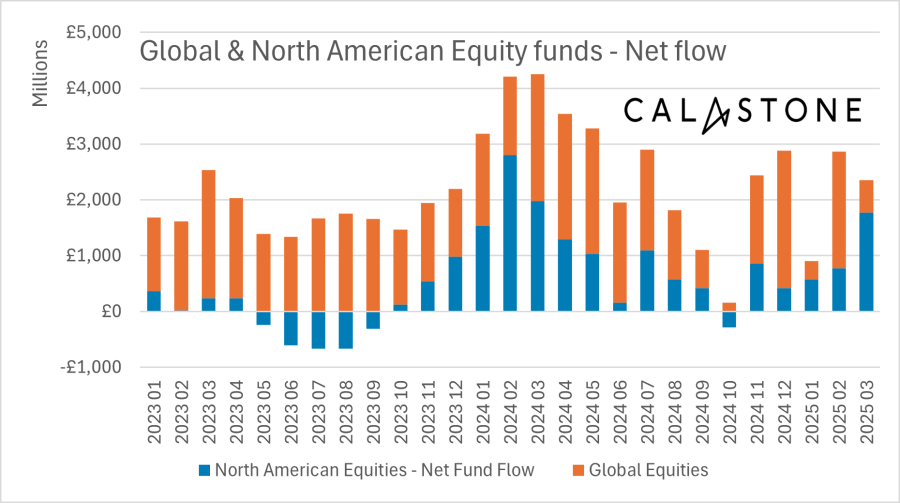

In March, equity funds experienced their best month of inflows in 2025 so far, according to the latest data from Calastone, with North American equity funds experiencing their highest inflows since March 2024.

North American funds absorbed a net £1.77bn last month, led by index trackers that attracted £8 of every £10 invested. Global funds, which are still dominated by US equities, followed with net inflows of £580m.

Source: Calastone Fund Flow Index – Mar 2025

Investor appetite remained undimmed by the US equity market selling off since mid-February. Nonetheless, Calastone’s March data does not reflect any trading activity after global equity markets went into meltdown following Donald Trump’s ‘Liberation Day’ tariffs on 2 April.

Edward Glyn, head of global markets at Calastone, said: “The strong appetite for US equities in March is at odds with tidal forces in global markets that are seeing a strong rotation out of US assets and into markets like Europe and the UK.”

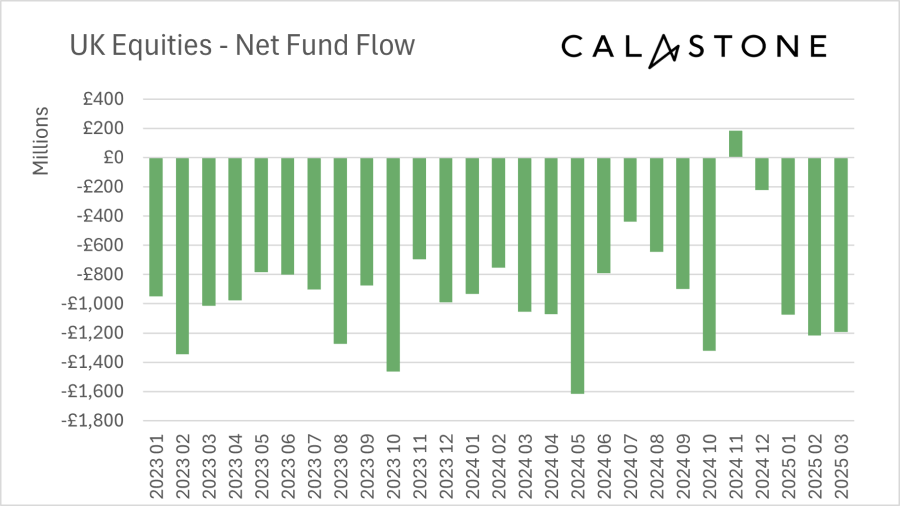

Only Asia Pacific and UK funds experienced outflows last month. UK funds had a particularly poor month, with investors pulling £1.19bn in March, bringing the year's total outflows to £3.48bn, the worst quarter on record.

This comes despite a relatively strong UK stock market, which outperformed global equities during the first quarter.

Source: Calastone Fund Flow Index – Mar 2025

“Bond flows perhaps tell us more about underlying investor sentiment at present,” Glyn said.

Indeed, as inflation fears rose, investors sold a net £700m of their bond fund holdings last month, the worst result since September 2024. By contrast, money market funds surged, absorbing an extra £513m, meaning money market funds had their best quarter on record.

Glyn concluded: “Headlines dominated by talk of trade wars, economic uncertainty and inflation have seemingly put bond investors off the asset class for the time being. Strong flows into safe-haven money market funds suggest uncertainty is a key motivator.”