Gold has made strong returns in recent months while shoring up portfolios from choppy markets, but why is it performing so well when government bonds offer a similar safe haven with the added benefit of yield?

While the yellow metal was lacklustre in the tech-fuelled bull market, gold has delivered decent returns and diversification benefits more recently. Gold has risen more than 8% over the past 12 months, outpacing the MSCI AC World index and at one point moved past the $2,000 an ounce mark, a threshold last crossed in September 2020.

Jason Hollands, managing director of Bestinvest, said: “Gold has long been an asset that investors flee to in times of financial uncertainty, such as periods of hyper-inflation or when distrust in the financial system is high and other fears stalk the markets. It is effectively a panic asset, seen as a port in a storm at times of market stress.”

Performance of gold vs stocks and govt bonds over 1yr

Source: FE Analytics

But, in theory, gold should not be performing as well as it has been recently. Because it does not generate any income, rising government bond yields – which have followed aggressive rate hikes by central banks – should hurt gold as investors can instead hold ‘safe’ government bonds.

To explain why gold has managed to rise in this environment, Hollands highlighted four main factors.

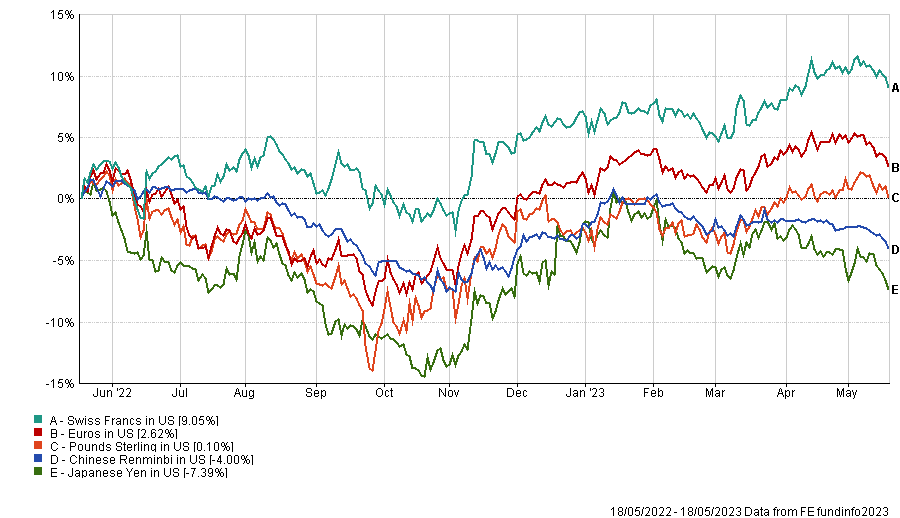

The first is the weakness of the US dollar. As the markets anticipate the end of the US Federal Reserve’s cycle of interest rate hikes due to decelerating US inflation, the dollar has weakened to the benefit of gold.

“When the dollar is strong, demand for gold is negatively impacted because it hurts affordability for buyers in non-dollar currencies. With the dollar now softening again, this is supportive for gold,” Hollands explained.

Performance of US dollar vs other currencies over 1yr

Source: FE Analytics

Concerns over the health of the banking system, following the collapse of several US banks and growing scrutiny on US regional banks, have pushed investors toward the perceived safety of gold.

“A period of worry about the stability of the banking system is a classic environment for investors to flock towards the perceived safe haven of gold,” Hollands said.

The third factor is central bank buying of the yellow metal. Emerging market central banks, notably China, have significantly bolstered their gold reserves over the past year, reacting to the weaponisation of the dollar amid geopolitical tensions such as Russia’s invasion of Ukraine.

“Physical gold held in domestic vaults is much harder for foreign powers to move against,” Hollands noted. “There is no reason to believe that the gold buying spree by central banks is done and dusted.”

The final factor is political brinksmanship over the US debt ceiling, which is creating uncertainty around federal spending and the US economy.

Although previous standoffs about raising the debt ceiling have been resolved successfully, this time former president Donald Trump – the frontrunner for the Republican nomination – has told Republican congressmen and senators that they should be willing to risk a default unless the Biden administration agrees to “massive” spending cuts.

Hollands said: “While a disastrous default is extremely unlikely, cuts to Federal spending will be the pound of flesh congressional Republicans expect and this will have a yet to be clear impact on the US economy. All this uncertainty will likely be driving some risk-averse investors towards gold.”

But while these four factors might support gold in the near term, meaning the metal looks attractive to investors against a backdrop of global economic uncertainty, Hollands pointed out that it does have some potential pitfalls.

Contrary to investing in stocks or bonds, gold is essentially an unproductive asset that provides no yield, dividends or fixed income. Unlike companies that generate revenue through products or services, gold merely resides in a vault and creates an opportunity cost for investors. The lack of productive use makes it challenging to evaluate whether the current prices are a bargain or overpriced.

Gold prices heavily depend on what buyers are willing to pay, driven by real-world demand factors like the jewellery market, central bank purchases and industrial usage. However, these prices are also significantly influenced by financial market sentiment, which can swing sharply and unpredictably.

That said, Hollands argued that owning a modest amount of gold can serve as an ‘insurance policy’ for a portfolio during challenging times. Each of Bestinvest’s five Smart portfolios includes around a 6% holding in physical gold, through an exchange traded commodity (ETC).

Those looking to add the yellow metal to their own portfolio have several options.

The first is by purchasing physical gold items, which can be stored at home or in a secure vault like the Royal Mint, for a fee. Certain gold bullion coins issued by the Royal Mint even have legal tender status and are exempt from UK capital gains tax and VAT.

Those who prefer more liquidity and tax-efficient options like ISAs and pensions have two alternatives: indirect investment in gold mining companies' shares or investing in physical gold via ETCs.

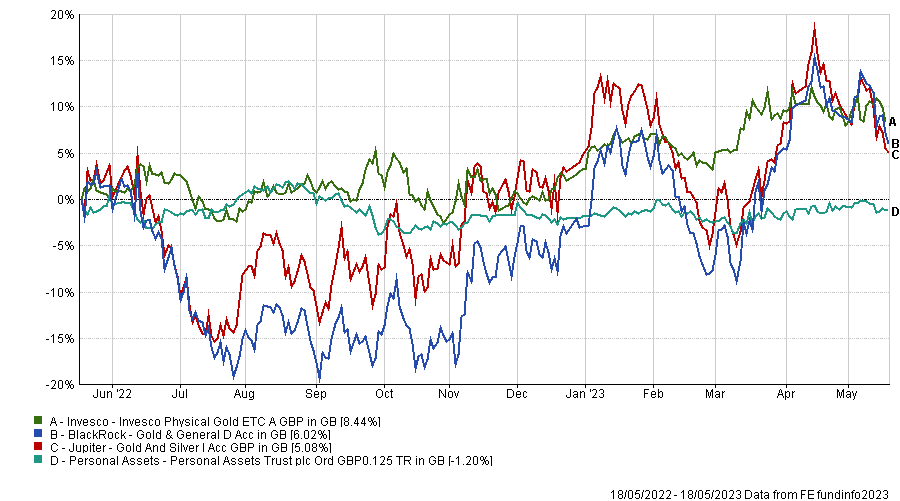

Performance of highlighted funds over 1yr

Source: FE Analytics

Gold mining shares can be volatile due to the high costs of gold extraction. Movements in gold prices can significantly impact profitability, leading to large swings in these companies' share prices.

Therefore, Hollands suggested that investors wanting exposure to gold to dial down risk in portfolios should prioritise owning physical gold rather than mining stocks. For those with a higher risk tolerance, funds such as BlackRock Gold & General or Jupiter Gold & Silver, which own both mining shares and physical bullion, are options.

Bestinvest advocates for exposure to physical gold through ETCs, as they provide investors with exposure to the gold price backed by physical holdings. The firm’s preferred ETC is the Invesco Physical Gold ETC GBP, due to its low annual costs and the security of gold bars stored in JP Morgan Chase Bank's London vaults.

Lastly, Hollands pointed to multi-asset funds such as Personal Assets Trust, which is managed by Troy Asset Management and allocates 11% to gold-related investments as part of its capital preservation strategy. The trust also holds significant US Treasury Inflation Protected Securities, equities, short-dated government bonds and cash.