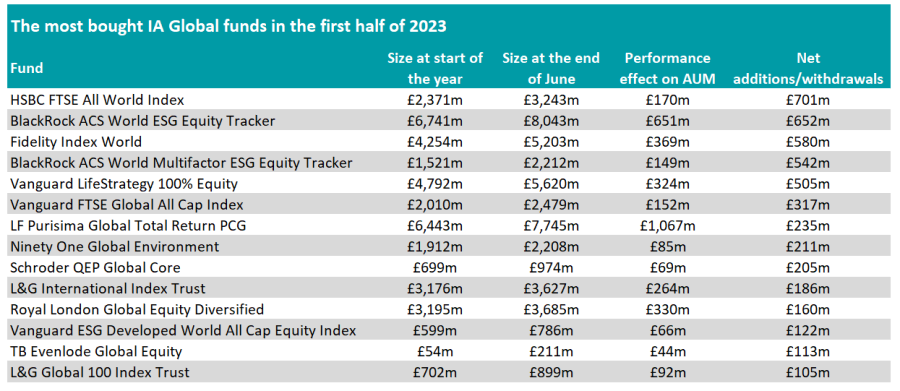

Investors moved into passive funds for their global exposure in the first half of 2023, according to data from FE Analytics, choosing to move their money from active funds with a growth tilt.

In the below study, Trustnet reveals the most bought and sold funds in the IA Global sector in the first six months of the year and shortlisted those in which investors either added or withdrew at least £100m.

The five most-bought funds are all index trackers from assets managers HSBC, BlackRock, Fidelity and Vanguard.

With investors adding £701m, HSBC FTSE All World Index is the global fund that grew the most in the first half of the year. The fund, which replicates the performance of the FTSE All World index, has an ongoing charge figure of 0.13% and a tracking error of 3.79% over five years.

Among the most bought global trackers, Fidelity Index World is slightly cheaper, with an OCF of 0.12%, but deviates more from its benchmark with a tracking error of 4.12% over the same period.

Vanguard FTSE Global All Cap Index has the lowest tracking error in the list, 0.54% over five years, but charges 0.24%.

Source: FE Analytics

Among the 14 global funds in which investors have poured at least £100m, only four are actively managed: Ninety One Global Environment, Schroder QEP Global Core, Royal London Global Equity Diversified and TB Evenlode Global Equity.

Ninety One Global Environment is the active fund that has benefited the most from investors’ movements, as they added £211m to its AUM.

Environmental, social and governance themes suffered in 2022, but investors have bought back into them this year. However, with Stewart Investors Worldwide Sustainability and Liontrust Sustainable Future Global Growth among the most sold funds, the picture seems to be a mix one for sustainable funds.

TB Evenlode Global Equity, launched in 2020, has more than doubled in size in the first six months of the year, growing from £54m to £211m as investors put £113m into the fund.

Royal London Global Equity Diversified, managed by FE fundinfo Alpha Manager James Clark, Peter Rutter and Will Kenney, benefitted from £160m in inflows, although performance added another £330m to the fund’s AUM.

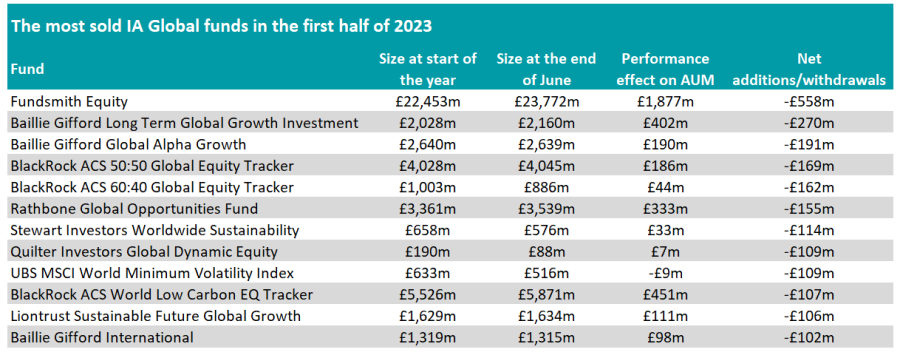

However, it’s been a more complicated period for active funds with a growth bias.

Source: FE Analytics

For instance, Fundsmith Equity is the fund in the IA Global sector that has experienced the strongest exodus, with investors withdrawing £558m from the fund.

In spite of this, the fund has grown by £2bn in the first half of the year, as performance made up for the withdrawals.

Fundsmith Equity remains the largest active fund in the Investment Association universe, with nearly £24bn in AUM at the end of June.

Rathbone Global Opportunities, another popular global fund with exposure to tech businesses such as NVIDIA, ASML and Alphabet, has also lost investors’ favours, with withdrawals amounting to £155m despite positive performance.

It has also been a difficult period for Baillie Gifford, with three funds of the Edinburgh-based asset managers in the list of the 14 funds where investors withdrew at least £100m in the first half of the year: Baillie Gifford Long Term Global Growth Investment, Baillie Gifford Global Alpha Growth and Baillie Gifford International.

The two latter funds are run by the same team and are open-ended versions of Monks, while Baillie Gifford Long Term Global Growth Investment is the open-ended version of Scottish Mortgage.

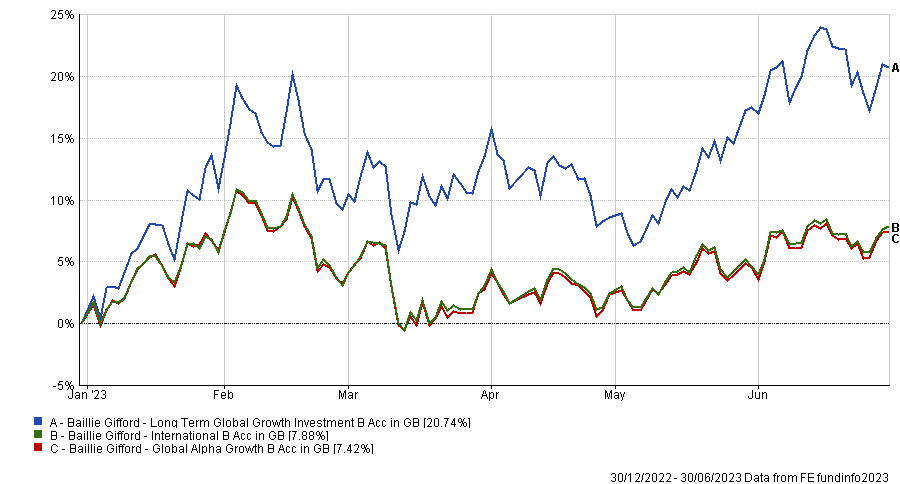

Similarly to Fundsmith Equity, these funds made positive returns over the six months. For instance, performance enabled Baillie Gifford Long Term Global Growth Investment to grow its AUM by £132m.

Performance of funds in the first half of 2023

Source: FE Analytics

UBS MSCI World Minimum Volatility Index is the only fund in the list where performance compounded outflows. The fund fell £117m in size between January and June 2023 with £109m of this coming from withdrawals.