Markets have not yet come around to understand the real implications from higher-for-longer inflation and should review their long-term expectations, according to Jasmine Yeo, manager of the Ruffer Investment Company.

Over the past few decades, central banks have maintained a 2% goal on inflation, intervening with interest rate movements whenever prices strayed too far from this figure. Their objective hasn’t changed in today’s market, although post-Covid inflation has proved a harder beast to tame than expected.

“Our view is that 2% has become a floor for inflation, rather than a ceiling,” Yeo said. “In the cyclical theatre of monetary policy, financial markets and fiscal profligacy, we now find ourselves staring down the barrel of a second wave of inflation. Far from being an abstraction, this looming wave appears to be less an ‘if’ than a ‘when’ and yet financial markets are ambivalent.”

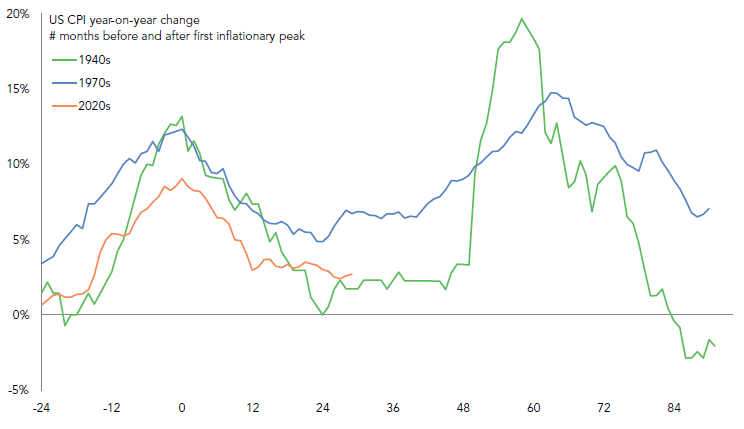

The historic pattern has been that inflation comes in waves, as the chart below shows. Today’s experience (in orange) doesn’t look too different from the post-war in green and the 1970s in blue, meaning we might be due a second wave of inflation soon.

Waves of inflation

Source: Ruffer, US Bureau of Labor Statistics. US CPI year-on-year percentage change. Bottom axis shows months before and after first inflationary peak. Data to November 2024.

The Ruffer managers see multiple ingredients for a second wave of inflation already baked into today’s circumstances, including the big fiscal stimulus injected into a global economy that has, for now, sidestepped recession; central banks reversing course from tightening to easing; imminent tariffs to push up goods prices; robust wage growth and labour bargaining power; geopolitical tension simmering, yet never distant from full-blown crises; and commodity prices parked at relatively low levels, awaiting the spark of demand revival.

“The era of low and stable inflation and interest rates has come to end, but the market is just yet to price it in. It’s now four years since the year-on-year Consumer Price Index (CPI) in the US was at or below the Fed’s target, yet the markets pricing of future inflation remarkably remains anchored between 2% to 3%,” Yeo said.

“This is a failure of imagination on the part of the market. Inflation matters to portfolios because it doesn’t just change which assets perform best, it changes the way the assets relate to one another. A more positive stock-bond correlation means periods like 2022, where conventional assets fell in excess of double digits together, are likely to repeat more frequently.”

While the market continues to give policymakers the benefit of the doubt, Yeo has positioned the Ruffer portfolio to benefit from what she sees as “a creeping inevitability not yet priced in”.

The portfolio now holds around 33% across equities and commodities, which should benefit from a broader market rally and continued economic strength. Commodities are one of the best-performing asset classes in periods of inflation, historically delivering 15% when inflation is high and rising, the manager said.

These are supported by exposure to bonds and gold equities, which should rise in value if yields were to fall. Index-linked bonds are “exciting”.

“With the duration element already repriced much lower, the real yields of around 2% look attractive as an each-way bet on normalisation of rates or inflation protection,” she said.

The portfolio then includes a list of unconventional protections, such as derivatives, to manufacture positive returns when bonds and equities are falling in tandem.

On top of that, S&P 500 protection has become “crucial”. With US equities facing poor risk-reward dynamics, “a significant market decline would create fireworks in the portfolio’s S&P put options and volatility plays”, Yeo added.

Finally, yen exposure is “a valuable hedge” against a potential unravelling in equity markets. “With carry trades under scrutiny, foreign exchange dynamics might prove an invaluable stabiliser,” she said.

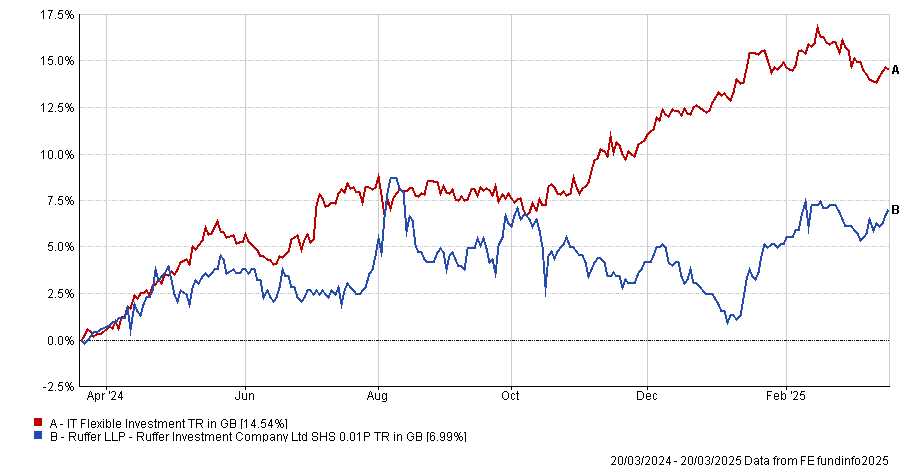

Performance of fund against index and sector over 1yr

Source: FE Analytics

The manager hopes this recipe will be enough to rescue the trust from its recent “painful” performance. Investors have been patient as the trust made a loss of 0.4% in net asset value (NAV) total return terms for the half-year to December 2024, while in share price terms, the value of the company rose 0.2% over the past six months, meaning that across 2024, the company returned next to nothing while the rest of the market soared.

Yeo remained positive that returns will come “like ketchup from a glass bottle”, as she recently wrote in the latest company report.