Leadership in the US equity market will broaden out in 2021 as the coronavirus vaccine is rolled out but long-term trends of technological disruption will remain key drivers, according to fund managers.

Despite the Covid-19 shock that caused a dramatic market setback earlier in the year, the US equity market has made back most of its losses and is positive year-to-date.

The performance this year has been a continuation of a decade of returns driven largely by success of growth stocks that include big US tech companies such as Facebook, Amazon, Apple, Microsoft and Google (Alphabet).

However, despite this success, investment strategists at Vanguard said in their 2021 outlook that they do not expect the trends that have defined the last decade to persist.

“We expect equity markets outside of the US to outperform, largely because of lower valuations and a higher dividend yield,” the strategists said. “Likewise, we are expecting value stocks to outperform growth over the next decade based on our fundamental assessment.

“The higher return outlook for non-US equity markets underscores the benefits of global equity strategies in this environment and provides a timely opportunity for US investors to review areas of excessive concentration risk.”

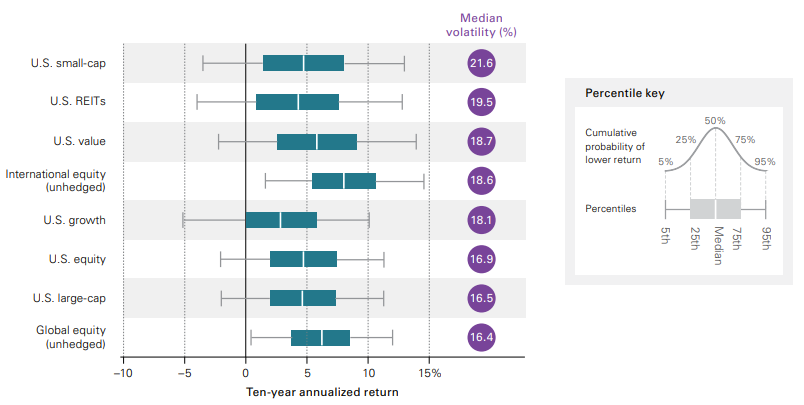

As such, Vanguard’s 10-year annualised return outlook for global equities (in USD) is in the 5 to 7 per cent range, whilst its outlook for US equities is around the 4 per cent range, as shown below.

Source: Vanguard

The strategists expect annualised excess returns for value stocks to be 1.1 per cent, and excess returns for growth stocks to be 2.6 per cent.

“Given these differences and continued low inflation expectations, our view is that the outperformance will be primarily driven by the contraction in the valuations of growth stocks, rather than the valuations of value stocks returning to levels seen in prior decades,” they explained.

Whilst cyclical and value-orientated sectors look most attractive in 2021, Scott Glasser, co-chief investment officer at ClearBridge Investments still favours technology disruptors over the long term.

“Positive vaccine results from three separate drug candidates in November immediately boosted the outlook for cyclical stocks,” he said. “A broadening of market leadership that should continue into 2021.

“We believe the cyclical and value-oriented sectors most severely impacted by the pandemic shutdowns look the most attractive. We expect the greatest increases in earnings growth will occur in these areas, as they will benefit from easier year-over-year comparisons and improving sentiment.

“The market has already responded to this anticipation for improvement and should continue to do so.”

However, when it comes to technology stocks, he admitted their valuations suggest they are overbought and “most at risk of disappointing investors in 2021”.

However, Glasser provided a caveat to this view: “Yet much of market forecasting is based on past analogs and we would argue that given the unique nature of the Covid-19 pandemic, which caused voluntary shutdowns of broad swaths of the economy, such analogs are not as applicable today.

“At current interest rates, technology valuations are well supported. Technology companies, which also include names in the communication services and consumer discretionary sectors, were direct beneficiaries of the shift to work from home and e-commerce.

“While valuations have expanded, growth has expanded as well and the major trends reliant on technology software and services remain in place. The pandemic accelerated those trends, making the digital parts of the economy larger, and we expect technology stocks will continue to grow faster than the overall market.”

Although he is taking a more cyclical bias in 2021, he believes it’s important to continue to maintain exposure to technology disruptors that are transforming the economy.

Despite this, he did admit that investor sentiment and earnings forecasts for the first half of 2021 were a bit “exuberant”, which could lead to some consolidation and a slight correction early in the new year.

However, in the longer term, Glasser said: “Markets should head higher as the economy normalizes with the distribution of a vaccine and adjustment to a new presidential administration in the US.

“We also believe that a durable economic bottom has formed, providing further support for equities, which tend to perform strongly coming out of recessions.”

Christopher Rossbach, manager of the J. Stern World Stars Global Equity fund, is another who does not subscribe to the belief that value or cyclicals will outperform in the long run.

“I'm not really a big believer in a market rotation and, in the long term, I don't care about it,” he said. “I think the digital platforms will continue to do well, although how Amazon will trade when it has 15 per cent growth, not 60 per cent, we'll see.

“However, if it doesn't trade so well in 2021, then it'll be an opportunity for the next year.”

In terms of an overall US equity outlook, Rossbach does expect the performance of US equities to be a little more balanced in 2021: “The digital companies may not do quite as well relative to others, but for long term investors it shouldn’t matter.”

He said that ultimately a rotation into value versus growth stocks won’t prevent businesses from getting disrupted.

“They might do well, but only because they've done so poorly recently,” he said. “I don't see how they will sustainably do well, because getting disrupted is still getting disrupted.

“So, airlines are still a terrible business. Automobile makers are still a terrible business. Retail is still a terrible business. It's not going to change.

“Just because it's slightly less terrible and just because some of them will have survived and others won't, doesn't make them any less terrible.”

Performance of S&P 500 Growth vs S&P 500Value over 10yrs

Source: FE Analytics

Indeed, Franklin Equity Group portfolio managers Grant Bowers and Matthew Moberg said that Covid-19 merely accelerated the ‘Fourth Industrial Revolution’ that the world is experiencing and will continue to go through in 2021.

They said: “Examples of rapid industry shifts include work from anywhere, remote sports and entertainment, greater reliance on restaurant takeout and delivery services, increasing industry consolidations, supply chains returning domestically, and retailers moving exclusively online.

In their view, the accelerated adoption of technological solutions during the pandemic was “just the beginning”.

They added: “As we emerge from the pandemic crisis, we believe the continued shift to digital solutions will be more important than ever and may continue to accelerate as late comers catch up, while employees and consumers retain at least some (if not most) new behaviours that have become necessary in the age of global social distancing.

“Going forward, we see drivers of value creation across all industries, such as health care, fintech, consumer retail and manufacturing.

“Leaders on the forefront of these trends are proving they understand the state of their businesses and can meet their customers’ needs faster than ever, leading the way in highly dynamic business environments.”

As a result, Bowers and Moberg’s focus will be on quality companies that they believe display innovation and can potentially generate “solid, risk-adjusted investment performance” over a long-term horizon.

They said: “We remain focused on finding quality companies with strong competitive advantages, robust balance sheets and healthy free cash flows that can weather a severe economic downturn or increased market and economic volatility.

“Many of these high-quality companies should be able to emerge from a crisis even stronger, in our view.”