Multi-asset managers are overwhelmingly backing bonds in 2023, with some saying this is the most excited they have been on the asset class in more than a decade.

After a 40-year bull run, government bonds reached a point in 2021 where they could no longer offer either of the key characteristics they are typically expected to deliver: income and diversification.

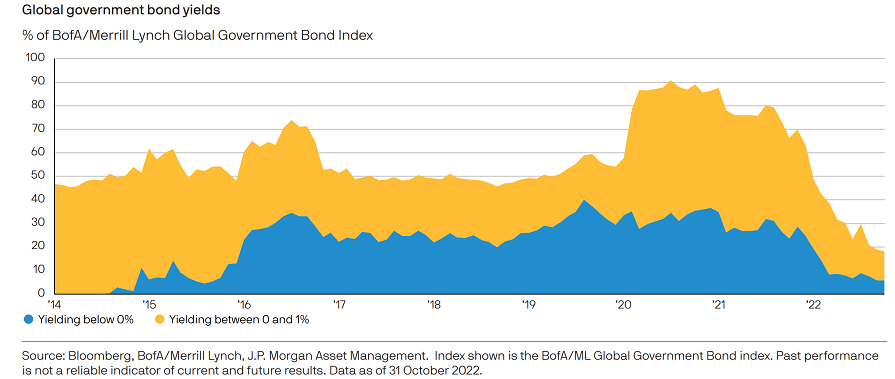

As analysts at JP Morgan Asset Management noted: “At one point, a staggering 90% of the global government bond universe was offering a yield of less than 1%, forcing investors to take on ever greater risk in extended credit sectors that had much higher correlations to equities.

“Low starting yields had also diminished the ability of government bonds to deliver positive returns that could offset losses during equity bear markets.”

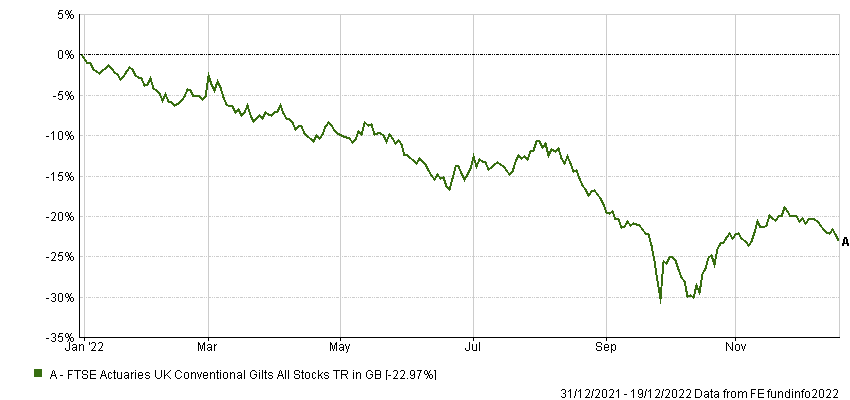

This all changed in 2022, as central banks began to hike interest rates in a bid to control inflation, causing a “brutal” correction in fixed income. Investors in UK government bonds also had to deal with the fallout from Kwasi Kwarteng’s disastrous mini-Budget: while these assets are supposed to be the safest available, the FTSE Actuaries UK Conventional Gilts All Stocks index was down more than 30% at one point this year.

However, multi-asset managers claim the market has now priced in expected increases in inflation and interest rates, meaning the only way is up for bonds.

Performance of index in 2022

Source: FE Analytics

Karen Ward (pictured), chief market strategist for EMEA at JP Morgan, said: “We are more excited about bonds than we have been in more than a decade. The reset in fixed income this year has been brutal, but it was necessary.

“After the pain of 2022, the ability for investors to build diversified portfolios is now the strongest in more than a decade. Fixed income now provides both income and diversification and therefore can be a sturdy foundation for multi-asset portfolios once again.”

Janet Mui, head of market analysis at RBC Brewin Dolphin, went even further, saying bonds now look more attractive than equities.

“Investors are now able to lock in decent yields while taking little-to-no credit risk in selected investment grade credit – for example, in developed market government bonds – with the potential for attractive price returns when interest rates eventually fall,” she explained.

“The conviction on equities is less clear in 2023, as weak growth and earnings could drag the market lower before a decisive fall in rates helps equities bottom.”

Meanwhile, Luca Paolini, chief strategist at Pictet Asset Management, said he expected the return on global equities to be limited to 5% for the coming year, barely above the 3% forecast for global government bonds.

So where in the fixed income market are managers finding opportunities? Analysts at JP Morgan said that, given uncertainty about inflation and growth, and the “chunky yields” available in short-dated government bonds, investors may want to spread their allocation along the fixed income curve, taking more duration than they would have advised for much of 2022.

Colin Finlayson, fixed income investment manager at Aegon, is taking a similar approach.

“Yields could still be pressured higher by rising inflation and subsequent central bank tightening in the short term, although the bulk of the heavy lifting is behind us,” he said.

“We favour incrementally adding duration, while looking for signs of a peak in inflation rates and yields to begin adding more meaningful interest rate risk.”

When it comes to corporate bonds, he is focusing on financials and non-cyclicals at the higher end of the credit-quality scale to mitigate risks as rising costs squeeze margins.

“Market volatility will remain the key risk to this,” he added. “We have a strong overweight in investment grade credit, with a preference for financials and less cyclical corporates, as well as companies rated at the higher end of the credit-quality spectrum.”

John Husselbee (pictured), head of the Liontrust multi-asset team, said high yield bonds now offer attractive spreads versus government bonds, which will provide a buffer against inflation and the risk of defaults.

However, the analysts at JP Morgan were more cautious.

“Within credit markets, we believe that an ‘up-in-quality’ approach is warranted,” they continued.

“The yields now available on lower-quality credit are certainly eye-catching, yet a large part of the repricing year to date has been driven by the increase in government bond yields.

“High yield credit spreads still sit at or below long-term averages, both in the US and Europe. It is possible that spreads widen moderately further as the economic backdrop weakens over the course of 2023.”