his US and European equity exposure, taking a small amount of risk out of the portfolio.

“When things are very uncertain, that's just a natural thing to do. It’s good housekeeping, a part of portfolio risk management. We did it as an interim measure to try and make sense of what's going on in Europe and in America, until we decide if we have to do anything more significant,” he explained.

As at the end of January, the Aegon Diversified Monthly Income fund had 14.3% in US equities, its third-largest position after global fixed interest (29%) and UK equities (17.1%). European equities followed (11.2% in British companies, 10.9% in the rest of the continent).

McEntegart is waiting to see how the US administration will continue from here, which will have repercussions on whether the world will continue to see the US as a safe haven.

“I'm not going to attempt to try to make sense of what president Trump will say or do next or of the way that he will say one thing and then say the opposite. It's possible he slows down a little bit in the summer, but I don't see him changing,” McEntegart said.

“Everybody hopes that we can still treat the US as a safe haven and as of today, we still are, but that’s a big question. The thing to worry about is what does that then mean not only for the assets one might have in America, but also for your investments in the rest of the world.”

However, if things in the US do settle down, the manager said he is ready to allocate more to the region, especially as prices, including those of the Magnificent Seven, have fallen quite a lot.

Performance of the Magnificent Seven stocks over the year to date

Source: Yahoo! Finance

“If we can get comfortable with the US situation, we would put some money back into those companies or other ones linked to the artificial intelligence theme, which we feel will continue for many years,” he concluded.