Associating artificial intelligence (AI) with the Magnificent Seven stocks Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta is a mental shortcut that many investors take when thinking about the sector.

The fact that these are all mega-cap growth stocks might create the impression that AI beneficiaries must all be growth-focused disruptors, but that assumption is wrong, according to Paul Niven, manager of the F&C Investment Trust.

In the trust’s portfolio, there is one stock that overtook Nvidia over the past couple of years, and what’s more – it’s a value stock, which is synonymous for being cheap and undervalued.

Niven, who owns each of the Magnificent Seven (all except Tesla are part of the top 10 holdings), said they have contributed handsomely to the trust’s returns. In fact, the strategy has gone from the second quartile of performance over the past three years to the first over the past 12 months.

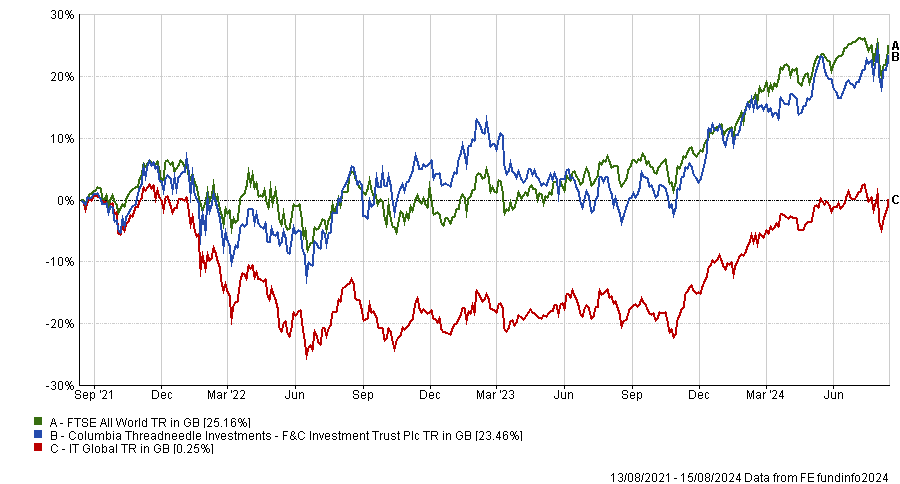

Performance of trust against sector and index over 3yrs

Source: FE Analytics

But speaking with Trustnet recently, he explained that by no means was this all due to the Magnificent Seven. There were other tech-adjacent names that performed well in the recent past, including Broadcom, TSMC and Qualcomm. But one in particular he was pleased with was Vertiv, which did better than AI darling Nvidia.

Vertiv is a beneficiary of the AI theme but it's not at the frontline in terms of designing or manufacturing chips. In fact, it is very much at the rear, providing cooling solutions as part of a wider range of services to data centres. As such, it has been driving the secular theme of AI by supporting the large-cap growth frontrunners.

Performance of stock over 1yr

Source: Google Finance

Vertiv is not in F&C’s benchmark, the FTSE All-World Index, but the trust has the ability to select its holdings from elsewhere too. And in this case, it paid off, with the stock rising 234% in 2023 and 82% in the first six months of 2024 (in sterling terms).

“It was selected by one of our value managers at Dallas-based Barrow Hanley, and it was very pleasing to see a value stock do this well at a time when value was significantly underperforming growth,” Niven said.

At the beginning of 2023, F&C had 2.2 million shares in Vertiv, but the manager has been taking profit.

“We’ve sold more than half of that position because the stock had gone up so much, and then subsequently sold 700,000 more,” he said.

“We could have made more money, but as a value manager, you need to manage that position, which was done that has done very well for us.”

At the end of last year the trust only had about 1 million shares left in the stock.

While the manager is pleased with the trust’s performance, which was able to beat its benchmark in 2024 so far, Niven wishes he had done more, telling Trustnet last week that he underestimated the market and should have added more gearing.