Equity income funds managed by the likes of Fidelity, Schroders and Columbia Threadneedle have the strongest track records of staying at the top of their sectors over the long run, analysis by Trustnet has found.

In this research, we examined the rolling 10-year returns of IA UK Equity Income and IA Global Equity Income funds starting at the turn of the century. These rolling decades were calculated on a quarterly basis, giving us 56 periods to look at, but we only reviewed funds with a quartile ranking in at least half of those periods.

Of the 46 funds that were eligible, just seven – or 15% – were in their peer group’s top quartile in 75% or more of the rolling 10-year periods this research looked at.

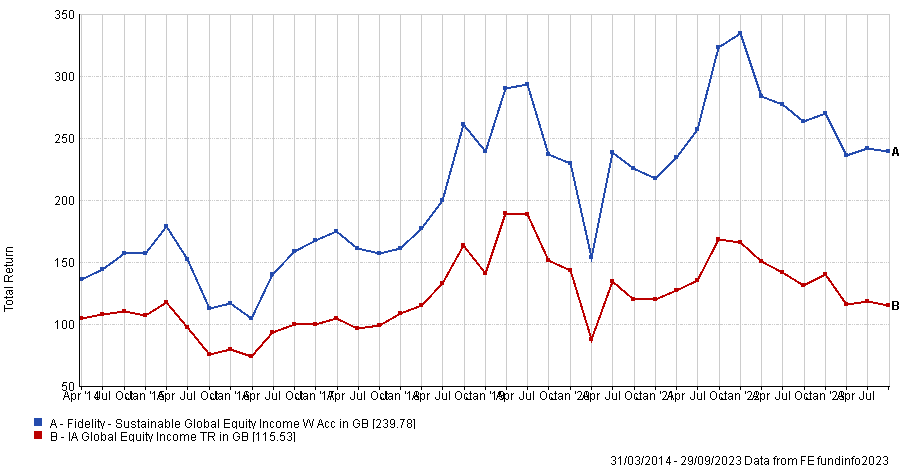

Rolling 10yr returns of Fidelity Sustainable Global Equity Income vs sector

Source: FE Analytics

The fund with the strongest track record is pictured in the chart above: Fidelity Sustainable Global Equity Income. It has been in the IA Global Equity Income sector’s first quartile in 37 of the 39 rolling 10-year periods in its history – a success rate of 94.5%.

However, it is worth noting that manager Aditya Shivram has only been in charge of Fidelity Sustainable Global Equity Income since July 2021, although he managed the offshore Fidelity Global Equity Income fund since its launch in 2013.

The £79m fund looks for sustainable, higher quality companies with stable and/or improving returns on capital, reasonable valuations, low leverage and predictable, stable business models.

Fidelity said “the focus on quality dividend payers results in a defensive bias to the portfolio but with some exposure to higher quality cyclicals”. Top holdings include insurer Progressive Corporation, professional services firm Marsh & McLennan and analytics company RELX.

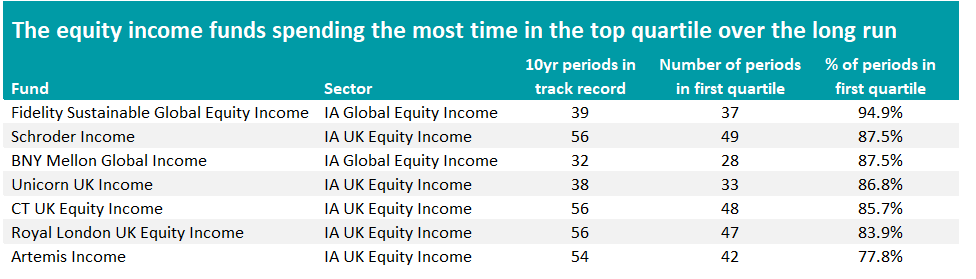

Source: FE Analytics

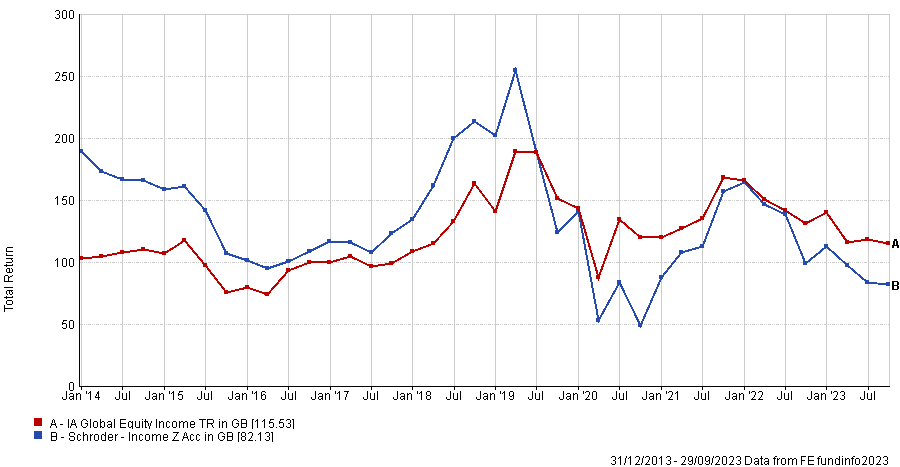

Schroder Income, in second place with an 87.5% top-quartile rate, is the first fund on the list that has a track record spanning the full 56 rolling 10-year periods.

Managed by Kevin Murphy and Nick Kirrage since 2010, the £1.1bn fund looks for significantly undervalued companies with strong balance sheets and the ability to generate cash to pay for dividends.

Top holdings include Shell, HBSC and Sainsbury’s, while the portfolio is running overweights to financials, consumer discretionary, telecommunications and tech companies.

Analysts with FE Investments said: “Their contrarian positions have tended to pay off well over the long term. Their process has evolved to include features that aim to counteract human biases, which is an attractive addition.”

Rolling 10yr returns of Schroder Income vs sector

Source: FE Analytics

Two more funds on the list have track records covering the entire timeframe examined in this research – CT UK Equity Income and Royal London UK Equity Income – while Artemis Income was active in 54 of the 56 periods.

CT UK Equity Income is another fund with a contrarian approach. It was managed by Rochard Colwell for much of the track record examined in this research but Colwell retired in November 2022, when it was taken over by Jeremy Smith.

FundCalibre analysts describe Smith as “an extremely experienced manager” with a very similar style to Colwell. “The fund has a patient high-conviction approach and has proven to be extremely consistent over many years,” they added. “We are confident that Jeremy can continue to deliver solid results.”

Royal London UK Equity Income is another fund with a strong long-term track record but a relatively recent arrival in charge. Much of the fund’s 83.9% top-quartile rate was overseen by former manager Martin Cholwill but it was taken over by Richard Marwood in May 2021.

However, Marwood is an experienced manager and is the head of Royal London’s equity income team. Royal London UK Equity Income made a top-quartile total return in both 2021 and 2022 and is in the second quartile over 2023 so far.

Artemis Income, meanwhile, is another well-known fund, described by analysts at Barclays as “one of the stalwarts of the UK equity income market”. They added: “It’s easy to understand why – an experienced team adhering to a simple, but successful, investment philosophy, has delivered strong long term returns and a sustainable income stream.”