The government must do something to arrest the struggling UK stock market, according to UK fund managers, who have backed chancellor Rachel Reeves’ idea to make sweeping changes to the ISA and pension landscape in an effort to provide fresh impetus into domestic stocks.

One option reportedly on the table is to cut the cash ISA allowance down to £4,000 from the current £20,000 ceiling – something Premier Miton Investors is in favour of.

“Limiting the future tax benefit to will significantly reduce the almost £300bn allocation to cash within ISAs and immediately increase future investment savings into equities,” the firm said in a statement earlier this week.

Clive Beagles, manager of the JOHCM UK Equity Income fund, also believes the current savings landscape should be looked at, noting the cash ISA was set up for people to “invest in individual equities” rather than their current purpose, where “we have people sticking tens of millions of pounds into ISAs to earn an interest of 4% tax-free”.

“That is not what they were intended for when they were set up but they have morphed into something different. In that regard it is perfectly logical and fair to think about whether that is the right structure and whether it is something that can be reassessed,” he said.

The other area he would consider looking into is pensions, where he estimated the government loses out on around £52bn in tax relief on contributions each year.

Pension fund allocations have shifted markedly over the past 20 years, with most now mirroring the allocations of global benchmarks, meaning very little (around 3-4%, he suggested) is invested in UK companies.

“So £50bn of that ends up in other assets. In recent years that has been going into Amazon, Microsoft, Tesla and all that lot. It might be good for individuals’ wealth creation but the country has gained nothing in return from giving £50bn in relief, in terms of creating growth, jobs and future tax revenues for this country,” said Beagles.

“I think it is perfectly fair and logical to look at that and say: ‘have we got this right or have we allowed it to be too free-market orientated?’

“They [the government] have tried the carrot [to encourage investment into the UK] and that hasn’t really worked so they need to try some kind of stick. They know they need to do something.”

His point was echoed by Ken Wotton, manager of the Strategic Equity Capital investment trust.

“As an investor – or someone with a pension – do I want governments telling me what I should or should not invest in? Or if I am an adviser, do I want them dictating that to me? No, because you are trying to get the best returns within your risk profile,” he said.

“But as a taxpayer, if you are giving a £6bn to £7bn subsidy so people can invest in ISAs per year or the circa £60bn going into pensions, is it reasonable to ask for something back by directing some of the investment in those wrappers into UK domestic assets? Yes I think it is. When you frame it like that, I don’t think it is an unreasonable requirement.”

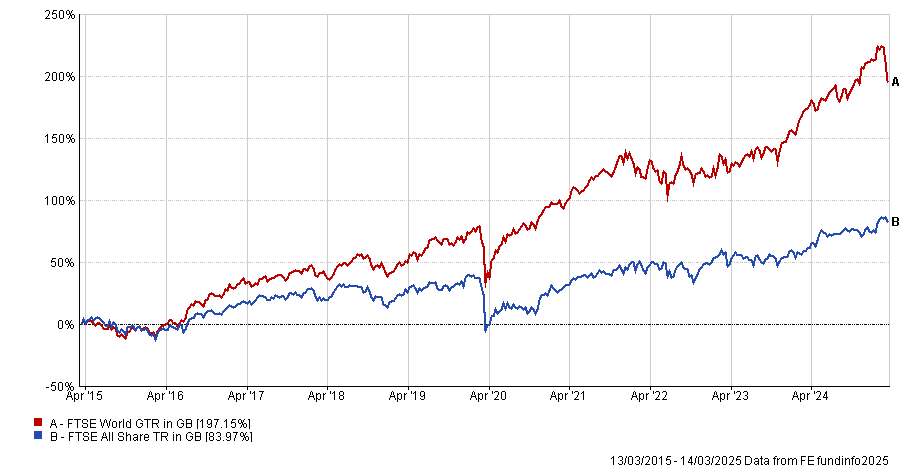

What the specific policies will be remains to be seen, but Beagles said it “might not take much” to shift the fortunes of the UK market, which has been lagging behind international peers for years. Indeed, the FTSE All Share index made less than half the returns of the FTSE World index over the past decade, as the below chart shows.

Performance of indices over 10yrs

Source: FE Analytics

“Allocations have clearly fallen so far that I think it wouldn’t take a huge amount to make an incremental difference. Whether it is just about doing something to send a message and then international investors go ‘at least the UK is doing something about it’. It could be it doesn’t need much,” he said.

It is crucial the UK has a “functioning capital market that is open for business”, he added, or the current pace of mergers and acquisitions (M&A) will mean “[we] won’t really have a market left at all”.

“I think we have been sleepwalking into oblivion in that regard,” he noted.

Wotton said more companies left the UK market last year than entered it, but added some of this was cyclical, although he appreciated there were structural issues as well.

He agreed that it was critical for the UK market to thrive, not just for domestic investors but for the overall economy as well.

“I strongly believe the UK public markets, both the main and AIM, are really important components of the growth ecosystem of the UK. They provide access to capital to companies that are using that to innovate and drive growth,” he said.

“You also can’t have a functioning private market if you don’t have a public market as well,” he added, as private investors need a way to recycle their holdings once they have achieved their goals. Otherwise, private companies will simply choose to set up elsewhere, typically in a country with a stock market they intend to list on.