Equity investors are in for a treat, as the price of growth has dropped to levels unseen since 2018, according to Steven Hay, manager of the popular £5bn Baillie Gifford Managed multi-asset fund.

While opportunities in the current market are broad-based and span across equities and bonds, the scale is tilting in favour of the former asset class, prompting this balanced strategy to go moderately overweight its neutral equity position of 75% to the current 79%. That is all due to a more favourable risk/reward ratio, measured as price to earnings (P/E).

Known for its growth-style approach, Baillie Gifford usually buys companies with higher P/Es than the index. That would be “standard”, because they are “the companies with the best growth opportunities”, Hay explained.

While the P/E premium of the Managed portfolio has been up to 60% at times in the past, it has now dropped below 30%, which hasn’t been the case since 2018 – meaning that now the same amount of future growth comes at a lower price than historically.

Asked to put a number on that, Hay said he expected the portfolio to grow 50% more than the index, so based on consensus expectations for growth, “we're looking at 12%, versus 8% for the index”.

“We're getting as good a growth differential as we could get, but at historically cheap valuations. That's where the real optimism comes from at the moment and why we have gone overweight,” he said.

“At previous times when the P/E premium has been as low as it is now, we haven't seen such a big earnings difference, so that makes us pretty excited about the opportunities for the fund.”

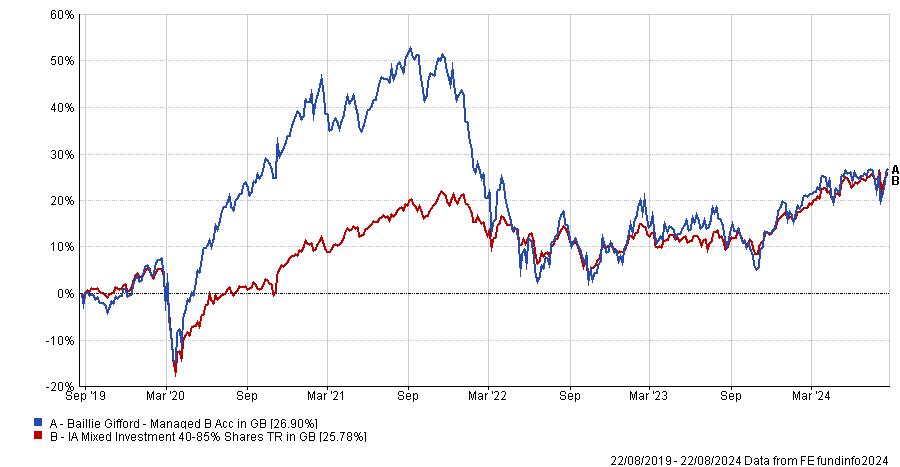

Performance of fund against sector and index over 5yrs

Source: FE Analytics

With these observations, Hay wanted to prove that, contrary to popular belief, Baillie Gifford managers do care about valuations.

“Yes, our managers will be focused on the growth side of things and what the earnings growth is likely to be. But we're well aware of what price you're paying for that growth. We are trying to buy growth at as cheaper prices as we can,” he said.

Another “myth” about the fund house is that it only looks for opportunities in tech, whereas the manager said opportunities are “pretty well-spread”.

“There is certainly technology business exposed to AI [artificial intelligence] and technology in the portfolio, but there is plenty more.”

In fact, as the manager recently told Trustnet, he’s been cutting his exposure to Nvidia and favouring names on the industrials side as well the consumer sector – to name a couple, Spotify and US healthy fast-food chain Sweetgreen have been top contributors to the fund’s performance over the past year.

While “all our regional equity teams are very enthusiastic”, Hay has been wary of maximising the equity exposure to the maximum level allowed by the IA Mixed Investment 40-85% Shares sector, because that would mean cutting fixed income.

“We are likely to be between 75% and 80% equities. Our cash weighting has decreased from 5% to 2%, and bonds are quite attractive at the moment too, so we don't really want to go underweight bonds to fund the equity side,” he said.

While bond managers are “more enthusiastic than they had been a few years ago” and bonds in the fund still offer a “very attractive” 8% yield, the opportunities in the equity side looked “even more attractive”, and that's why the overweight has gone there, funded mainly out of cash.

There is one caveat, however. With a higher exposure to equities come higher risks. The manager admitted that having one of the highest equity exposure in the sector has cost him a lot of relative performance over the past three years, when the fund was last in the peer group rankings.

“It is probably fair to say that we have one of the highest equity weightings in the sector. Maybe the types of growth that we look for are more exposed to the interest-rate backdrop. On top of that, some of these themes take time and only come through further in the future,” he said.