The Polar Capital Technology Trust’s 450% return over the past decade has made it a popular choice for investors looking to gain exposure to global tech stocks, which have performed incredibly well over the period.

Investors have piled into the trust in recent months, with it appearing in interactive investor’s top 10 most bought stocks between November 2021 to February this year, although demand has waned lately as rising interest rates hampered growth stocks.

Total return of trust vs sector over 10yrs

Source: FE Analytics

With so many already invested in the £3.3bn trust, some may be wondering what they can add alongside it, Here, Trustnet looks at the expert’s top picks for what funds and trusts investors could put next to Polar Capital Technology.

Schroder Global Sustainable Value Equity

Kasim Zafar, chief investment strategist at EQ Investors said investors should balance out Polar Capital Technology’s large allocation to large-cap US tech, where 73.6% of assets are held.

He recommended the Schroder Global Sustainable Value Equity fund, which predominantly invests in mid- to large-cap companies in Europe and the UK, which jointly make up 62.8% of regional allocations compared to 17.8% in the US.

Total return of fund vs sector and index over 10yrs

Source: FE Analytics

Although the fund has underperformed the MSCI World benchmark by 199 percentage points over the past decade, the shifting sentiment from growth to value may improve performance.

“Crucially, exposure to the value factor should mean the fund can outperform while growth equities are under pressure from rising bond yields,” Faulkner added.

Herald Investment Trust

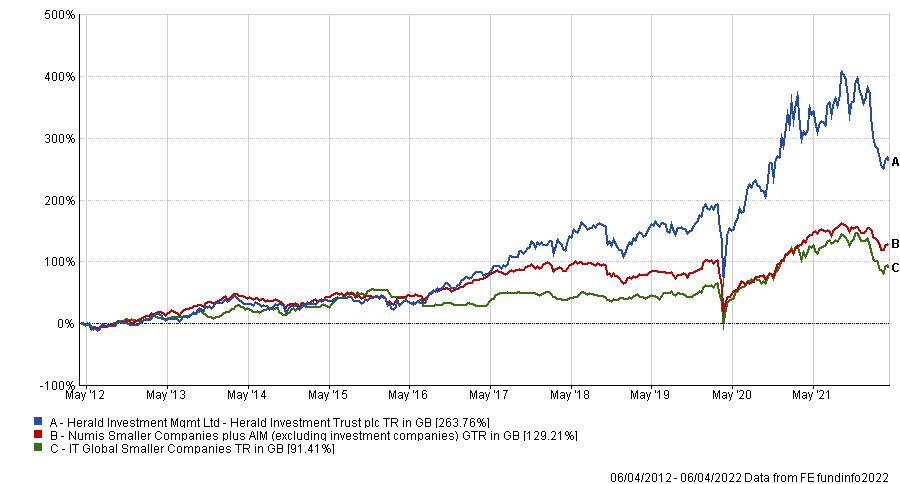

Likewise, Philippa Maffioli, senior advisor at Blyth-Richmond Investment Managers, said the Herald Investment Trust with its small-cap bias would help diversify against Polar Capital’s large-cap focus.

The trust invests in telecommunications, multi-media and technology companies around the globe and has returned 263.8% over the past decade, double that of its peer group.

Total return of trust vs index and sector over 10yrs

Source: FE Analytics

With shares on a 20.9% discount to net asset value, Maffioli said that the current value is attractive for new investors.

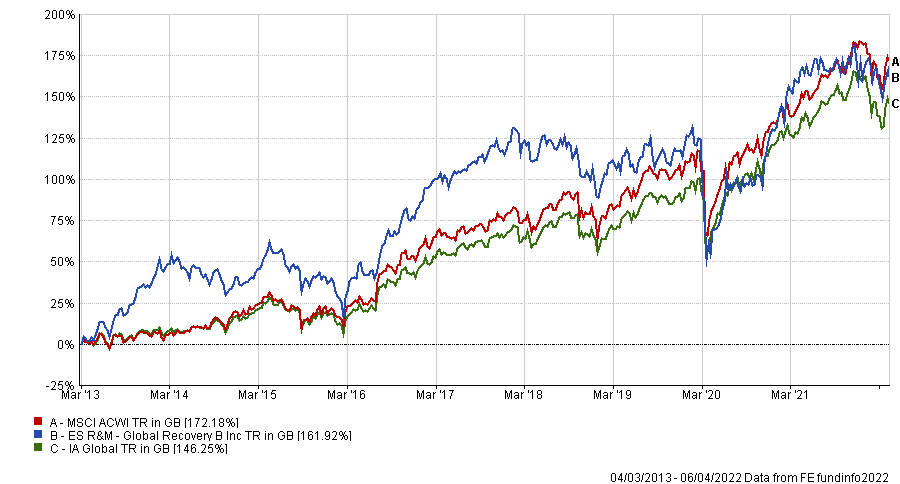

River and Mercantile Global Recovery

Another option for investors looking for a different style is the River and Mercantile Global Recovery fund, recommended by Fairview Investing co-founder Ben Yearsley.

Total return of fund vs sector and index since launch

Source: FE Analytics

With 498 asset holdings, risk is spread across a broad portfolio and many of the large sector allocations vary from Polar Capital’s, with financials (20.7% holdings), consumer discretionary (19%) and industrials (17.4%) taking up the main positions.

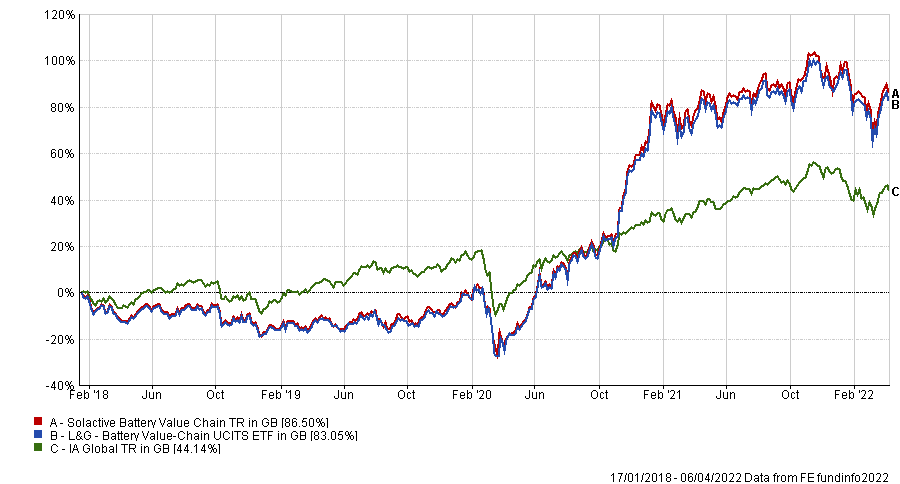

L&G Battery Value-Chain ETF

Andy O’Shea, investment director at Pharon Independent Financial Advisers, recommended another technology trust with very little overlap in holdings – the L&G Battery Value-Chain ETF.

It invests in across every stage of the production in electric vehicles, from mining the materials to manufacturing batteries.

Total return of ETF vs sector and index since launch

Source: FE Analytics

The ETF is up 83% since its launch at the start of 2018 and O’Shea said that performance could accelerate as the demand for infrastructure, such as charging stations, increases over the coming years.