Active managers could be falling into “a dark age”, according to AJ Bell, as little over one-third of active funds are beating passives this year while investors pull out their money at an “unprecedented” rate.

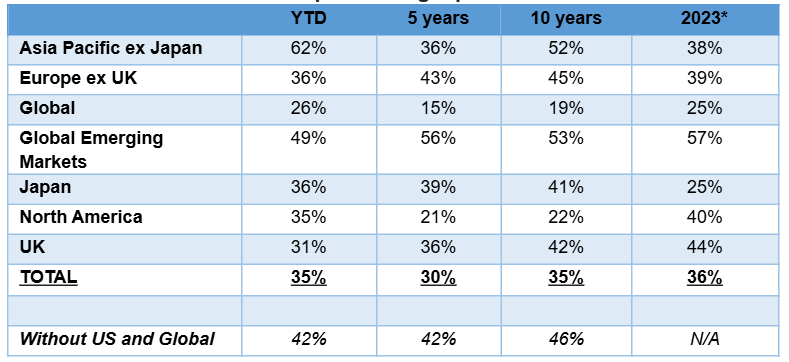

The platform’s latest Manager versus Machine report found just 35% of active equity funds have beaten the average passive in their sector in 2024. This isn’t just a short-term snapshot either, as only the same proportion have outperformed over 10 years.

In this research, AJ Bell looked at seven equity fund sectors, covering Asia Pacific excluding Japan, Europe excluding UK, global, global emerging markets, Japan, North America and the UK.

% of active funds outperforming a passive alternative

Sources: AJ Bell, Morningstar. Total return to 30 Jun 2024. *Data to 30 Nov 2023.

When the Manager versus Machine research was launched in 2021, 56% of active managers outperformed their passive rivals over a 10-year period.

Laith Khalaf, head of investment analysis at AJ Bell, said: “Across all sectors active performance has weakened since then, with the exception of the North American equity sector, which stands at the same low level it did three years ago.

“The variation suggests there is some cyclicality in the performance of active managers and we may be witnessing a downdraft driven by the longstanding hegemony of US technology stocks, which serves to push active managers further into a deep black hole the longer it persists.”

The particularly weak showing of the North American and global equity sectors highlights this point. Just five companies – Amazon, Apple, Meta, Microsoft and Nvidia – accounted for 46% of the S&P 500’s returns in the first six months of 2024, with Nvidia responsible for 25%.

“Failure to hold a market weight in the top performing technology stocks has therefore been a costly enterprise for active managers this year, and indeed over the past decade. Coming into this year, an active US manager would have had to hold 28% in the Magnificent Seven stocks, and 7% in each of Apple and Microsoft, simply to match the exposure of a passive fund,” Khalaf explained.

“Those are pretty punchy portfolio positions for an active manager to adopt, with the unpleasing result they would simply be in line with the rest of the market. Consequently that part of the portfolio would perform just like the benchmark and would legitimately lead investors to question why they are paying active fees for the privilege of index returns.”

But the picture is even worse today as the strong performance from US tech stocks in 2024 so far means an active US equity fund would now have to hold 32% in the Magnificent Seven stocks, with 7.2% in Microsoft and 6.6% in each of Apple and Nvidia (as of 30 June 2024), to match a passive fund’s exposure.

Global equity funds are also impacted by this, as US stocks now account for around 70% of global stock market capitalisation. AJ Bell pointed to 2023 research, which found the average active global equity fund held around 10% less of its portfolio in the US than a typical global index tracker.

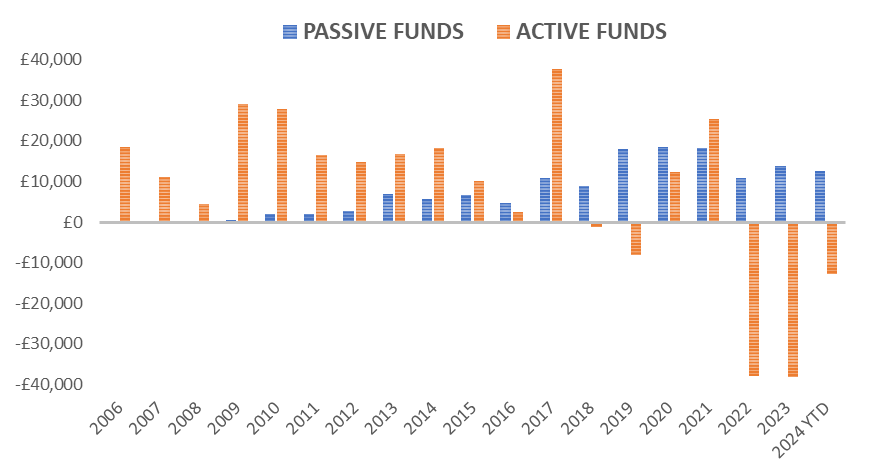

Net retail sales (£m)

Sources: Investment Association

The Manager versus Machine report also showed “an absolutely unprecedented spell” of outflows from active funds in recent years. Retail investors have pulled £89bn from active funds since the start of 2022 while investing £37bn into passives over the same period.

AJ Bell did find one “small and not particularly reassuring glimmer of light at the end of the tunnel”: active outflows seem to be slowing from their nadir in 2022 and 2023.

However, the platform warned that £31bn would still be withdrawn from active funds this year if the current run rate is maintained. This would be down from £38bn in 2023.

“Active managers must be starting to feel like an endangered species. Not only is performance flagging, but passive funds are winning the battle for hearts, minds and wallets,” Khalaf finished.

“These are absolutely unprecedented outflows. It’s like a dark age has descended on the active management industry.”