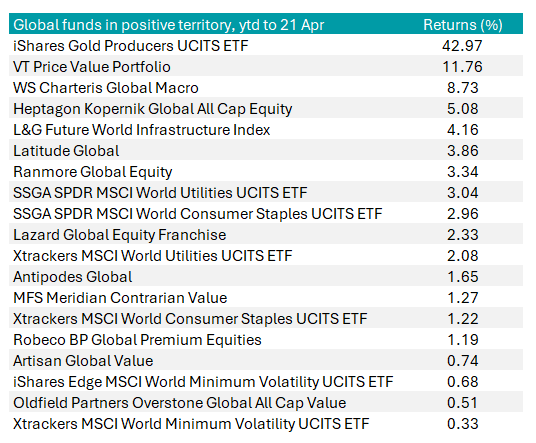

The IA Global sector is awash with red in 2025 but a handful of funds remain in the black. Achieving positive returns year-to-date is no mean feat, given that the MSCI World has fallen 13.3% and the MSCI All Country World Index is down 12.6%.

The average fund in the IA Global sector has sheltered investors from the severest losses but bore the brunt of this year’s sell-off, falling 9.6% year-to-date as of 21 April 2025.

Yet a few global funds have made money despite US equities (the mainstay of their benchmarks) tanking. These rare outperformers include Heptagon Kopernik Global All Cap Equity, Latitude Global, Lazard Global Equity Franchise, Robeco BP Global Premium Equities and Antipodes Global.

To remain above water, funds needed to be overweight Europe and the UK but underweight the US. Exposure to precious metals, miners, utilities and consumer staples would have also helped.

Value investing gained ascendancy because value managers tend to veer away from expensive tech stocks, which have sold off the most in 2025. Value funds in positive territory include Ranmore Global Equity, Artisan Global Value, Oldfield Partners’ Overstone Global All Cap Value strategy and MFS Meridian Contrarian Value.

They were joined by several sector specialists, including iShares Gold Producers UCITS ETF, L&G Future World Infrastructure Index, SSGA SPDR MSCI World Utilities UCITS ETF and SSGA SPDR MSCI World Consumer Staples UCITS ETF.

Global funds in positive territory YTD

Source: FE Analytics

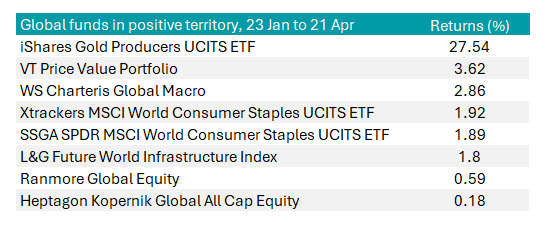

Eight funds also managed to deliver positive returns between 23 January and 21 April 2025 (after the MSCI World index peaked on 22 January).

Out in the lead was iShares Gold Producers UCITS ETF, up 27.5%. Four actively managed funds and three passive strategies followed with more modest returns, as the table below shows.

Global funds achieving absolute returns since 23 Jan

Source: FE Analytics

The £52m VT Price Value Portfolio and the £5.1m WS Charteris Global Macro placed large bets on precious metals and miners, which have paid off. They also share an unconstrained approach to global equities and a preference for undervalued companies.

Price Value Partners aims to preserve capital and generate relatively low-risk absolute returns. The firm’s investment process was inspired by Benjamin Graham and it endeavours to buy shares in high-quality businesses at a valuation that allows for a margin of safety.

The Price Value Portfolio’s largest holdings as of 31 March included Pan American Silver Corp., Hecla Mining, Genesis Minerals, iShares Physical Silver ETC, WisdomTree Physical Silver, Artemis Gold and Torex Gold Resources.

Charteris takes a big picture view of global economic themes and trends, then invests predominately in blue-chip companies whilst seeking to mitigate downside risks.

The global macro fund held 18.9% in cash as of 31 March (it can have up to 20% in cash) and its largest holdings include MAG Silver, gold miner Agnico Eagle, copper miner Antofagasta, Standard Chartered and Coca-Cola.

Lead manager Ian Williams can switch all, or part, of the portfolio into G7 government bonds if he believes global equity markets are vulnerable to a setback, although he had not gone down that route as of 31 March.

Ranmore Global Equity and Heptagon Kopernik Global All Cap Equity stand out for exceptional medium-term performance as well as preserving wealth this year. They have navigated a variety of different market conditions to achieve top-quartile returns over one, three and five years.

The $1.4bn Heptagon Kopernik Global All Cap Equity fund had just 9% in the US as of 31 March 2025 and 45.3% in emerging markets. Its top 10 holdings include Impala Platinum Holdings, Anglo American Platinum, LG Uplus Corp and KT Corp (two South Korean telecom companies) and NAC Kazatomprom JSC, Kazakhstan’s national uranium importer and exporter.

In a similar vein, the $590m Ranmore Global Equity fund had just 18% in North America as of 31 March with 27% in Europe, 21% in Asia ex-Japan, 13% in Japan and 9% in South America. Its largest holdings are Petrobras, Associated British Foods, Mattel, Tesco and Shinhan Financial Group.

The fund’s manager, Sean Peche, said: “For the first time in I don’t know how long, international investors have a reason to sell the US and a reason to buy elsewhere – and not just on valuation. You’ve got political disruption, the return of Donald Trump, alienation of allies, whereas now we’re seeing stimulus in Germany and China, and governance reforms in Japan and Korea. That creates real asymmetry.”

Peche also thinks the concentration of investors’ capital in the US creates risks. “If you’re 70% allocated to the US and the winds shift, whether it’s tariffs, political volatility or regulatory clampdowns, that’s a lot of sheep trying to leave the same field at once,” he explained.

Kopernik Global Investors in Tampa, Florida, also has a contrarian culture. Chief investment officer (CIO) David Iben and deputy CIO Alissa Corcoran, who manage the all-cap fund, aim to capitalise on market dislocations and build portfolios with low correlation to other managers.