Unique funds can offer advantages to those who choose to buy them. Building a differentiated portfolio with multiple sources of return reduces the chances of all investments being exposed to the same market forces and falling at the same time should anything go wrong (correlation risk), for example.

That’s why determined investors can go to great lengths to find funds that do things differently. But not everyone has the time, resources and knowledge to do that, so below, Trustnet asked the help of fund pickers to highlight a fund that genuinely does things differently.

For Jason Hollands, managing director at Bestinvest, in a crowded and competitive industry like asset management, ‘unique’ is an extremely high bar to meet, with good ideas being copied quickly.

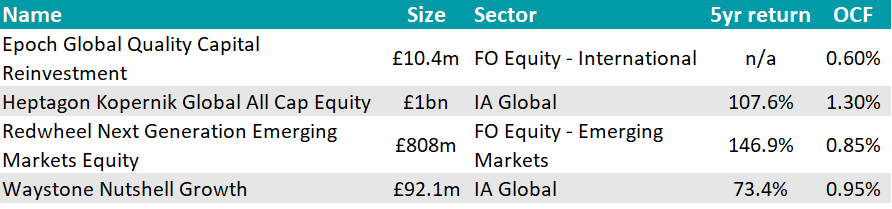

However, one fund that he believes has a very distinctive mandate is Redwheel Next Generation Emerging Markets, a $997.5m strategy which focuses on smaller emerging markets and frontier markets.

Manager James Johnstone has zero weightings to the big emerging market economies of India, China, Taiwan and South Korea, which together make up 75% of the MSCI World index. Instead, the biggest geographic exposures in the fund are Indonesia, the Philippines, the United Arab Emirates, Mexico and Vietnam. At the sector level, banks represent 30% of the portfolio, but the fund also has high exposure to real assets, including commodities and real estate.

With just over 80 holdings, it is a relatively concentrated strategy, given the riskier nature of the markets it targets, and it also has a bias to mid and small-sized companies.

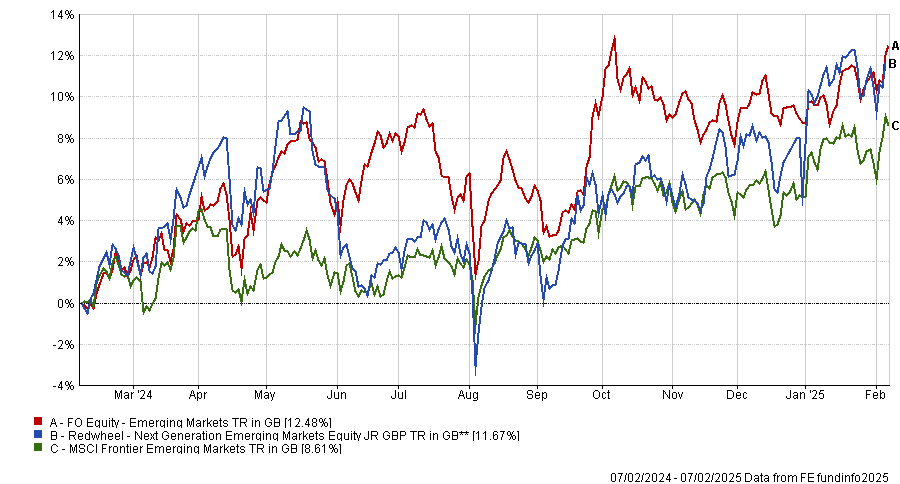

Performance of fund against sector and index over 1yr

Source: FE Analytics

The opportunity resides in the very favourable demographic profile of these areas, according to Hollands, where it is powering dynamic growth in consumption over the coming decades. Out of the 50 fastest-growing economies forecast by the International Monetary Fund (IMF), 38 fall into the universe of the Next Generation fund.

“Currently just 3% of global equities is represented by these under-researched markets, so the potential for that to expand is enormous,” he said.

“A small holding to this fund could add a little spice to a long-term portfolio. It could be used to dovetail core emerging markets funds, creating improved diversification to some of the world’s fastest-growing economies.”

This fund is also one of Shard Capital’s higher conviction propositions, said Ernst Knacke, head of research at the firm. As for another option, Knacke views Heptagon Kopernik as a “phenomenal” house for global value.

Its Global All-Cap Equity strategy looks very different to other global equity funds and to its benchmark, the MSCI All Country World index, with just 12.2% invested in the US as at 31 December 2024, versus 66.4% for its benchmark.

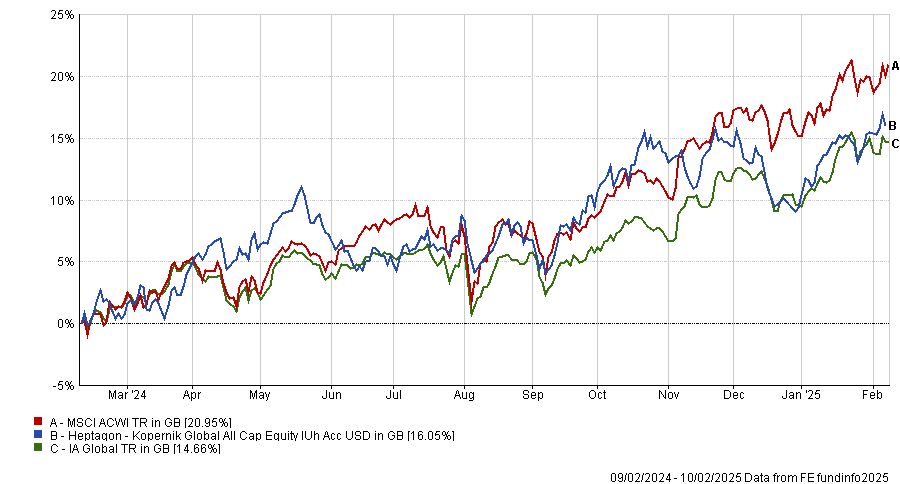

Performance of fund against sector and index over 1yr

Source: FE Analytics

David Iben and Alissa Corcoran manage $1.1bn of assets and seek to find mispriced opportunities globally. Their two largest holdings are South Korean mobile network operators LG Uplus and KT Corporation.

The next-largest positions are South Africa’s Impala Platinum Holdings and Anglo American Platinum followed by Hong Kong conglomerate CK Hutchison Holdings and National Atomic Company Kazatomprom, an energy company in Kazakhstan.

Going from value to growth, Darius McDermott, managing director at FundCalibre, picked Nutshell Growth, which stood out to him for its “blend of academic rigor and real-world pragmatism”.

“Fund manager Mark Ellis brings a fresh perspective, having transitioned from a successful trading career into fund management,” he said. “We see this unconventional path as a strength.”

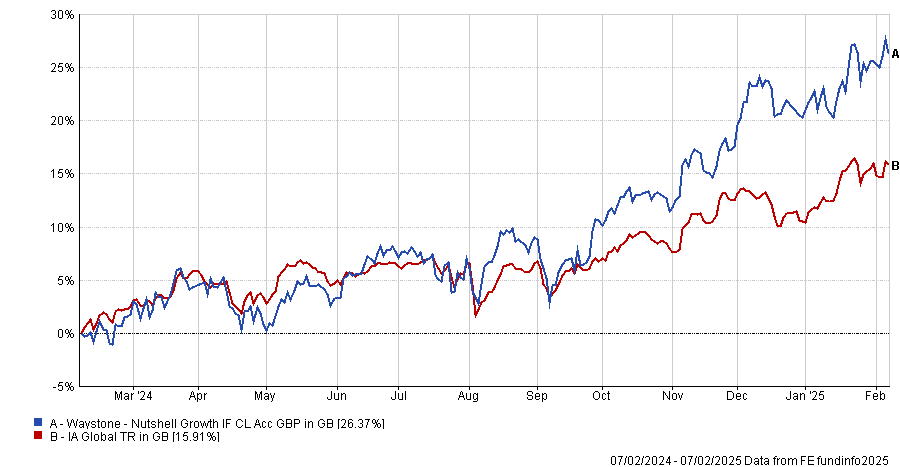

Performance of fund against sector over 1yr

Source: FE Analytics

Unlike many quality-growth funds, Nutshell Growth maintains a high turnover of holdings. The team challenges traditional stockpicking methods, suggesting that outdated analyst reports often suffer from biases and a short shelf life.

“This strategy avoids attachment to specific companies or management teams. It thrives on nimbleness, using new information to reposition swiftly – an ability rooted in Ellis’ trading expertise.”

This innovative approach has helped the fund deliver second-quartile returns over five years (it launched in 2019) and consistent top-quartile returns after that.

Finally, Matt Ennion, head of fund research at Quilter Cheviot, chose TD Epoch US Quality Capital Reinvestment, a new fund from a boutique manager owned by the Toronto Dominion Bank.

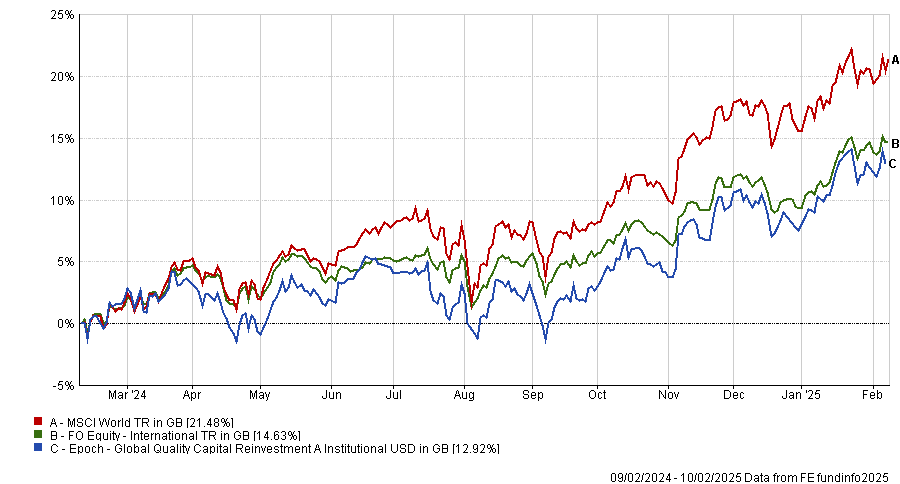

Performance of fund against sector over 1yr

Source: FE Analytics

It invests in a diversified portfolio of quality US businesses that prioritise capital allocation and generate a return on investment sustainably greater than the cost of capital.

“The differentiating feature of the strategy is that its strong performance record has been generated with limited exposure to the Magnificent Seven, with the optimized portfolio ensuring diversified exposure to quality companies that offer strong growth prospects across the market”, Ennion said.

“This characteristic of the portfolio should further benefit holders if the drivers of the US market return broaden out beyond the technology sector and will also offer valuable diversification benefits with other US funds.”

Source: FE Analytics