Defence spending has boomed due to rising geopolitical tension and the share prices of European defence companies have soared as a result. But investors hoping to capitalise on this trend should be wary of getting in now, according to Dmitry Solomakhin, manager of the Fidelity FAST Global fund, who believes defence is a bubble that could soon burst.

“Fundamentally, I understand why people are positive, but stocks have priced all this optimism in and so much more,” he explained.

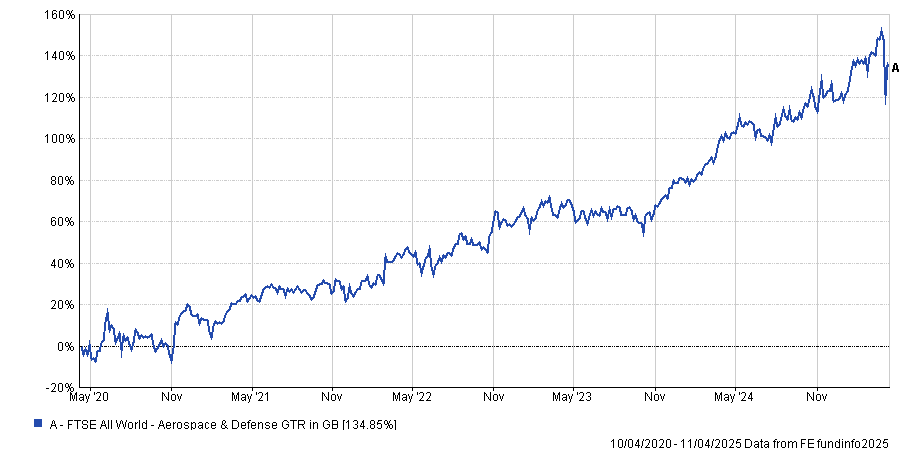

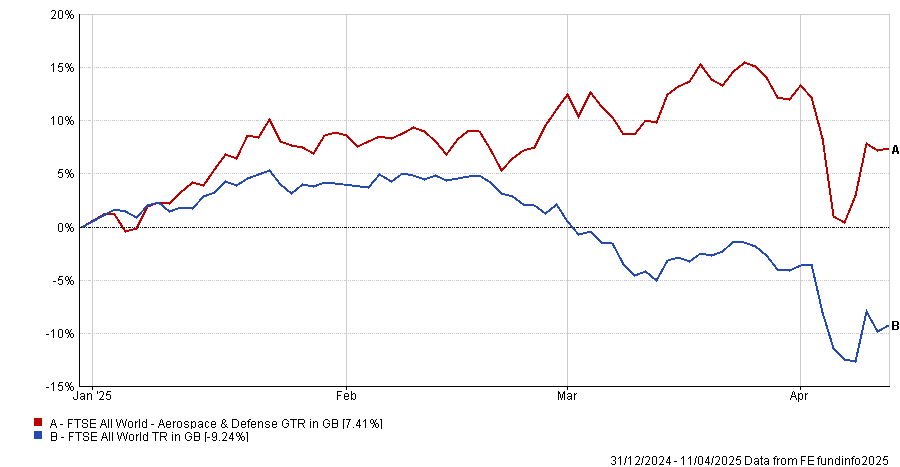

The FTSE All World Aerospace and Defence index is up 134% over the past five years and the sector has been a strong performer this year despite the broader stock market downturn. The HAN Future of Defence UCITS ETF, for instance, has returned 8.9% year to date.

As Dan Coatsworth, investment analyst at AJ Bell, said: European defence seems to be a “winning trade”.

Performance of index over the past 5yrs

Source: FE Analytics

Investors – including Solomakhin’s colleagues in Fidelity’s multi-asset team – have been piling into European defence stocks on the back of European governments’ increased commitments to military budgets.

In the UK, Chancellor Rachel Reeves's spring statement promised a further £2.2bn spending for the Ministry of Defence next year, following Prime Minister Keir Starmer’s plan to increase defence spending to 2.5% of GDP. Elsewhere, the new German government has committed £500m to an infrastructure and defence fund.

Many defence companies have raised their prices by three or four times recently “because it is a war and they can”, Solomakhin observed.

But even if defence grows as a portion of GDP and companies’ profit margins increase, current valuations are unlikely to be sustainable long term, Solomakhin argued.

He believes investors are focussing on headlines about defence spending and the industry-wide upsides, whilst failing to consider stock-specific downsides. For instance, many defence companies still have exposure to US-run programmes, so could be at risk from recent market volatility and Donald Trump’s anti-globalisation tendencies, he said.

Stock markets have been “moving away from fundamentals for the past 10-15 years” and are now driven by themes, which tend to exaggerate market moves, he continued. This has led to a mismatch between the fundamentals of defence companies and perceptions amongst investors.

While he conceded that defence companies probably have some room left to run, he believes the bubble is now close to its peak. Interest from retail investors in Asia is an indication that the defence trend is well known and priced in, he said. “If you see Asian investors looking at defence names the same way they used to look at electric vehicle names, it shows that you are probably too late to the game.”

Even so, bubbles do have a certain allure, even for professional fund managers, which Solomakhin thinks is due to the fear of missing out. “There is a very good friend of mine, a highly experienced manager, who always tells me, ‘If there is a bubble, I want to be in it’,” he said.

“The market always loves bubbles. It happens all the time. It happened with green names in the past, it is happening with artificial intelligence and now with defence.”

The mistake investors are currently making is believing they can time the market and predict when the defence bubble might burst, he said. “You always think you can get out in time, and you will avoid the downturn. Some people can but most can’t.”

Despite these arguments, UK-listed defence contractors Babcock International and Rolls-Royce are the top two positions in his fund, with an allocation of 6.6% and 6% respectively. Over the past year, Rolls Royce is up 79%, while Babcock is up around 42%.

Solomakhin was initially attracted to Babcock and Rolls-Royce as compelling turnaround stories but he continues to hold them today because they are highly visible and have a long-term approach to defence. For example, Babcock has “unique expertise in nuclear programmes”, which gave it more room to run than many investors expected, he said.

He views Babcock and Rolls-Royce as international – not just European – companies, despite them being UK-listed. “Both are so diverse in their defence budget, exposures and customers that they’re pretty much international, so you can’t really put them in the European or UK domestic basket,” he explained.

By contrast, the share prices of continental European defence have been increasingly driven by speculation around geopolitical conflict and news flow, he said.

As a result, while there are some good names within the European defence industry, investors should be careful to ensure they have fully analysed each company’s programmes and potential risks, rather than just investing because the sector is in the news, he concluded.

Over the past five years, Solomakhin’s fund is up 126.5%, the seventh-best result in the FO Equity International sector, partially due to long positions in Rolls-Royce and Babcock.

Performance of fund vs sector and benchmark over the past 5yrs

Source: FE Analytics