Greencoat UK Wind is the largest renewable infrastructure trust, with a market value of £2.6bn, and the best-performing by a wide margin over five and 10 years.

Yet along with its sector, it has suffered significant losses over the past three years. Investor aversion has left discounts wide across the board, triggering a raft of discontinuation votes. Greencoat UK Wind is on an approximately 26% discount and faces its second annual discontinuation vote next month.

The trust has had a particularly bad time recently owing to a faulty cable at its largest asset, the Hornsea One offshore wind farm, which meant that some of the energy generated there could not be brought back to shore. This hurt revenues in 2024 and to add insult to injury, wind resource was low in the UK last year and the power price has fallen.

Greencoat UK Wind has made an 11% year-to-late loss in total return terms as of 24 March 2025 and lost 8.6% last year, according to FE Analytics. The IT Renewable Energy Infrastructure fared even worse in 2024, down 16.1%.

Markuz Jaffe, research analyst at Peel Hunt, described recent sector-wide returns as “horrific” and said investor sentiment is at a “trough in pessimism”. “You’ve got selling activity at quite irrational levels, whereas actually your forward-looking return starts to be really quite attractive,” he said.

William Heathcoat Amory, managing partner at Kepler Partners, concurred: “I think the baby’s been thrown out of the bathwater with Greencoat.”

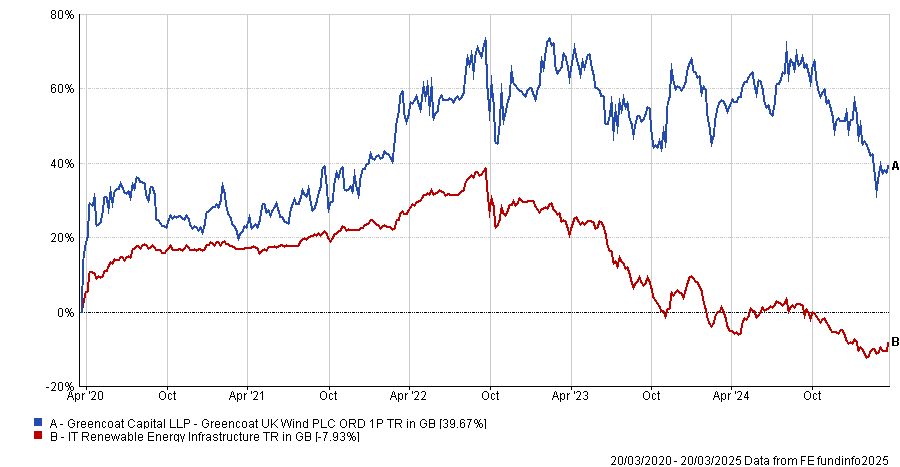

Performance of trust vs sector over 5yrs

Source: FE Analytics

Greencoat UK Wind’s 9% yield and the board’s commitment to keep increasing the dividend in line with RPI inflation (which is unique in its peer group) may go some way to mollifying investors. As Jaffe said: “It’s got a really strong track record of cashflow generation that’s fed through to investors receiving inflation-linked dividends.”

Nonetheless, the trust’s mixed fortunes divide opinion.

Jefferies has rated it a ‘buy’ and the trust is one of Peel Hunt’s three core buy-and-hold trust picks in the infrastructure space, alongside Cordiant Digital Infrastructure and Octopus Renewables Infrastructure Trust.

Heathcoat Amory holds the trust in his SIPP and is optimistic about its prospects. The discount means “the odds are in your favour”, he said.

However, Chris Clothier, co-chief investment officer CG Asset Management, thinks the trust is a ‘hold’ for now. The Capital Gearing Trust and other multi-asset funds that CGAM manages have a small position in Greencoat UK Wind, having cut back exposure aggressively last year.

Quilter Cheviot Investment Management head of investment fund research Matt Ennion was more circumspect. He believes the renewable energy infrastructure sector faces significant headwinds, such as elevated interest rates, a lack of buyers and too many trusts, and thinks the sector is ripe for consolidation.

Besides, Quilter Cheviot Investment Management has historically used The Renewable Infrastructure Group (TRIG) instead because it has a more diversified portfolio, with small positions in solar power and batteries.

Asset disposals, share buybacks and the discontinuation vote

Next month’s discount-triggered discontinuation vote, which Greencoat UK Wind is likely to survive, is not as significant as actions taken by the board to appease shareholders in advance, Jaffe said.

For instance, Schroders Greencoat changed its fees on 1 January 2025 to be based on whichever is lowest: market capitalisation or NAV.

The trust has bought back £100m of its shares at a discount since October 2023 and recently initiated another £100m buyback programme.

Furthermore, the board has signalled its intention to sell assets and use the proceeds to pay down debt and fund more buybacks. Jaffe said this proves the board is listening to shareholders.

Matthew Hose, an equity analyst at Jefferies, was also constructive. “The renewal of a material buyback programme may be exactly what the market is looking for after the weak share price of late,” he said.

“The commitment now appears open-ended given the support of significant levels of excess cash generation from the portfolio, which could potentially be supplemented by further disposals.”

Clothier wants to see concrete evidence of asset disposals and a larger quantum of buybacks. Transactions would also give investors more confidence that the trust’s assets are correctly valued, he added.

Strong cashflow and solid dividend cover

The trust’s dividend cover has historically been about 1.7x-1.8x, said Heathcoat Amory. Last year, problems at Hornsea One caused dividend cover to fall to 1.3x, which is still relatively strong for a difficult year, he noted.

The trust’s high dividend cover means it has excess cashflow, which can be used to invest in additional assets, buy back shares or pay down debt, he explained.

Jaffe added that the portfolio’s underlying cash profile is dependable – notwithstanding power price volatility – particularly as government-backed subsidies are in place for many of the assets over the next 10 years.

Balance sheet debt

Greencoat UK Wind is “unequivocally geared”, Heathcoat Amory stated. Its gearing is 39% of gross asset value and 60% of net asset value. He believes the debt is manageable, with an average interest rate of about 4.6%.

Furthermore, the trust’s debt is structured differently to other investment companies. Most renewable energy trusts take on debt on an individual asset-by-asset-basis. Debt is amortized over the life of the asset and the trusts pay off a portion each year.

Greencoat UK Wind has typically taken on debt at the company level. Therefore, it pays back loans in full when they mature (for instance by refinancing the loan) but does not have to amortise a portion of its debt every single year. Heathcoat Amory said the trust has £200m of debt maturing in November 2026 which it might be able to pay back from cashflow.

Jaffe said the way the trust’s debt is structured gives it more funding flexibility and potentially means it has more near-term cashflow available to invest in new projects, pay down debt or put to other uses.

The risks and rewards of wind power

Wind is more profitable than solar power so the trust generates more cashflow than a solar specialist would, Jaffe said.

However, wind resource is more variable and has been poor for the past couple of years. Those figures have just been incorporated into independent forecasters’ long-term assumptions about future generation capabilities. “It’s unhelpful, particularly at a time when the sector is feeling a lot of pain and investors are looking for reasons to sell rather than reasons to buy in this challenging market,” Jaffe said.

Across the sector, the valuations of most wind assets have been written down this year, Ennion said, in line with lower assumptions about the amount of power they will generate. Write-downs do tend to happen as assets mature and as forecasts about how much power they will generate become more evidence-based, he added.

Another risk is the power price, Ennion continued. TRIG has fixed 80% of its exposure to power prices over the next 12 months and about 70% over two years, whereas Greencoat UK Wind has a 50/50 split between exposure to the market price versus fixed revenues.

This worked in Greencoat’s favour during Covid when prices spiked but has been painful during the past 12 months when prices fell. For Ennion, the extra certainty TRIG has over its income is preferable.

Leadership changes

The trust was led until last year by its co-founders, Laurence Fumagalli and Stephen Lilley. Fumagalli stepped down last year and was replaced by Matt Ridley, who joined Schroders Greencoat from Temporis Capital in 2021.

Lilley plans to leave after the annual general meeting on 24 April and will be replaced by Steve Packwood as co-head of the investment team. He has 20 years of renewable energy experience and joined Schroders Greencoat from BayWa r.e. in January 2025.

Clothier is not concerned by the change in leadership. “The overall team at Greencoat is over 100 and the senior team has plenty of experience,” he said.

M&A potential

Over the long term, the trust has delivered NAV returns in the low teens, Jaffe said, and “the discount amplifies the forward-looking return potential”. Corporate action could accelerate the investment case.

Greencoat has a “straightforward portfolio: single geography, single technology” and the discount means it is “trading at a level that is pretty exceptional value”, he observed. “It could be seen as a prime candidate for a big institutional investor to bolt on or augment its existing infrastructure portfolio at quite an attractive price.”