Not every range managed by a fund house needs to be doing well at all times, but after a long period of underperformance, the question should be raised of whether a fund or two might have reached their end-by date.

That’s what Ben Yearsley, director of Fairview Investing, said of Janus Henderson’s multi-manager offering.

“It used to be good when headed up by Bill McQuaker [between 2005 and 2016, before he left for Fidelity], but it has never been the same since,” he said.

“Fund houses should feel free to shut funds down occasionally. Janus Henderson took a quick decision to sell off and close down its property fund a few years ago. Why doesn’t it do that with a few others?”

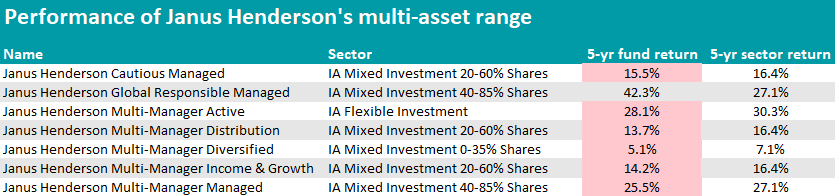

With the only exception of Janus Henderson Global Responsible Managed, which ranked in the first quartile of the IA Mixed Investment 40-85% Shares sector over five years, all other of the firm’s multi-asset funds are in the third quartile, if not the fourth (Janus Henderson Multi-Manager Diversified).

Source: FE Analytics

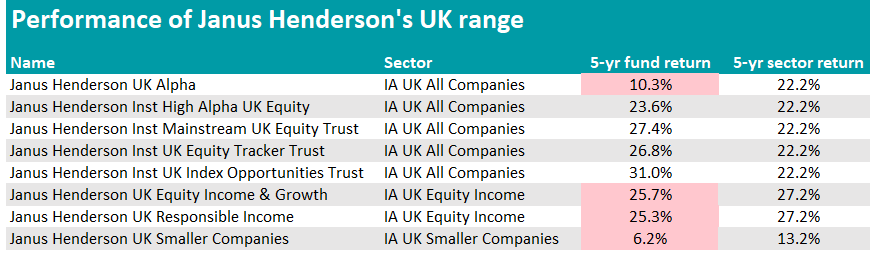

The UK fund range is another that is disappointingly average, according to Yearsley, and “could do with some work”.

Here, the UK income and small-caps strategies seem the most troubled, with all Janus Henderson vehicles in the corresponding Investment Association sectors underperforming their peers.

The Janus Henderson UK Smaller Companies fund, managed by director of UK equities Neil Hermon, is 7 percentage points behind its sector’s average. Funds in the UK All Companies sector are faring better – out of five portfolios, the Janus Henderson UK Alpha is the only one underperforming.

Source: FE Analytics

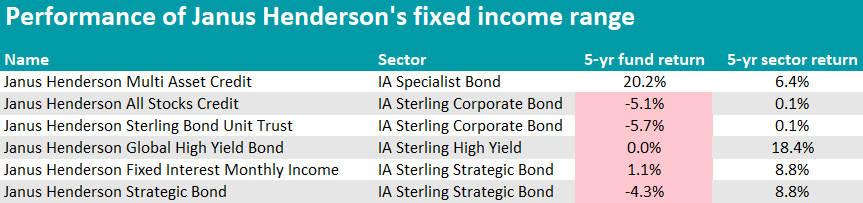

Performance has also been weak for the fixed income desk – the £1.7bn Janus Henderson Strategic Bond fund has been in the last decile for performance over the past three, five and 10 years. Its long-time manager John Pattullo is retiring in March 2025, as we reported on Trustnet.

Charles Stanley chief analyst Rob Morgan attributed the underperformance to its skew to longer-dated bonds, which have suffered in the prevailing environment of heightened inflation and interest rate expectations.

“However, as part of a portfolio there is still lots to admire and the fund could benefit from both strong stock selection and a more favourable macroeconomic backdrop should the stars align,” he said.

“Decision making is nimble, a key benefit of a small team, but is supported by a very large and well-resourced global credit research function.”

Similarly to the strategic bond fund, the Janus Henderson All Stocks Credit and Sterling Bond Unit Trust funds have also not risen above the fourth quartile of the IA Sterling Corporate Bond sector in any of the timeframes mentioned above.

However, co-head of fixed income Jenna Barnard remains an outstanding name that comes to mind in relation to Janus Henderson, said Yearsley. Others include FE fundinfo Alpha managers James Henderson, who mainly manages investment trusts, and Luke Newman, whose absolute return fund is “one of the stars of the show”.

Source: FE Analytics

Morgan agreed that the Janus Henderson Absolute Return has been “a real standout in the perennially disappointing Targeted Absolute Return sector”.

“While the fund’s asset growth has seen it morph into more of a global mandate from just UK, the managers have an excellent record of adding value through stock selection on both the long and the short side,” he said.

“My reservation is fund charges. There’s an annual management charge of 1% and a performance fee of 20%, which means investors do have to pay up to access this potentially useful fund.”

For Yearsley, John Bennett’s retirement hasn’t had too much of a negative impact on the firm’s European franchise, as Tom O’Hara and Tom Lemaigre are “doing a good job” as new co-heads of the team.

This is important because at Janus Henderson there is no house view, therefore success or failure rests on each manager and their process.

Among other funds worthy of praise, Morgan mentioned two global strategies – the Janus Henderson Global Technology Leaders and Janus Henderson Global Sustainable Equity funds.

The former generated “decent long-term performance with a bit of downside protection through a more varied portfolio than its peers and a focus on valuations”; the latter is “a strong offering in the global responsible space, which could make a good core holding for investors with a responsible or ethical mindset”.

It offers a high-conviction portfolio with a focus on solutions to sustainability challenges and screenings that exclude harmful activities.

A Janus Henderson spokesperson said: “We value the trust clients place in us and are disciplined in staying true to our investment style through all market conditions.”

“We continually review our services and where we identify that performance is not being delivered, we are committed to taking action where appropriate to deliver improvements that will benefit our clients.”