The IPO market is a real party animal. It’s the soul of the dancefloor when things are in full swing and sulks in the corner complaining that ‘nobody’s fun anymore’ when everyone else has gone home. It looks back at 2021 with fond memories but can’t help cringing – having drunk too much punch early on, there were fun times for sure, but regrets drifted in, and the hangover lasted well into 2022.

With the music having been firmly turned off since, it’s only now that the IPO market is waking up from a doze – but how it’s faring and whether there’s even a party to go to remains to be seen.

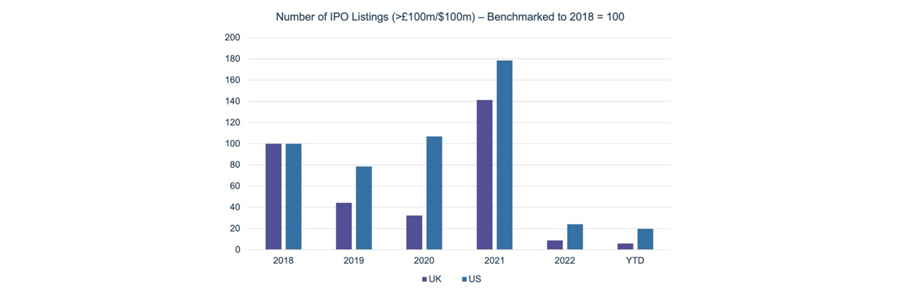

Reluctantly moving on from the party metaphor, let’s put the IPO market of recent years in context with data.

Source: Bloomberg, Tellworth Investments, as at 20 September 2023

Source: Bloomberg, Tellworth Investments, as at 20 September 2023

It’s worth commenting that, despite the UK IPO market having been singled out as being deathly quiet of late, the trend is broadly similar in the US: 2021 was a clear peak in terms of activity and things have remained notably subdued since.

More recently there have been signs of life, however, with a rise in interest levels having been fuelled by some higher profile IPOs in the US (e.g. ARM and Instacart). Over here in the UK, whilst there have been a handful of recent listings, the rumble of enthusiasm still feels more like a gurgle – but we think the pick-up is coming.

We believe that the UK market remains an attractive place to IPO, offering a robust regulatory system balanced against relatively low costs to list. It’s worth reminding that the UK punches well above its weight as an exchange for IPOs, representing around 5% of global listings – around double its proportionate contribution to global GDP.

Furthermore, with the Treasury and Financial Conduct Authority now conducting reviews into the UK as an IPO destination, there is potential for further measures to be introduced to enhance its position.

What would it take to get the UK’s IPO market going again? We think a combination of increased risk appetite, improved liquidity and macro stability. These aspects are linked and, whilst all three have been lacking in the UK, as reflected in trough sentiment and valuations close to relative lows, we see an improving outlook from here.

Should a degree of optimism begin to translate into an improvement of flows into UK equities and rising investor demand for new listings, this should give more private companies the confidence to list and feed the process.

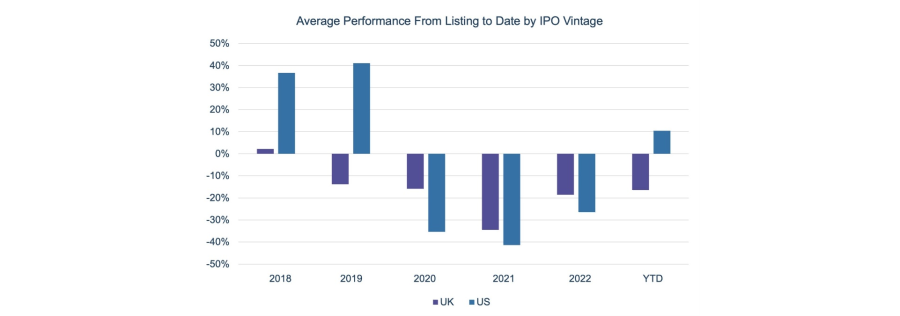

However, when the UK IPO market does open up again, we won’t necessarily be waiting with open arms. IPOs are a useful source of new investment ideas but not a magical route to performance – though the association with buoyant markets may rose-tint investors’ spectacles somewhat. The performance to date of recent years’ IPOs across both the UK and US should be reason enough for investors to keep their guard up.

Source: Bloomberg, Tellworth Investments, as at 20 September 2023

Obviously but crucially, all IPOs are different, and it really boils down to seeking decent companies at attractive valuations. There are many IPO success stories in the UK – Alpha Group and Watches of Switzerland being positive examples that we’ve historically invested in – but also many failures. The performance of the ‘website and warehouse’ focused IPO vintage of 2021 being a case in point on the latter.

Our assessment of IPOs follows the same process we deploy for any investment being considered but preferably with the higher degree of scepticism that the lack of listed track record should require. This leads to an implicit overlay to the investment process for IPOs – let’s call it ‘why why why’ (just coined):

- Why now? – Seller motivation? Skin in the game post listing? Listing on peak financials? Dressed for sale?

- Why this business? – What’s differentiated about it? Fits with what we normally look for in companies?

- Why not everything else? – What makes it attractive vs the several hundred listed companies already available?

As always, the day job remains to find the best investment opportunities we can in the UK equity market, and we welcome the prospect of a healthier IPO market as both a sign and a symptom of investor appetite returning. In terms of the timing, we say let’s get the party started.

James Gerlis, co-manager of the TM Tellworth UK Smaller Companies fund. The views expressed above should not be taken as investment advice.