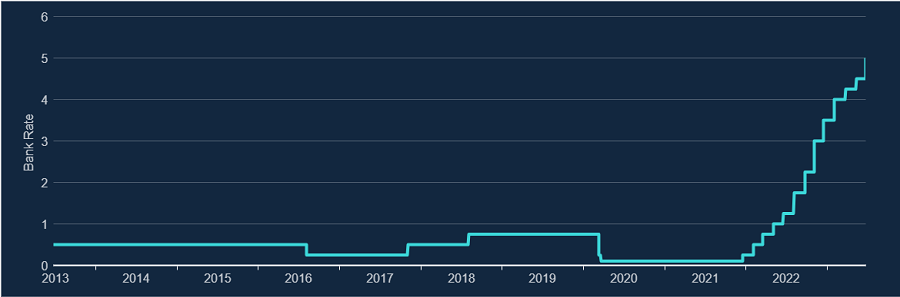

The Bank of England has announced the 13th consecutive interest rate hike today, increasing the base rate by 0.5 basis points to 5%.

The Monetary Policy Committee’s decision follows the shock of the latest consumer price index (CPI) figure, which was expected to abate but instead held firm at 8.7%. With the Bank now having overcome its reticence for a more aggressive hawkish stance, consensus sees terminal rates closer to 6%, with more pain to come for British households.

Base rate over 10yrs

Source: Bank of England

Neil Birrell, chief investment officer at Premier Miton Investors, called this a “rate grenade”.

“The BoE has opted to aggressively tighten policy and launched a rate grenade at the spectre of ongoing inflation. Inflation seems to be more embedded in the UK than elsewhere, leaving the Bank with little option than to act tough,” he said.

“The size of this hike is, however, a surprise. The fear is that this could rapidly tip the economy into a recession, but that is obviously not deemed to be as bad an outcome as the risk of ongoing elevated inflation.”

Huw Davies, manager of the Jupiter Fixed Income Absolute Return fund, highlighted the UK as an outlier from the rest of the developed world.

“Although all developed nations have experienced a similar post-pandemic surge in inflationary pressures, the UK’s position is looking increasingly out of step with inflation slowing in other countries. UK core inflation is now by some margin the highest amongst G10 nations and worryingly is accelerating after seemingly having peaked towards the end of 2022,” he said.

“The move today is a tacit admission that they have been behind the curve in their hiking policy and this measure is an attempt to regain the initiative and their credibility. The key problem is that UK real rates have consistently been negative despite the tightening cycle. It feels like the BoE will have to inflict more pain on UK households to achieve a return to a controlled level of inflation more in line with their inflation target.”

Richard Carter, head of fixed interest research at Quilter Cheviot, agreed and sees a recession at the end of the tunnel, questioning the effectiveness of the Bank’s policy.

“While the UK avoided recession at the turn of the year, it does not mean one is not lurking further down the tracks. Clearly, interest rates are a blunt tool and are failing to have the desired effect in dampening demand, but the BoE will keep using them,” he said.

“The problem the BoE faces is much of this inflation has been driven on the supply side so it is not clear exactly what else the Bank of England can do. We are ultimately stuck in a sort of holding pattern waiting for the data to improve.”

Mortgage holders will be the first to feel the brunt, but soaring interest rates will also have a significant impact for investors, explained Bestinvest managing director Jason Hollands.

“Soaring interest rates and elevated gilt yields will act as a near-term headwind to equities, with 10-year gilts now yielding 4.4%, which is higher than the circa 12-month forward 4.2% dividend yield on the FTSE 100 index,” he said.

“This is not in itself a sell signal per se, as in the past bond yields were often higher than equity yields, but this hasn’t been the case since 2008 when the global financial crisis ushered in an era of ultra-low borrowing costs which meant for a long-time equity investing has been the only game in town. That is no longer clear cut and bonds should be back on investor’s radars as part of a diversified portfolio.”

In this environment, Hollands recommended investors remain cautious towards those more domestically focused UK companies, typically more prevalent at the smaller and medium sized end of the market, as well as property.

“Instead, it is right to focus UK equity exposure on larger, internationally focused businesses and defensive sectors like consumer staples and healthcare than can weather the storm,” he concluded.