US tech behemoths have been struggling in recent months but the pain has ramped up since president Donald Trump’s ‘Liberation Day’. Since then, returns from the ‘Magnificent Seven’ stocks (Amazon, Apple, Meta, Tesla, Nvidia, Alphabet and Microsoft) have ranged from poor to outright disastrous.

The best of the bunch has been Alphabet, down just 3%, while Elon Musk’s Tesla has plummeted 15.8% since 2 April.

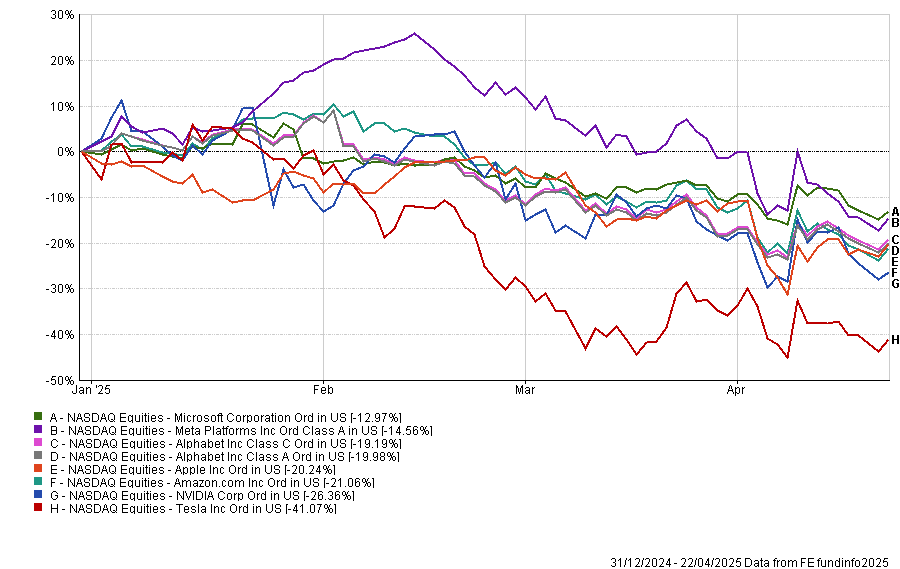

It compounds a tough 2025 so far, in which Microsoft has dropped 13% – the best return in 2025 of the seven stocks – while Tesla has haemorrhaged 41.1%.

Shares price performance of Magnificent Seven stocks YTD in dollar terms

Source: FE Analytics

The most recent falls came after Trump announced a swathe of tariffs on almost every country in the world set at a 10% minimum (although many were far higher).

He then backtracked, knocking this down to 10% for all except China and pausing any higher charges for 90 days until negotiations had taken place.

China retaliated to the US president’s aggression with increased tariffs of its own. This has caused a tit-for-tat, with Trump upping tariffs on the Asian powerhouse even further and sparking fears of a full-blown trade war between the two nations.

Last week Nvidia said trade disputes would cost the chipmaker $5.5bn, as tightened controls on US exports to China mean it can no longer export its H20 chips to Chinese customers without a special licence.

While some fund managers maintained this was not the time to panic, Hugh Grieves, co-manager of the Premier Miton US Opportunities fund, said the market is misevaluating the extent of the problems for the tech giants.

Taking the case of Nvidia, he said there are only four US hyperscalers that can purchase the vast number of chips required for Nvidia to maintain its current profits.

Outside of this, the only other real major buyer is China. “There’s no one in Japan [for example] that is going to spend tens of billions of dollars on these products,” he said.

While chip sales could be “funnelled through Singapore” and other Asian countries, without China, demand for Nvidia chips is likely to fall.

But Nvidia is unlikely to be the only casualty of the US-China trade war. Yesterday, Tesla missed first-quarter earnings and revenue expectations as it warned that a ‘rapidly evolving trade policy’ presents risks to its costs and product demand.

Grieves expects other major tech companies to make similar announcements going forward. Amazon may be at risk because as much as 70% of its inventory comes from China. “You can’t double the prices of all of those goods overnight and expect to sell the same amount. Demand destruction is pretty significant,” he warned.

Amazon is one of Nvidia’s biggest customers but if Amazon’s profit margins shrink, that could curtail its ability to invest in artificial intelligence (AI).

Then there is Meta (the owner of Facebook), which is another key spender in the AI space. The firm relies on two Chinese retailers – Temu and Shein – for a healthy chunk of its advertising revenue and profits, he said, which could stop if the trade war continues.

“They took advantage of the de minimis value customs exemption to be able to ship into the US without paying tax. That has been shut. I don’t know if they have a business in the US anymore. If they don’t, they aren’t going to advertise in the US. So if [a chunk of] Facebook revenue goes to zero, is it still going to spend on AI?” he asked.

“Maybe it will, but it is going to look horrible on a relative income statement because if your profits are going down and your capital spending is going up, it is not going to be pretty.”

Meanwhile, others such as Apple, which was given a reprieve by Trump as smartphones were made exempt from tariffs, could still lower guidance in the future, he warned.

However, analysts are unlikely to forecast any of this, meaning they will have to “accept they’ve got stale numbers” until these companies report the true impact of tariffs, he argued.

“Then everyone is going to stick their hands up and say ‘oh what a surprise, we never saw that coming’,” said Grieves.

As such, he said we are in an AI bubble akin to the broadband bubble that ran alongside dot-com euphoria in the early 2000s.

“I have been vocal for some time saying AI is a bubble. Expectations are way too high and there are no killer products – certainly none that are going to generate hundreds of billions of dollars in revenue, which is what is required from the huge investment” from the largest US tech companies, he said.

The comparison here is with fibre cables. Although internet traffic did boom in the decades that followed the dot-com bubble – the assumption that drove the frenzy in the first place – costs “went through the floor”.

“So the value proposition for all these fibre-optics brands collapsed. The business models collapsed. All the names people knew and loved in the dot-com bubble disappeared. I think you are seeing something similar at the moment. The costs of providing these AI services is coming down courtesy of the Chinese,” said Grieves.

“To say we are one and done is optimistic. I remember in October 2000, Cisco came out with lower guidance. ‘Oh this is it, the numbers have been reset’ they said, but that was just the beginning, it wasn’t the end.”

For mega-cap tech stocks, the longer “we go on without some killer products”, the more likely the US hyperscalers “start to scale back their capex plans”, he warned, increasing the risk of further disappointment.