Investment trusts have had a tough few years, with discounts widening across the board, thanks to factors such as pivotal changes in the interest rate environment hitting the alternatives market and Liz Truss’s mini-Budget in 2022.

Throw in the UK’s interpretation of the European cost disclosure directive, which created an obstacle that was removed only a few weeks ago, and it is clear to see why investors may have been hesitant.

But this is exactly why some managers find that now is the best time to get involved. One such person is Alastair Laing, who is in charge of Capital Gearing, a specialist multi-asset trust that derives all its equities allocation from trusts.

“A range of things have caused a big dislocation and large discounts to emerge, which for us is exciting,” said Laing. “There's a lot of doom and gloom around investment trusts, but that is typical when discounts are widening out. It's happened before and the narrative changes as to why, but financial markets are cyclical.”

Below, he shares some recent examples of high-quality managers of well-run portfolios that are trading on a discounts that should provide strong gains over the long term.

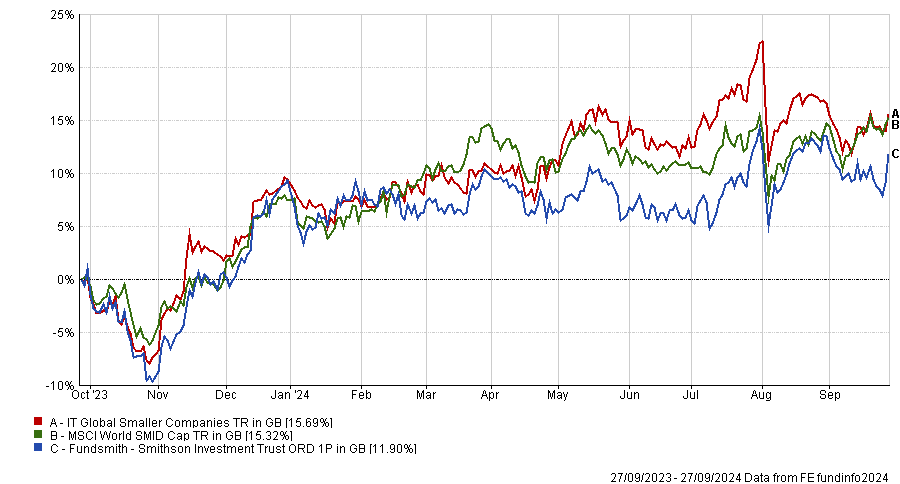

A good example of a position that he has built recently is the Smithson Investment Trust, run by Simon Barnard and Will Morgan.

Performance of fund against sector and index over 1yr

Source: FE Analytics

It is the closed-ended mid-cap equivalent of Terry Smith’s

“It performed incredibly strongly and was very in demand and trading on a premium for a while, so it wasn't of interest to us until later, when it had a really tough period and moved to a discount. Barnard is a good manager with a good process which you can now get on the cheap,” Laing said.

For the manager, the turning point was earlier this year, when Smithson was supposed to be involved in a continuation vote that was to be held at the annual general meeting.

It was cancelled by the board at the last minute and at that point, “all the stars aligned” for Laing, who took the opportunity to buy the trust on a discount and engage with the board.

“We built quite a big position and, along with other shareholders, made the case that cancelling the continuation vote was not appropriate corporate governance.”

The board listened by reinstating the continuation vote and also started a “very material” share buyback scheme. “We love share buybacks at discounts, that's risk-free upside,” Laing said.

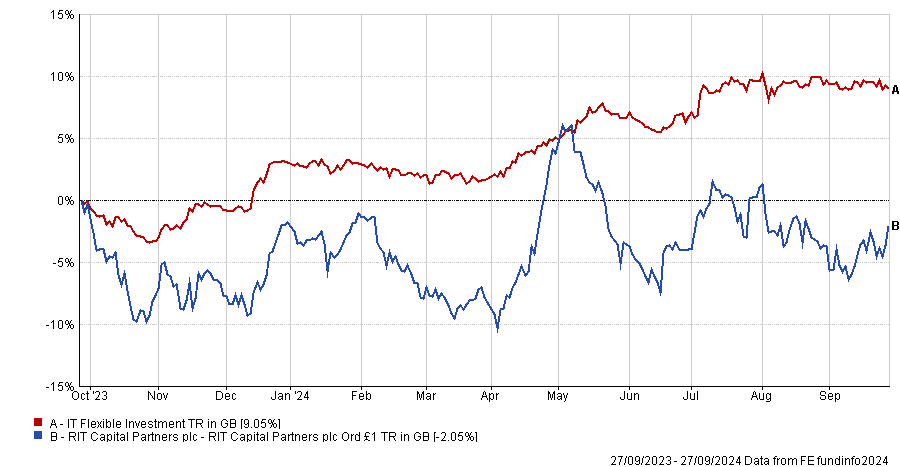

Another example of a trust that he has bought is RIT Capital. It has an “outstanding long-term track record” but has fallen to big discounts since 2022, reaching today’s 30%. The trust was also “hit badly” by cost disclosure, having had to disclose ongoing charges of 4.5%. That's now gone away with the Financial Conduct Authority’s intervention.

Performance of fund against sector and index over 1yr

Source: FE Analytics

“We like the process, we like the manager and again historically, the board didn't do buybacks,” said Laing. “We built a position, engaged with the board and now it is buying shares. Buying shares at a 30% discount is very powerful.”

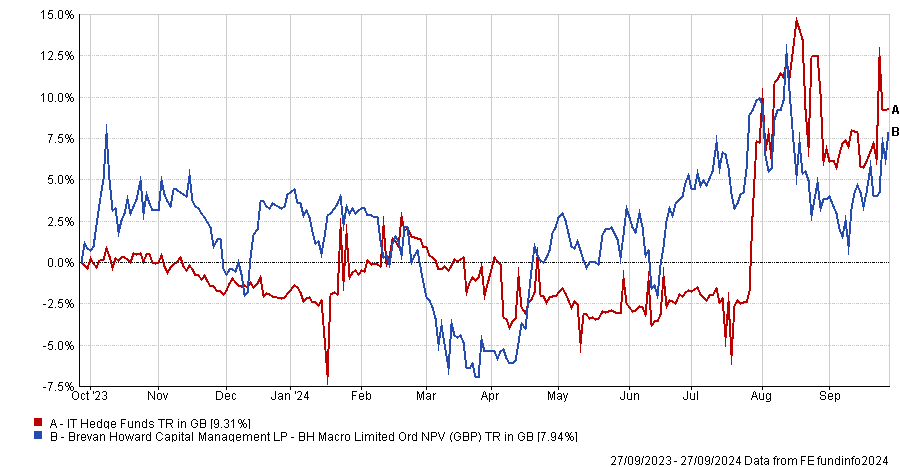

A final, more esoteric example is the £1.2bn hedge fund BH Macro. During the global financial crisis, Brevan Howard earned a solid reputation for delivering strong returns while most investors experienced losses.

Performance of fund against sector and index over 1yr

Source: FE Analytics

The trust was also successful during the market volatility of 2022, but last year was tougher, and the NAV total return was down 1.8%, as Winterflood analysts noted.

They said this discount is “an attractive entry point for access to a manager with an attractive record of protecting capital in difficult times. However, it may require corporate action for the discount to narrow, given that Investec and Rathbones combined hold a 25% stake according to Bloomberg, which is seen as an overhang by the market.”

The “very stable” underlying NAV has been eclipsed by the share price, which has gone from about a 10% premium to an 18% discount over the past 18 months, and Laing bought in on double-digit discounts, again engaging with the board and initiating share buybacks.

All of these positions amount to almost 1% of the Capital Gearing portfolio and were built over the past 12 months.

“We don't think those will be quick returns, but they will outperform the underlying asset class over the next three or four years,” said Laing. “That's how we seek to more reliably generate alpha than trying to beat the market at stock picking.”