Outperforming momentum strategies with a contrarian approach has been a challenge for the better part of the past decade, but one that Jonathan Pines is proud to have successfully overcome.

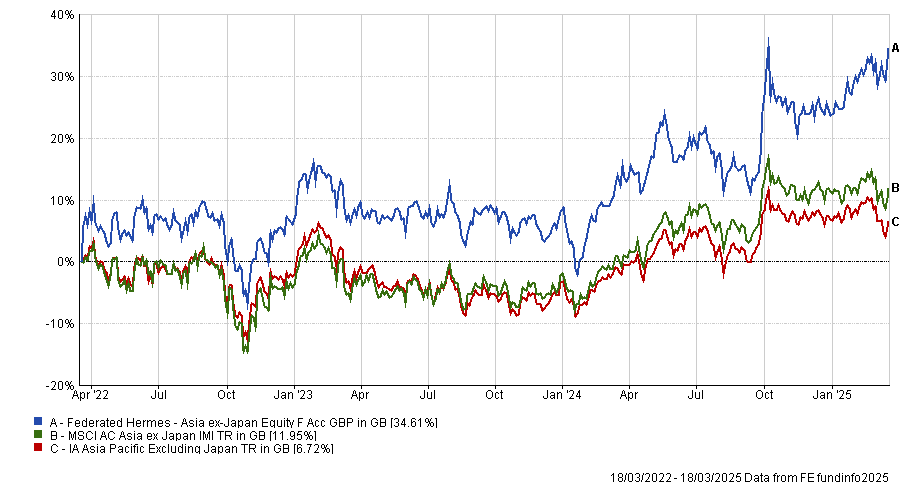

The Federated Hermes Asia Ex Japan Equity fund has made top-decile returns in the IA Asia Pacific Excluding Japan sector over all main timeframes, becoming the top fund in the 113-strong peer group over the past three-years, when it distanced the competition by an average of almost 30 percentage points, as the following chart shows.

Below, Pines talks about how he has achieved that performance, why he is happy to buy lower quality companies if the price is right and why passive funds do make his job more difficult, until they won’t anymore.

Performance of fund against index and sector over 1yr

Source: FE Analytics

How do you invest?

We are contrarian, bottom-up investors and we differentiate ourselves in two ways. First, we don't mind buying lower quality if the price is right. We will go down the quality scale for a very attractive price. If there are no Ferraris trading at good prices, we will buy Fords.

Second, we are practically and demonstrably contrarian. On average, the stocks we buy have underperformed over the three, six, nine or 12 months before we have bought them.

Is valuation more important than quality?

We do want quality but we are not going to pay up for it. Sometimes markets fall in love with quality and prices become very expensive, so much so that it will take years to make up for the price even with the company’s compounded earnings.

For the companies we buy, we want the stock price to double within five years and, mathematically, that’s only possible if earnings double or the price multiple doubles.

Right now, some Indian consumer goods companies are trading at 60x P/E (price-to-earnings ratio). How are those stocks going to double? Earnings are not even close to doubling over the next five years and the price is already at a starting point of 60x. It makes it very, very difficult to achieve a doubling in the stock price at elevated starting valuations.

Momentum has won out over contrarian strategies over the past decade. Will the ongoing growth of passive investing make your job even harder?

Passive strategies buy more of the stocks that have done the best and push them up even more, because of the money flowing into them.

For most periods, it is going to be a headwind to be contrarian, until it isn't – until the big gulf between the value and the price of the biggest momentum stocks is recognised by the market, and they will sell sharply.

Will contrarianism be in trend then?

I don't think contrarianism can ever be in trend because, by definition, it's not. What we are hoping for is that at least some of those headwinds become tailwinds in the future. Instead of trying to outperform by stock picking in the context of a hostile overall environment, we will be stock picking in a context when momentum isn't flying.

What were the worst calls of the past year?

In the history of our fund, our consistent underweight to Taiwan Semiconductors (TSMC) has been the worst call that we've ever made, taking hundreds of basis points on performance over the years. In 2024, it cost us a massive 200 basis points.

We had a position in TSMC – it just wasn't big enough. We underestimated the massive price and earnings momentum in artificial intelligence (AI). We've actually been cutting our position TSMC even this year following the DeepSeek news.

Our overweight to Samsung Electronic also cost us 250 basis points. The company has gone through difficulties, which we did anticipate when we bought it at 1.2x book price.

We thought the risk was asymmetric, that if things continued to go wrong, it could trade close to book price but no lower than that; and if things went right, it could get up 2x. Unfortunately, the market was so disappointed with its missteps that the stock went all the way down to 0.85x book value. At this valuation, we really like it, actually.

Performance of stock over the past year

Source: Google Finance

What were the best calls?

Having been wrong for many years on China, our overweight is coming around. Korean financials are doing well as well, as they are improving their governance.

The electric vehicles (EV) sector is doing particularly well. Xiaomi is considered China’s Tesla and Brilliance China, the BMW joint venture in the country, has been trading on such a cheap price – below the net cash on its balance sheets – and it’s paying dividends, so the stock price went up because of that.

Xiaomi added 100 basis points and Brilliance China 140 basis points last year.

What do you do when you are not manging money?

I play squash, which is a great workout and a great game to get a quick sweat – but also injuries.