Investing according to environmental, social and governance (ESG) principles has thrived during 2020’s coronavirus pandemic but FE fundinfo data shows this trend is far from restricted to just this year.

Responsible investing strategies have outperformed this year, as the pandemic accelerated pre-existing trends such as flexible working, automation and the re-shoring of supply chains, and arrangements. At the same time, investors’ focus on companies’ treatment of their customers, employees and suppliers has increased.

But how is reflected in the performance of ESG funds versus their more conventional peers?

In this research, Trustnet has reviewed 26 Investment Association sectors that have at least one member with an ethical or sustainable approach to see how their performance compares with those that do not take this approach.

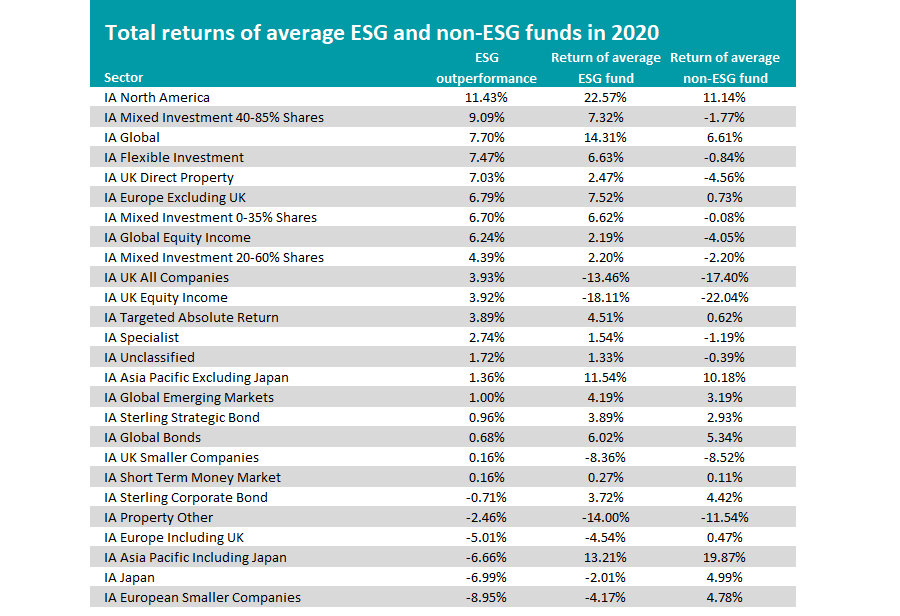

When we put the 2020 total returns of the average ESG fund next to the average non-ESG, we found that ESG was ahead in 20 of the 26 sectors.

The highest outperformance came from the IA North America sector, where the 22.57 per cent made by the average ESG fund is 11.43 percentage points above that of the rest of the peer group.

The sector has three funds that have labelled themselves as having an ethical/sustainable investment focus on FE fundinfo’s systems: Brown Advisory US Sustainable Growth, Candriam Sustainable North America and Legg Mason ClearBridge US Equity Sustainability Leaders.

Source: FE Analytics. Returns as at 23 Oct 2020

Another seven sectors – IA Mixed Investment 40-85% Shares, IA Global, IA Flexible Investment, IA UK Direct Property, IA Europe Excluding UK, IA Mixed Investment 0-35% Shares and IA Global Equity Income – have seen the average ESG members beat the average conventional fund by more than 5 percentage points this year.

The very highest returns this year have come from funds that do not use an ESG strategy. In the lead is Morg Stnly US Growth with a 98.35 per cent return, closely followed by Baillie Gifford American’s 92.92 per cent gain. The next five highest returning funds are non-ESG strategies.

This is to be expected, given that the bulk of funds are conventional in their approach. Indeed, of the 4,125 funds in the Investment Association universe, only 248 have categorised themselves as taking an ethical/sustainable approach.

But despite their relative rarity, a surprising number of ESG funds are found near the top of 2020’s performance table. The highest ranked is Baillie Gifford Positive Change, which is in eighth place overall thanks to its 59.48 per cent total return.

If we look at the top 10 per cent of this year’s total returns, then 52 of the 412 funds have an ESG strategy. These include Guinness Sustainable Energy, Brown Advisory US Sustainable Growth, Liontrust Sustainable Future Managed Growth, Rathbone Global Sustainability and Royal London Sustainable World Trust.

This trend has not sprung out of nowhere and ESG funds were beating others in years before the pandemic, but 2020 represents something of a change in pace.

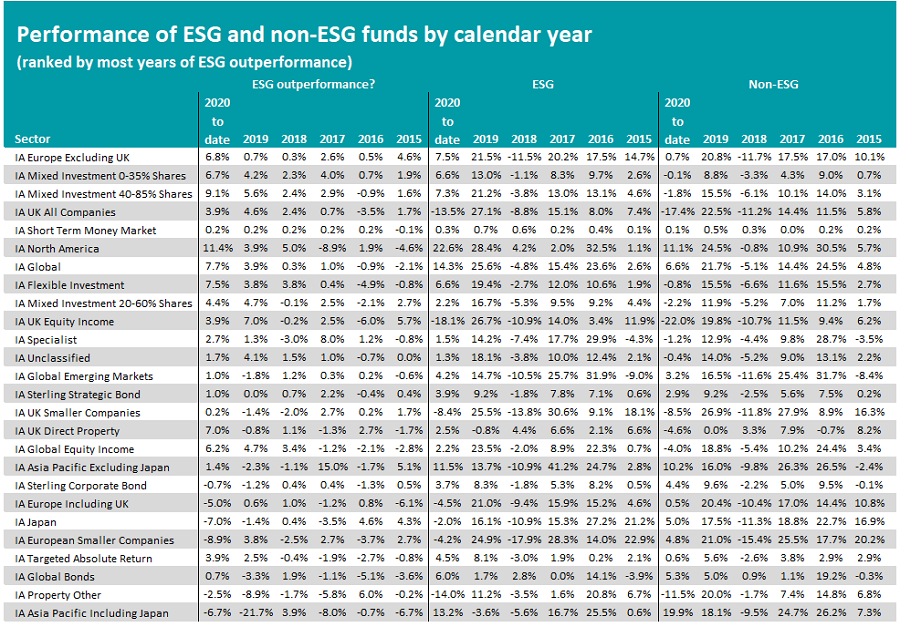

Source: FE Analytics. Returns as at 23 Oct 2020

Trustnet looked at 2020 so far plus the five full calendar years before to see how often ESG has outperformed the conventional approach. The results are shown in the table above, ranked by the number of periods in which ESG has outperformed.

With ESG outperforming in 20 of the 26 fund sectors, 2020 has been a very strong year for responsible investment but by no means the only year when this approach has worked.

There were 16 sectors in 2019 where ESG generated a higher average total return than a non-ESG approach, 18 in 2018 and 17 in 2017. Things were more challenging in 2015 and 2016, however, when ESG outperformed in fewer than half of the sectors.

In all, there are 15 sectors were the average ESG funds has beaten its average conventional peer in four or more of the six periods under consideration here.

Two of them – IA Europe Excluding UK and IA Mixed Investment 0-35% Shares – have seen their ESG members outperform in all of the five full calendar years as well as in 2020 so far.

The average ESG fund in the IA UK All Companies, IA Mixed Investment 40-85% Shares and IA Short Term Money Market peer groups has outpaced its non-ESG peer in five of the six periods.

Another 10 sectors – including IA Global, IA Mixed Investment 20-60% Shares, IA UK Equity Income, IA Global Emerging Markets and IA UK Smaller Companies – has seen their average ESG member outperforming in four of the periods.

On the other hand, ESG has failed to beat non-ESG in five of the periods in the IA Asia Pacific Inc Japan and IA Property Other peer groups.

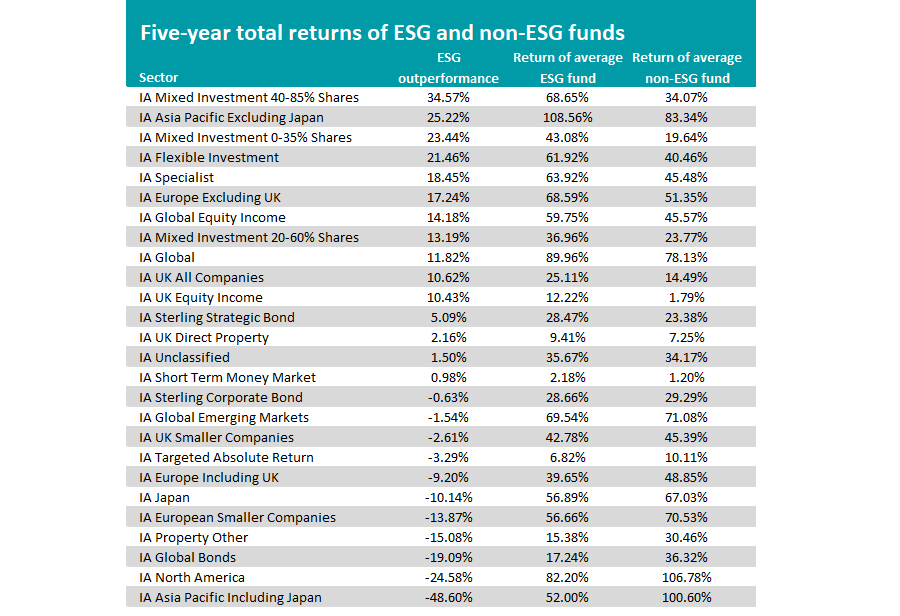

Source: FE Analytics. Returns as at 23 Oct 2020

Running the numbers of five-year total returns shows how responsible investment funds have outperformed over the longer term. ESG has outperformed in 15 of the 26 peer groups.

The sector where ESG strategies have been most successful relative to their peers is IA Mixed Investment 40-85% Shares. Its six ESG members have beaten their conventional peer by 34.57 percentage points over the past five years.

The best performing ESG member of that sector is Royal London Sustainable World Trust, which has made 110.61 per cent over five years. This is also the highest return of the entire sector.

ESG funds in the IA UK All Companies and IA Global sectors – the two most popular peer groups – have beaten non-ESG strategies by around 10 percentage points over the last five years, on average.

Global ESG funds with strong track records here include Liontrust Sustainable Future Global Growth (up 132.80 per cent), Janus Henderson Global Sustainable Equity (127.18 per cent) and Pictet Global Environmental Opportunities (122.43 per cent).

Royal London Sustainable Leaders Trust (62.14 per cent), ASI UK Responsible Equity (55.85 per cent) and Liontrust Sustainable Future UK Growth (49.41 per cent) are among those outperforming in the IA UK All Companies sector.