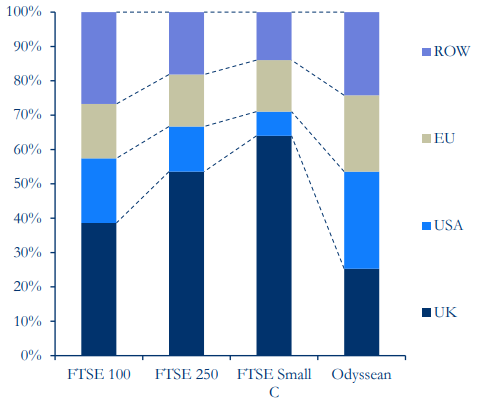

Smaller companies in the UK can offer investors some exciting growth potential, but most are heavily reliant on the domestic market than their large-cap, more international peers.

Yet there are some that have a truly global reach. Here, Stuart Widdowson manager of the Odyssean Investment Trust shares some hidden gems in the small-cap space that offer global exposure despite their small size.

Revenue exposure by region

Source: Frostrow Capital

Xaar

Although ink printer cartridge manufacture Xaar operates from Cambridge, it only relies on 2.4% of its revenues from the UK. Most of its income comes from customers in the Americas (40.7%) and Europe (22.9%).

Widdowson said that there are a only “very small number of competitors” it contends with globally, most of which are based in Japan, but their technology differs from Xaar’s.

The company has a patented line of industrial printing cartridges that are unique to Xaar, giving it an advantage over its peers.

“It’s a really unique asset and there are significant barriers to entry for anybody developing similar technology,” Widdowson said. “It's been built up over 15 years, so we don't think anyone's going to climb up against it.”

Share price of Xaar over the past five years

-3.png)

Source: FE Analytics

It is also launching new products that cater to a wider net of customers, such as Aquinox, which should boost its share price over time as it expands its network.

Widdowson explained: “With things like this new product, it is expanding into new printing markets where it has never played before, so that’s increasing the addressable market quite substantially. It's one of these recovery situations that we think will turn into a really strong growth company.”

Elementis

Chemicals company Elementis is the top holding in Widdowson’s IT UK Smaller Companies trust (accounting for 13.6% of its assets), yet only 2.8% of its revenues come from its home market.

The £660m company manufactures a number of speciality chemicals and personal care products, but unlike many competitors, it has the advantage of controlling its supply chain.

Share price of Elementis over the past five years

-1.png)

Source: FE Analytics

For example, Widdowson said it owns the “world’s only commercially-viable” Hectorite clay mine, which is a core ingredient in paint coatings and cosmetics.

“The value of that is going to go up over time, so pricing power is really good. We really liked that attribute of a business,” he added.

“From a valuation perspective, we think those mineral assets account for the bulk of – potentially more than – the whole value the company.”

Make-up sales dropped substantially during the pandemic, which led to a deep drop in share price that the company has yet to recover from, but this cheaper valuation has made it more attractive.

Widdowson: “The shares are trading on a significant discount but the earnings are set to recover nicely, it generates lots of cash and it's undervalued, so we think it's a really interesting asset.”

XP Power

Another undervalued company trading at an attractively low share price is power converter manufacturers XP Power, according to Widdowson.

He said that shares had “derated quite materially over the past 18 months,” but this created an appealing entry point for new investors.

“It's a company that markets really struggled to value, but we think it's a very good business,” Widdowson added.

“We bought in when the shares were under a cloud and I would expect the company to re-rate over time as growth comes back. Alternatively, I wouldn't be surprised if somebody else ended up owning it.”

Share price of XP Power in 2022

-2.png)

Source: FE Analytics

It made an overall loss of £30m in 2022 – compared to a £28m pre-tax profit the year prior – and shares in the company dropped 58.6% throughout the year.

Despite this, Widdowson said the UK-domiciled business, which relies on 8.9% of its revenues from its home market, has strong fundamentals that should be priced in at some point in future, boosting shareholder returns.

Ascential

Analytics company Ascential takes in around 10.6% of its revenue from the UK despite being domiciled in the country. It owns a number of businesses that research e-commerce activity to optimise the practises and marketing of their clients.

Widdowson said companies are willing to fork out for their analytics services as forecasts early on help them avoid bad creative decisions and save them a lot of money down the line.

Share price of Ascential over the past five years

-1.png)

Source: FE Analytics

Nevertheless, Ascential’s strong fundamentals have been overshadowed by poor sentiment. But this has made it more exciting from a valuation perspective, according to Widdowson.

“At times the share price has been very volatile but when we invested we felt it was trading at a massive discount and trading was pretty good at the company,” he added.

Gooch and Housego

Photonic components manufacturer Gooch and Housego was the most UK-reliant company Widdowson highlighted, yet less than a quarter (22.3%) its revenues come from the region. Its biggest market is the US, which accounts for 37.9% of its income.

The £135m company produces a number of electronic products, but its fibre cables are one area of the business that appears most promising, according to Widdowson.

Share price of Gooch and Housego over the past five years

.png)

Source: FE Analytics

These subsea cables run data along the ocean floor and, with ever-increasing demand, the company could thrive on its expertise in this field.

Widdowson said: “More and more data needs to cross continents, so more of these things need to get laid, not to mention the replacement cycle as well.

“That's a good little niche within it. There’s lots of things Gooch and Housego does, but that's just one of the many applications they have in their market.”

He added that Gooch and Housego have “at least a 50% market share” in the fibre cable market despite the companies small size, making it a “niche global leader”.