As dividends are typically the focus of income investors, growth investors are overlooking the “unsung hero” of long-term returns, according to Gavin Harvie and Neil Sutherland, partners at Scottish-based investment firm Dundas Global Investors.

In their view, growth investors should not dismiss dividends because both dividend yield and dividend growth make a significant contribution to long-term total returns.

“For some other quality-growth managers, the dividend is just a residual. It just happens. It’s great if you get it,” said Harvie, who manages the £206m Heriot Global fund. “But for us - unless cash flows grow - there’s unlikely to be real earnings growth and the dividend is the best test of sustainable cash flow growth.”

Sutherland added: “Where the dividends go, the share prices follow. Dividend growth has really been the unsung hero of long-term total returns.”

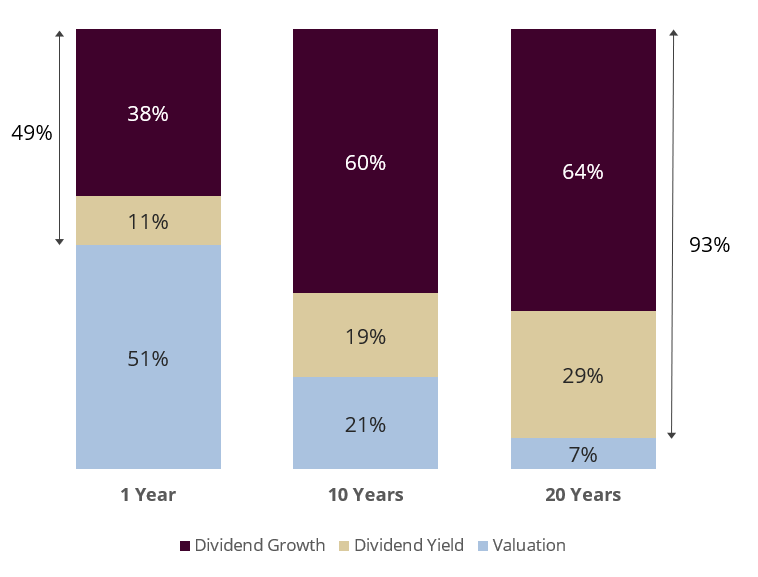

They highlighted a 2016 study commissioned by the Norwegian Ministry of Finance that broke down the components of the MSCI All Country World Index total return over 20 years.

It found that over a period of one year, over half of the index total return came from valuation moves while 11% came from the dividend yield and 38% came from dividend growth.

But over a longer period of 10 years, it found that 79% of the total return came from dividend growth and dividend yield, while only 21% came from moves in valuations.

Over a 20-year period, 93% of the total return came from dividend growth and dividend yield. Only 7% came from moves in valuations.

Source: MSCI 2016 study of long-term returns

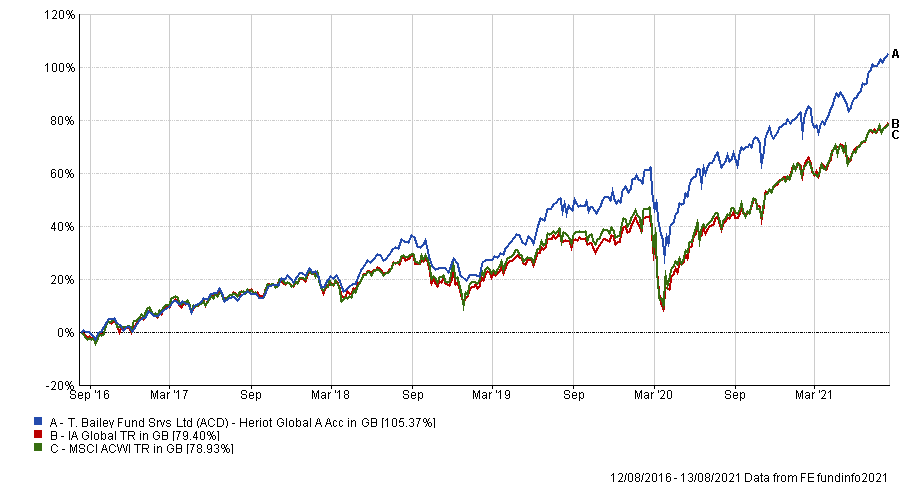

The FE fundinfo five-crown rated Heriot Global fund was one of just 11 global active funds that managed to deliver top-quartile performance while delivering top-ranked low volatility over the past five years, as highlighted in a previous article.

Harvie attributed much of this feat to the fact that they invest in companies that are sustainably growing their dividend. “Sustainability is vital,” he explained. “They need to be able to grow their dividend year on year on year.”

In his view, the combination of sustainable growth and sustainable dividends is something that is misunderstood by most growth investors, making it an “undervalued area” within global equities.

Heriot Global’s approach is somewhat similar to that of the S&P 500 Dividend Aristocrats index, which is made up of companies in the US S&P 500 index that have consistently increased their dividends for the past 25 consecutive years.

But Sutherland said the Heriot Global strategy is more about finding the dividend aristocrats of tomorrow.

He noted that the companies in Heriot Global typically have a higher return on equity, higher re-investment rates, and a lower pay-out ratio than the S&P 500 Dividend Aristocrats.

The higher re-investment rate is vital, according to Sutherland. “That sustainable dividend growth only comes if you’re reinvesting the money into those companies,” he said.

This focus on dividends has paid off for the fund. Heriot Global has managed to deliver top-quartile returns of 105.37% over the past five years, alongside top-ranked low volatility.

Performance of fund over 5yrs

Source: FE Analytics

An important indicator the managers of the fund look for is how boards of directors at their companies allocate cash – but particularly how much revenue is re-invested into research and development (R&D).

While stocks in the MSCI All Companies World index re-invest about 2% of their revenue into research & development (R&D), Sutherland points out that the companies in the Heriot Global portfolio re-invest roughly 7% into R&D – more than three times as much as the index.

This is where he said the edge comes from, and this is where most of their analysis is focused on: trying to work out whether that R&D budget will be successful in growing the business.

Harvie noted that companies with higher re-investment rates into R&D also tend to have both higher margins and higher growth.

Whilst overall company capital expenditure grows at a pace of 3% to 4% each year, R&D expenditure has been growing at a much faster pace of 7 to 9% each year.

Harvie suggested that R&D expenditure will continue to grow in the next 20 years as our economy becomes more intellectual property-driven, idea-driven and intangibles-driven.

“We think it is going to be a lot more than that people even think today,” he said. “So one of the things we're doing now is investing in the businesses the huge technology and R&D advantage.

“Because when capital is free because interest rates are low and debt is so cheap - when you combine machines with borrowed money at extremely low interest costs - it's extremely difficult to do high quality R&D.

“It's extremely difficult to come up with multibillion dollar ideas. What we try and find is businesses that can do that element and therefore that is what sustains their competitive advantage.”

One of the ways of finding companies that are successful in this endeavour is by determining how decentralised their R&D budget is, Harvie revealed.

“When we hear companies talking about decentralised R&D, that's fantastic because that means that there's higher ROI,” he said.

“It’s not: build and sales will come. It's: we're building for them today - so it’s a much lower risk sale. You can pre plan to pre allocate capital to make sure they generate high returns on the R&D dollars.

“Typically high R&D cost companies have high returns on capital because they've been able to manage that relationship between innovation and capital allocation in terms of physical assets really well.”

He added that high levels of accountability within the R&D management team is also a very good indicator: “When the business leader has accountability, they've got their own profit & loss.

“That means that they're not coming up with fanciful projects that just become a cost centre, but they’re having to be profit motivated in their innovations to begin with.”