Donald Trump’s second stint in the White House and the attempt by Saba Capital to seize control of several investment trusts have swayed what investors have been researching in recent months, analysis by Trustnet suggests.

Examining the research trends of the thousands of private and professional investors who use Trustnet can offer some interesting insights into market sentiment and the events that are influencing it.

In this article, we are looking at the research that has gone into investment trusts in the Association of Investment Companies universe over the past three months. By comparing how this has changed from a baseline reading (in this case, over the previous nine months), we can identify shifts in investor interest.

Over the past three months, the five most-viewed trust factsheets on Trustnet have been Scottish Mortgage, JPMorgan Global Growth & Income, F&C Investment Trust, Alliance Witan and Polar Capital Technology. These were also the most researched trusts in the nine months prior, albeit in a slightly different order.

When it comes to AIC sectors, the most popular are currently IT Global, IT UK Equity Income, IT Global Equity Income, IT UK Smaller Companies and IT North America. While the first four peer groups are unchanged from the previous nine months, IT North America jumped from eighth place to fifth and bumped IT Flexible Investment down a spot.

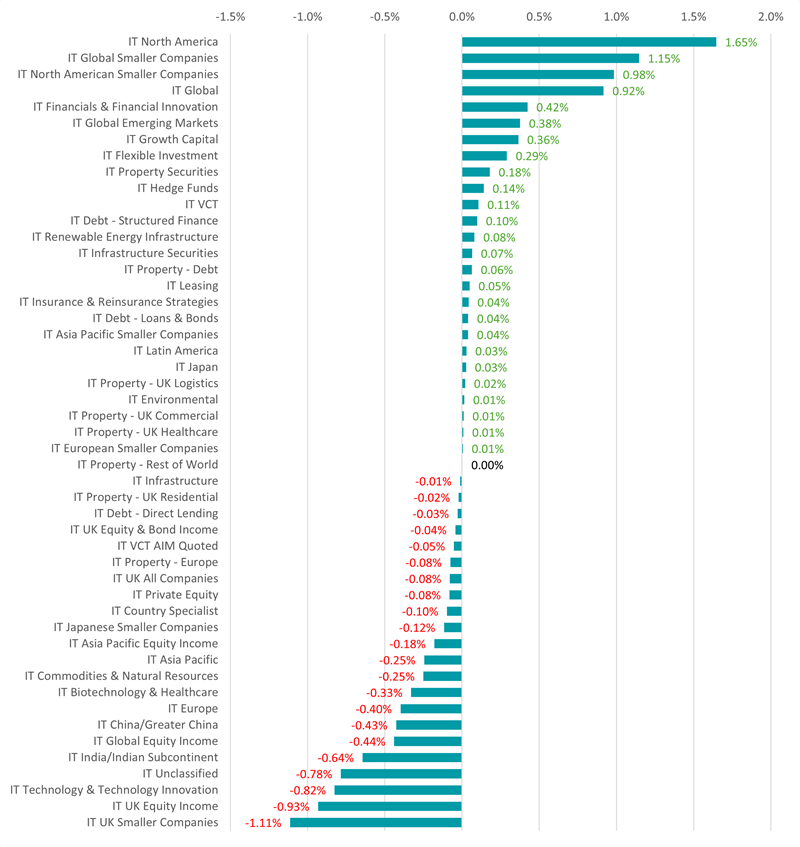

In the baseline period, IT North America trusts accounted for 3.32% of all investment trust research on Trustnet, but this grew to 4.97% over the past three months. This 1.65 percentage point increase in research was the largest over the period, as the chart below shows.

Source: FE fundinfo, Google Analytics

The ‘US exceptionalism’ narrative – that the US is an especially attractive destination for investors thanks to its strong economy, dominant companies and a culture of innovation – means that funds investing in the country have outperformed for some time.

However, the election of Donald Trump as US president last November further bolstered sentiment towards the world’s largest economy. Trump’s business-friendly, anti-regulation and America First agenda is seen as a boon for US companies, with trusts in the IT North America sector getting researched more as a result.

IT North American Smaller Companies and IT Financials & Financial Innovation are other beneficiaries of the Trump trade. Smaller companies and financials are seen as some of the areas with the most to gain from Trump’s plans to cut down on regulation.

Meanwhile, IT Global and IT Global Smaller Companies investment trusts have been winning a greater share of research over recent months, reflecting their relatively high weightings to the US market and the long-term trend of UK investors looking away from the domestic market and towards international opportunities.

This last point is also clear when we look at the trust sectors with the biggest falls in Trustnet factsheet views over the past three months: IT UK Smaller Companies and IT UK Equity Income had the biggest losses, while IT UK All Companies was also in negative territory.

Source: FE fundinfo, Google Analytics

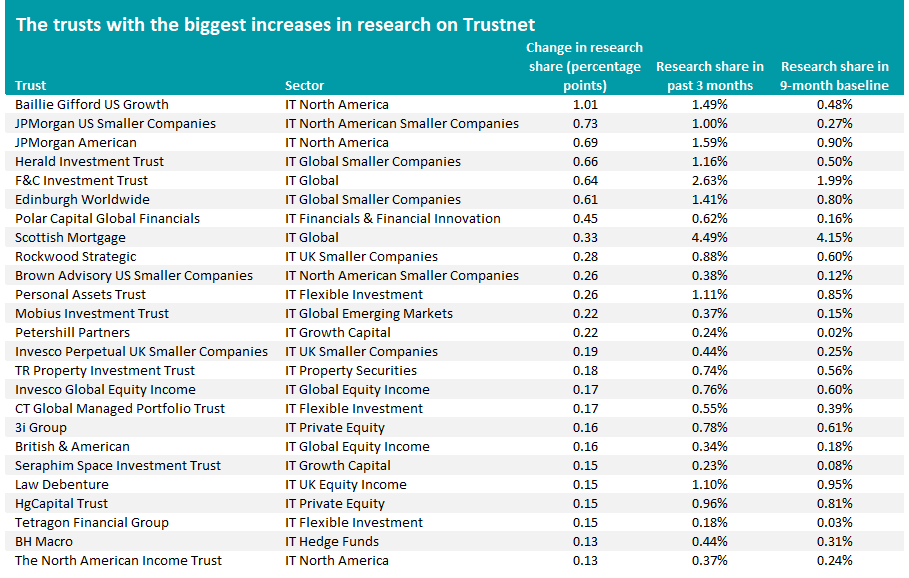

The table above shows the change in research for individual trusts in the Association of Investment Companies universe.

Baillie Gifford US Growth sits at the top of the table. It accounted for just 0.48% of investment trust research on Trustnet in the nine-month baseline period, but this grew to 1.49% over the past three months; correspondingly, it went from being the 60th most-viewed trust to the seventh.

Other trusts gaining more attention as Trump returns to the White House include JPMorgan US Smaller Companies (which went from being the 113th most-viewed trust to the 19th), JPMorgan American (23rd to sixth), Polar Capital Global Financials (168th to 38th) and Brown Advisory US Smaller Companies (193rd to 77th).

But while Baillie Gifford US Growth is likely being researched more because of increased interest in US equities, there’s another factor at play – the attempt by Saba Capital to replace the current boards at a number of trusts with its own appointees.

It was one of the seven targeted trusts, alongside CQS Natural Resources Growth & Income, Edinburgh Worldwide, Henderson Opportunities, Herald Investment Trust, Keystone Positive Change and The European Smaller Companies Trust.

All seven of these trusts have been looked at more by Trustnet users in recent months, with three of them getting enough attention to be among the 25 biggest research gainers shown in the table above.