The start of a new year tends to be a time when investors sit down and review the year that was, looking at what worked, what performed poorly and whether there are changes to be made.

As such, Alena Kosava, head of investment research at AJ Bell, looked at four investment trusts that might appeal to savers of all different risk tolerances, ranging from those that can ill-afford to lose money through to those that are willing to bet the farm for higher returns.

Cautious investors: Personal Assets IT

Starting with the former, Kosava suggested the Personal Assets trust run by Sebastian Lyon as a “solid choice” for people who want to protect their cash and then look to increase it (in that order).

Even the risk-averse will likely need to invest, with inflation rampant in the UK. The October reading for the consumer prices index (CPI) came in at 11.1% and although cash and bonds now pay much higher yields that they have done for much of the past decade, they are still far behind the current rate of price increases.

“The trust has generated steady returns over previous years and tends to do particularly well amid challenging market conditions and souring economic narrative – conditions we’ve been experiencing throughout 2022 – which the trust’s experienced manager had been concerned about for a long time,” said Kosava.

Its exposure to inflation-protecting assets such as gold and index-linked bonds has held up well in a period where equity markets sold off and there was a “material repricing” in the bond market.

The portfolio is relatively unchanged from a year ago with around 9% in gold bullion and 37% in US index-linked bonds supporting the main exposure to high-quality equities such as Unilever, Visa and Nestlé.

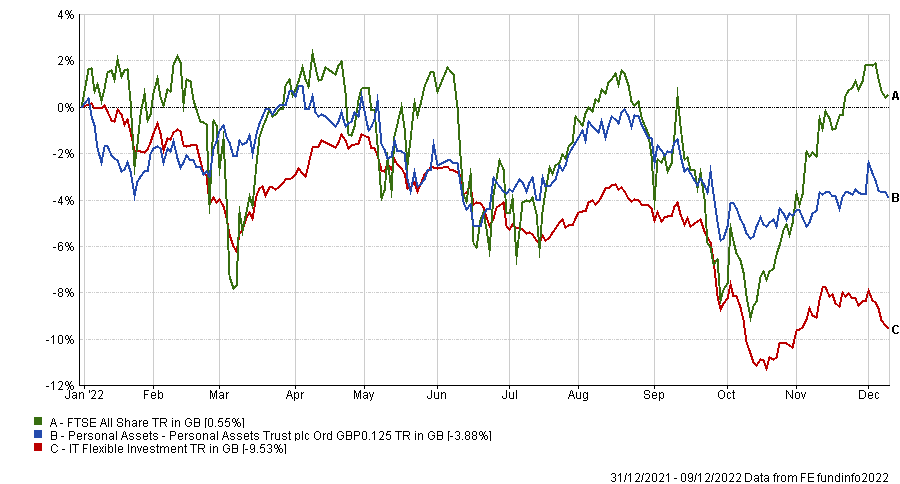

Personal Assets has lost just 3.8% so far in 2022, while the average peer in the IT Flexible sector is down 9.5%. However, it has underperformed the FTSE All Share index, which is up 0.55%.

Performance of trust vs sector and benchmark over YTD

Source: FE Analytics

“The trust is effective at providing investors with a multi-asset diversified portfolio and, given the emphasis on capital protection, should sit well with more cautious investors,” Kosava said.

Balanced investors: Fidelity European Trust

For those willing to take on some risk, but not wishing to have the falls of areas such as private equity, Fidelity European Trust strikes a nice balance, according to Kosava.

“The strategy is focused on identifying long-term growth opportunities in companies with strong fundamentals as well as long-term structural growth prospects,” she said, with manager Samuel Morse bringing three decades of experience to the portfolio.

He has “exhibited an ability to grow the dividend sustainably over a three-to-five year period” and co-manages the strategy with Marcel Stötzel, who was appointed in September 2020.

The trust’s track record is enviable, topping the IT Europe sector over one, three, five and 10 years, yet its shares are on a discount to the net asset value of 5.4%.

Performance of trust vs sector and benchmark over 10yrs

Source: FE Analytics

The key investment style is growth at a reasonable price and is similar to the open-ended Fidelity European fund. Morse and Stötzel aim to avoid timing markets and so tend to not invest in cylical stocks, which have been flavour of the month in 2022, as well as smaller companies, which tend to be riskier.

“With the manager being well-resourced and seasoned cautious investors focusing on ensuring capital loss mitigation on the downside, clients are set to benefit from this approach amid continued market turbulence,” said Kosava.

Adventurous investors: Worldwide Healthcare Trust

Taking a more aggressive stance can pay off in the long run and one option that could appeal is healthcare. Having come off the back of a global pandemic, investors may be forgiven for thinking the sector has done remarkably well, but now facing a prospect of a global recession the sector has struggled and could be attractively valued for a bounce back.

Kosava’s selection – Worldwide Healthcare Trust – had a tough 2020 and has languished so far in 2022 for a number of reasons, including an underweight to the big Covid pharma stocks and an overweight to life sciences, biotech and China.

As such, over the past year it has lost 10.2%, while the MSCI World Healthcare index is up 7.6% and over five years it is some 50 percentage points behind. Yet it remains in-line with the six-fund IT Biotechnology & Healthcare sector average over those periods.

Performance of trust vs sector and benchmark over 5yrs

Source: FE Analytics

“The bigger picture away from the immediate Covid winners story is how the rapid drug development of the past 18 months translates into revolutionary new treatments looking forwards,” Kosava said.

Despite a widening discount of 8.2%, the managers remain bullish about the healthcare sector and the trust’s long-term track record of delivering outperformance (it is still the second-best fund in the sector over 10 years, returning 315.5%) suggests now present a good buying opportunity.

“With the long-term drivers behind healthcare well established and further investment set to continue making for an exciting future ahead for drug development, this broad, diversified play on healthcare looks attractive after a period of significant underperformance,” she said.

Income: City of London IT

Lastly, those that require an income from their investments should consider the City of London IT, managed by Job Curtis since 1991.

The UK is an “obvious” place for income hunters thanks to its higher yield and this portfolio currently pays out around 4.9% per year.

It has the longest track record of dividend increases of any investment trust for annual increases in dividends, since 1966 and has achieved this mainly by focusing on quality companies able to grow dividends over time.

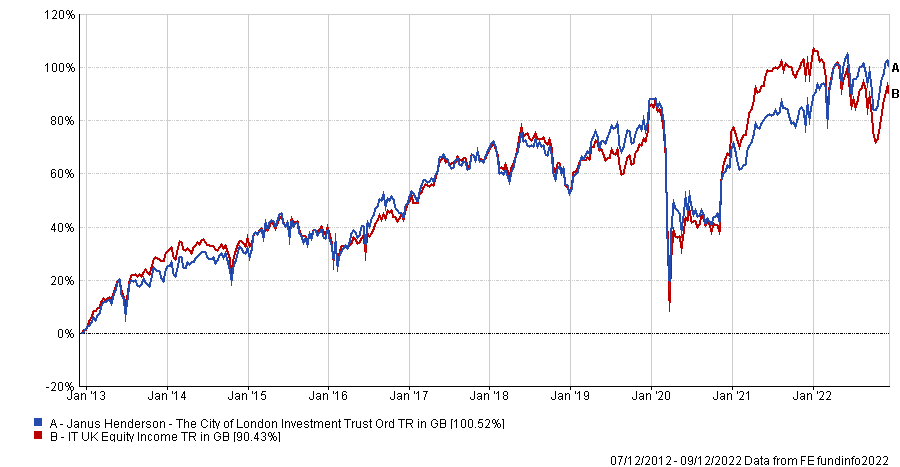

Performance of trust vs sector over 10yrs

Source: FE Analytics

Kosava said: “The board fully recognises the importance of dividend income to shareholders, with a relentless focus on consistency over time – the trust is able to hold back up to 15% of its income, beefing up revenue reserves for use in challenging times when company dividend income may be cut.”

While invested mainly in UK equities with a bias towards large, multinational businesses able to grow their profits consistently over the long run, the companies underpinning the portfolio enjoy overseas revenue streams making for a diverse global exposure, she added.

It has been the second-best performer in the IT UK Equity Income sector over the past year and has beaten its average peer over the long term as well, as the above chart shows.