US tariffs have wreaked havoc worldwide, but dramatic market movements could create commensurately large buying opportunities, according to Dina Ting, head of global index portfolio management at Franklin Templeton. She highlighted a handful of geographies and one industry sector in particular as tactical opportunities.

She began with Canada and Mexico, which were previously subject to separate tariffs, but have now been exempted for certain goods and minerals.

“If Canada and Mexico can make further progress with the emergency fentanyl issue that Donald Trump used to justify the tariffs, they may be folded into a separate tariff regime,” she noted.

“Steel, aluminum and imports of oil, gas and refined products are also exempt from the new tariffs, which may aid select economies and sectors – Saudi oil, for example”.

Other countries seeing minimal direct costs of tariffs include Brazil, Australia and the UK – the largest nations with which the US has a trade surplus.

Sources: Franklin Templeton, USDA, FactSet, MSCI

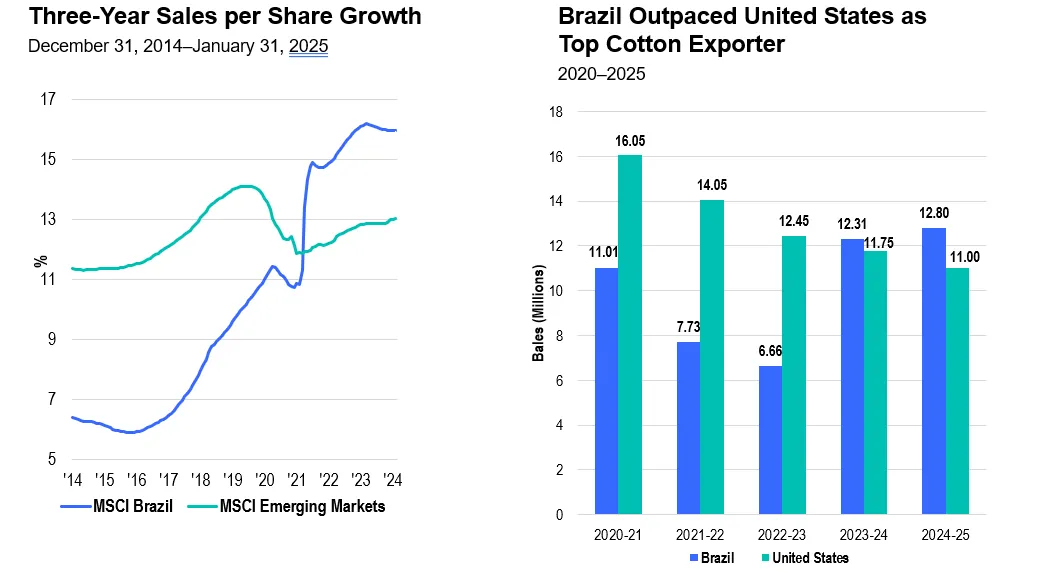

Brazil’s case was particularly interesting to Ting. It still struggles with high public debt but has a strong economy, underpinned by robust domestic demand, and unemployment was low in 2024.

“Soybeans remain a pivotal crop in Brazil’s agricultural expansion, driving the country’s rise as a leading global supplier of farm products, but a recent historic shift has also seen Brazil’s cotton exports surpass those of the US. Not surprisingly, China has been the main trade buyer for these products,” Ting said.

“Stable foreign direct investments have also been a key driver for Brazil’s current account balance, whose economic advantages also include vast natural resources and a large and young labour force.”

She also highlighted Taiwan and its semiconductor industry. From 9 April, goods from Taiwan will be subject to a 32% US import tax, with the key exception of semiconductors.

“No methodology has been published for how the tariffs will impact the complicated supply chain of semiconductor chips. Blunt data suggests the approach may have been much more simplistic and crude, which may leave the door open for adjustments,” Ting said. “Taiwanese officials have been quick to point to flaws in the calculations and have pressed for immediate negotiations.”

Thus far this year, the MSCI Taiwan Index is “in correction territory”, but Ting believes this is more a reflection of global uncertainty than the fundamentals of Taiwan's current economy.

Performance of index over the year to date

Source: FE Analytics

National GDP calculations predict growth of 3.3% in 2025, driven by continued demand for artificial intelligence (AI); the International Monetary Fund’s forecast is 2.7% – still well ahead of most developed countries and ahead of the G7’s lackluster 1.7%.

“Taiwan currently holds a two-thirds share of the global chips foundry market, dwarfing second-ranked South Korea’s 10%. In the production of the most advanced chips, including those used to train AI applications such as large language models, Taiwanese firms maintain near-total domination on global supply, with a market share exceeding 90%,” Ting said.

“At the same time, the Taiwan Semiconductor Manufacturing Company (TSMC) is diversifying production facilities overseas, not least for geopolitical reasons, with investment pledges of $200bn in the US.”

Precisely how all these developments will play out for global trade and investors’ portfolios remains to be seen, but Ting concluded by emphasizing “the now-particularly-significant wisdom of diversification”.