UK, value and energy funds rallied in February as the coronavirus vaccine rollout fuelled hopes of stronger economic rebound, FE fundinfo data shows, although the month’s best-performing fund was an absolute return strategy.

February saw continued progress in the UK’s vaccination programme and a roadmap to take the country out of lockdown; many other countries are also eyeing an eventual return to a more ‘normal’ way of life.

But last month ended up being a relatively muted month for markets, with the MSCI AC World index rising just 0.5 per cent and bonds selling off as investors worried about the prospect of higher inflation.

Ben Yearsley, investment consultant at Fairview Investing, said: “Good news is everywhere; vaccinations, dividends, even the weather has turned ‘spring-like’. Unfortunately, stock markets are addicted to stimulus so good news is bad, and bad news is good.

“Worries about the Covid crisis are less prevalent with many now concerned about the withdrawal of stimulus and interest rates increasing. Many fund managers are saying that growth will easily outstrip official forecasts both in the UK and US with huge levels of pent up consumer demand waiting to be unleashed.”

In light of this, the value style of investing – which is more geared to a boost in economic activity – outperformed growth stocks, while cyclical sectors like energy and financials beat tech and healthcare. In addition, small-cap stocks outpaced larger companies.

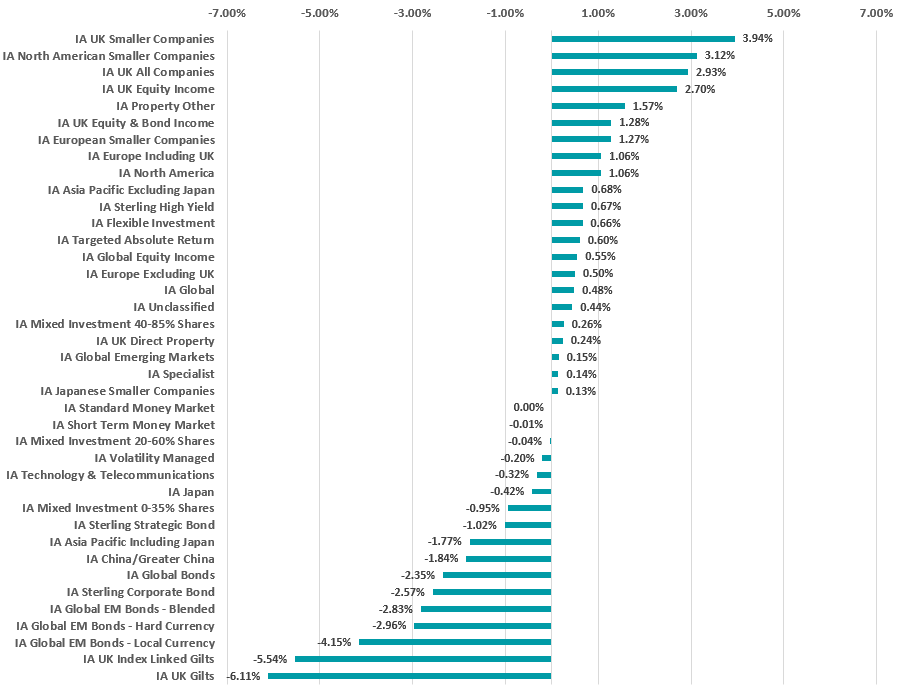

Performance of Investment Association sectors – Feb 2021

Source: FE Analytics

The above chart shows how the various Investment Association peer groups performed last month, with the IA UK Smaller Companies sector sitting at the top with an average total return of 3.94 per cent.

Smaller companies benefited from the growing confidence that the UK economy will experience a rapid rebound later in the year if the country’s vaccination programme continues to be rolled out so rapidly.

Sentiment was restricted to small-caps though, with the IA UK All Companies and IA UK Equity Income sectors also producing some of the month’s strongest returns.

While equities were the place to be in February, fixed income went through a challenging; bonds tend to perform less well in periods of strong economic growth and this is on investors’ minds. Both the IA UK Gilts and IA UK Index Linked Gilts sectors lost more than 5 per cent.

When it comes to individual funds, however, an absolute return strategy topped last month’s performance tables.

Source: FE Analytics

James Hanbury and Jamie Grimston’s £478m LF Brook Absolute Return fund made 21.35 per cent in February, thanks to a heavy weighting to UK equities and sectors like financials, industrials and materials.

The fund might be better known to some as LF Odey Absolute Return – it recently changed its name after Odey Asset Management launched the Brook Asset Management brand and relabelled its funds.

Mark Lacey’s Schroder ISF Global Energy fund came in second place after making 18.35 per cent. It benefitted from the rally in energy stocks (oil rose 15 per cent in February), as did similar strategies like Guinness Global Energy and BlackRock GF World Energy.

The fund in fourth place - VT Cape Wrath Focus – is a value strategy managed by Adam Rackley. It was highlighted in a Trustnet article earlier today for its history of outperforming when the value style is rallying, as was the case last month.

Other funds on the list that take a value approach include Ninety One Global Special Situations, Ninety One UK Special Situations and ASI UK Unconstrained Equity.

Gervais Williams and Martin Turner’s Premier Miton UK Smaller Companies fund was one of the strongest performers last month. This continues something of a run for the fund – it made the seventh highest return from the entire Investment Association universe in 2020.

Financials funds like Aptus Global Financials and Denker Global Financial had a strong month following the bounce in bank stocks.

Source: FE Analytics

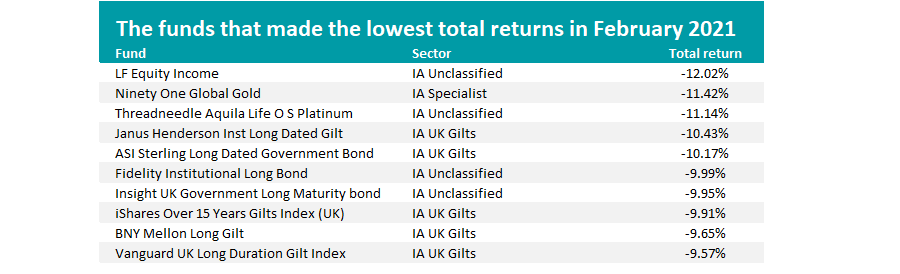

LF Equity Income made the lowest total return of February with a 12.02 per cent loss. The fund, which used to be the flagship offering of fallen star Neil Woodford, is currently being wound up.

The big trend from last month’s weakest funds, however, is the losses that hit bond funds. Most of the funds that posted the heaviest losses are long-dated bond funds.

Yearsley said: “With the sharp movement up in yields in February for long dated gilts it isn’t a surprise seeing these funds have such a tough time; it does show that gilts can be extremely volatile investments.”

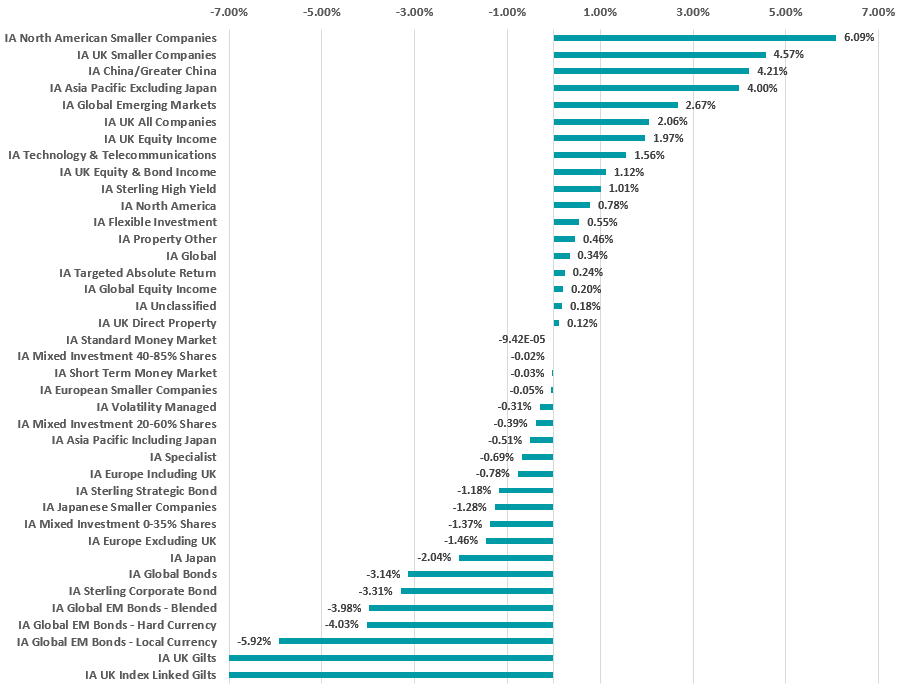

How does all this mean 2021 is shaping up so far? Below shows the year-to-date performance of the Investment Association sectors as well as the best and worst funds.

Performance of Investment Association sectors – 2021 to date

Source: FE Analytics