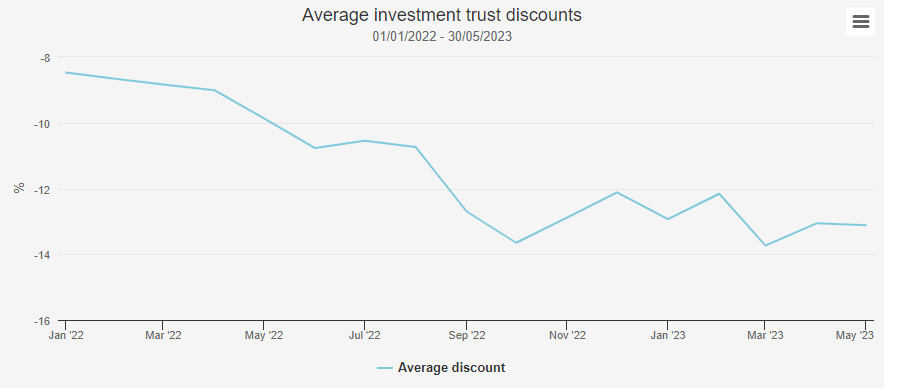

The share prices of most trusts have fallen well below their net asset value (NAV) amid volatile market conditions, allowing investors to buy them at a sizable discount.

Indeed, the average investment trust is currently trading on a 13.1% discount, according to data from Kepler Partners, with some sectors becoming even cheaper.

Ryan Lightfoot-Aminoff, fund research analyst at Kelper, said trusts investing in private assets such as property, infrastructure and smaller companies often have wider discounts during market downturns.

Source: Kepler Partners

The value of these assets are usually calculated periodically, so the NAV on trusts that invest in the them often lag the wider market and investment trusts have a 16.8% allocation to private assets on average, compared with 3.3% during the financial crisis of 2008.

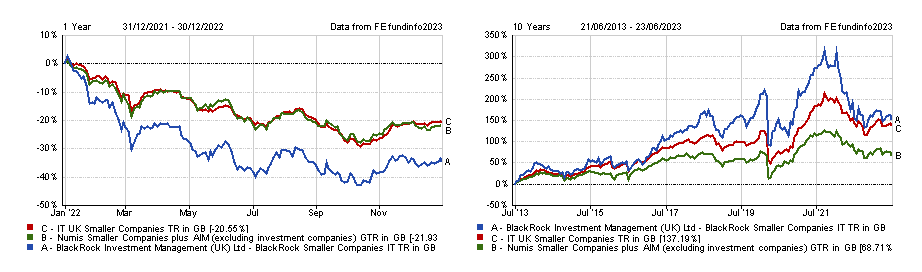

One trust with a “particularly wide” discount is Balanced Commercial Property, according to Lightfoot-Aminoff. Shares in the trust are currently selling 43.6% below NAV, whilst the average IT Property (UK Commercial) trust has a discount of around 21.7%.

Recent volatility dragged its 10-year return down 7.2%, but Lightfoot-Aminoff said long-running manager Richard Kirby (who has led the fund since 2005) is a safe pair of hands who has done a good job of reallocating through the downturn.

Total return of trust vs sector over the past decade

Source: FE Analytics

“Kirby has extensive experience in the sector,” Lightfoot-Aminoff said. “He has used this experience to rebalance the portfolio by reducing a number of office and retail assets at good valuations, in order to increase the exposure to the industrial sector, in particular logistics warehouses, which are set to benefit from the long-term structural trend towards online retail.

“We think the write-downs in the property sector have probably mostly been taken, so the wide discount could prove a good opportunity for long-term investors, even if we may need to see gilt yields start to fall before the discount materially closes.”

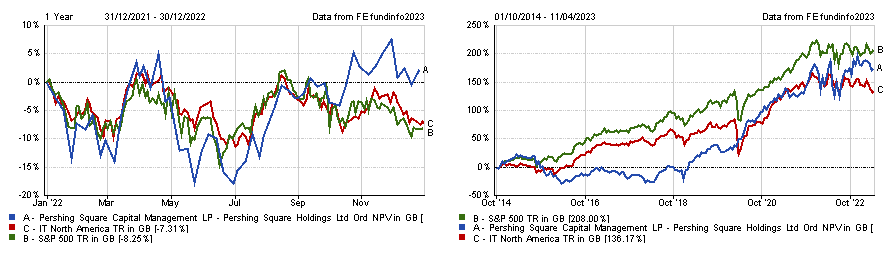

Another trust investing in private assets that Lightfoot-Aminoff pointed out as having an attractive discount is BlackRock Smaller Companies.

Small-cap companies in the UK have been some of the worst hit in recent years, with their focus on a single industry, smaller client bases and sensitivity to interest rates leaving them vulnerable.

BlackRock Smaller Companies was no exception, falling 34.3% in 2022, but Lightfoot-Aminoff said investors can buy a long-term outperformer at a 14.4% discount.

It beat the IT UK Smaller Companies sector with a total return of 151.7% over the past decade using an effective investment strategy that has remained unchanged – now could be “an attractive entry point” for investors wanting exposure to this trust, according to Lightfoot-Aminoff.

Total return of trust vs sector and benchmark in 2022 and over the past decade

Source: FE Analytics

“We think there are a number of sectors where concerns about interest rates have contributed to widened discounts, but these have arguably been exacerbated by wider economic concerns and the impact of a recession, in particular on UK smaller companies and property,” he added.

“Should recent optimism about the economy prove correct, the current wide discounts could prove an attractive entry point for long-term investors.”

Investors wanting exposure to UK small-caps may also want to consider the Schroder British Opportunities trust, as suggested by FundCalibre managing director Darius McDermott.

He said it “has really been in the eye of the storm” given its preference for small to mid-sized companies, but a good choice for investors who want a “pure play on the recovery of UK equities”.

“For a longer term play I think it still has merit,” McDermott explained. “As and when the economic situation starts to improve and/or inflation starts to fall more meaningfully giving space for interest rates to fall too, small, and medium companies could get the boost they have been waiting for.

“They generally do better coming out of a recession and with valuations looking attractive today, now could be a good entry point.”

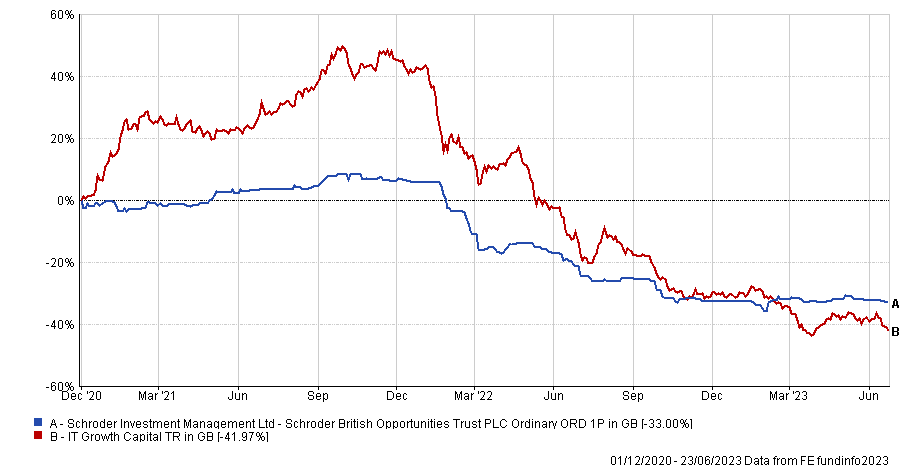

The trust had a challenging first few years, with down 33% since launching in late 2020, yet McDermott said managers Rory Bateman and Tim Creed bring with them some strong experience.

Total return of trust vs sector since launch

Source: FE Analytics

Sizable discounts can also be found in other hard-hit areas, such as the GCP Infrastructure Investments trust.

The £635m trust is up 26.9% over the past decade, trailing the IT Infrastructure sector by 27.6 percentage points, yet James Carthew, head of investment company research at QuotedData, said its 9.7% dividend yield was an appealing trait.

This, paired with its strong management and 35.6% discount, makes it “hard to fathom why it is so cheap,” according to Carthew.

Total return of trust vs sector over the past decade

Source: FE Analytics

He added: “I am always impressed by the investment adviser’s ability to come up with interesting new investment areas for the portfolio.

“As existing investments mature, funds are recycled – with higher yields, the adviser has an opportunity to add more yield to the portfolio but there is also room to improve the asset quality.”

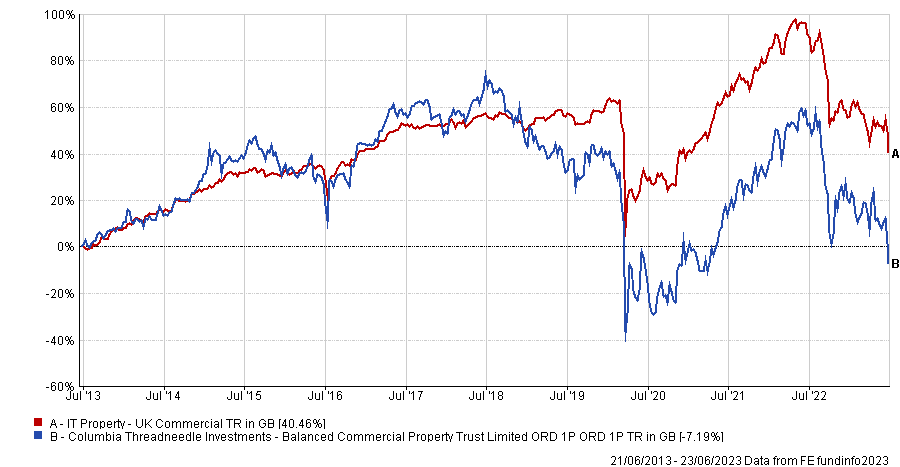

Shavar Halberstadt, equity research analyst at Winterflood, said that the widespread de-rating of trusts is ‘overdone,’ dragging many good portfolios down with the crowd.

One such trust is Pershing Square Capital, which is trading at around a 35% discount despite being up 173.5% since launching in 2014 (from its last valuation in April).

Regardless of volatile headwinds, it even delivered a positive return of 2.3% in 2022 while the rest of its peers in the IT North America sector fell 7.3%.

Total return of trust vs sector and benchmark in 2022 and since launch

Source: FE Analytics

Unlike other trusts noted by analysts, this fund typically avoids private assets and invests primarily in listed US large-caps.

Halberstadt also pointed out that investors could benefit from its $100m buyback programme, which was extended after it repurchased over $1bn in shares over the past five years.

Alternatively, investors looking to buy a more specialist portfolio at a discount may want to consider the RTW Biotech Opportunities, suggested by Numis associate director Priyesh Parmar.

The trust (formerly RTW Venture Fund until last week) was up 15.2% since launching in 2019. Although the fund’s outperformance sunk in line with the IT Biotechnology & Healthcare sector amid the volatility of the past few years, Parmar said the acquisition of Prometheus Biosciences earlier this year boosted performance.

Total return of trust vs sector since launch

Source: FE Analytics

Parmar added: “While the fund itself is cheap, the biotech sector itself is also cheap, following a vicious bear market which has resulted in valuations being near the lows hit in the global financial crisis.

“We see scope for a rerating as the manager builds its presence within the UK market, the liquidity of the shares improve, and the biotech sector recovers.”