Technology is not the sector investors seeking income would intuitively turn to. After all, tech stocks are not known for their payouts: Alphabet and Meta, for example, have never paid a dividend to their investors.

The rational for this is that investors are better served if the capital is reinvested to further develop the company and generate growth.

There is, however, a particular area in the technology sector where combining both growth and income is possible: semiconductors.

Martin Connaghan, investment director at Murray International, said: “In our mind the semiconductor exposure can help with delivering both elements of that strategy. They’ve proven themselves to be businesses which can deliver attractive capital growth over the long term.

“They are also businesses which we believe can offer an attractive level of yield at times, have the potential to pay consistently growing dividends (Broadcom has double digit dividend growth over 1, 3 and 5 years) and can also pay special dividends (Samsung Electronics paid a special in 2021).”

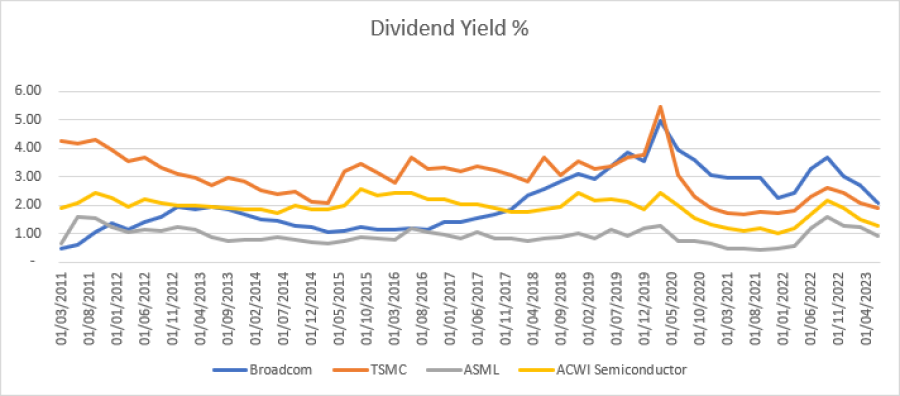

Dividend yields of Broadcom, TSMC and ASML vs MSCI ACWI Semiconductor

Source: Capital Group

Murray International holds businesses across different areas of the semiconductor industry, such as input materials, foundry, chip design, machine design and manufacturing.

It also has four semiconductor related stocks in its top 10 holdings: Broadcom, Taiwan Semiconductor (TSMC), BE Semiconductor and Samsung Electronics.

Yet, Connaghan said there are differences in dividend yields between the different businesses in the semiconductor space. Cycles to chip innovation, chip demand and capital expenditure on R&D can also have an impact on dividends at time.

He said: “You’ll come across businesses such as Nvidia or ASML, which perhaps sit within the growthier end of the industry and both of which have dividend yields that are too low in a Murray International context.

“You’ll then have businesses whose dividends mimic the cycle a little bit more, like TSMC or GlobalWafers. These businesses can throw off considerable cash flows and dividends depending on where we are in the demand cycle and where they may be in terms of capex.

“There are businesses like Analog Devices and Broadcom with yields getting towards 2%, but where you have very attractive and consistent double-digit growth profiles in the dividend across five years.”

Connaghan added that some businesses have cut their dividend recently, such as Intel for the first time in over 20 years.

Performance of indices over 10 years

![]()

Source: FE Analytics

While the semiconductor industry has beaten the MSCI World index over 10 years, its prospects for the years to come remain strong.

Julie Dickson, investment director at Capital Group, said: “There's a lot of growth and room for growth to play out as the semiconductor market evolves.

“The kind of businesses that are going to be long-term winners for are those that are shifting away from home computer, television, internet-related chip manufacturer and more towards data, AI, sensor technologies and machine learning, because that's where the growth is.”

Semiconductors should also benefit from the efforts to diversify the supply chain away from Taiwan and China.

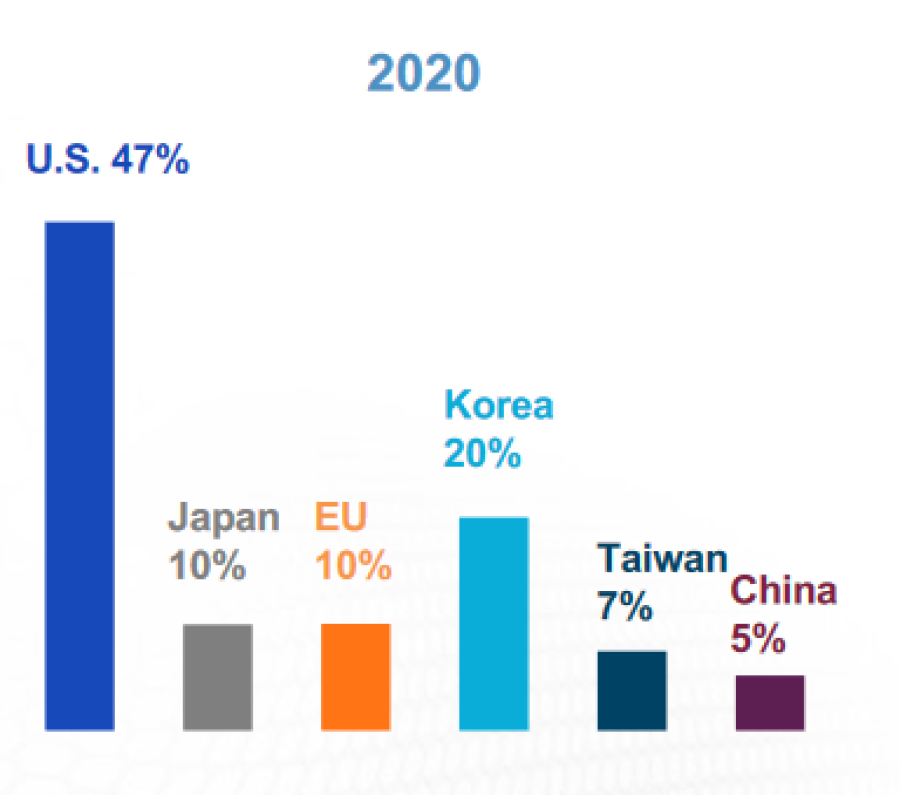

For example, the US has the largest market share (47%) in the semiconductor industry, according to the Semiconductor Industry Association. Its strengths lie in R&D, design and process technology, but it comes short in manufacturing.

Dickson said: “The US Congress recently passed a law called the Chips Act, which enables certain subsidiaries for these chip manufacturers to onshore the manufacturing process. A good example is Apple, which is bringing some of the TSMC foundries into the US to enable some of the manufacturing process to take place more locally.”

Market shares in the semiconductor sector

Source: Semiconductor Industry Association

She added that firms in the chips manufacturing segment are likely to be growing for the next 15 to 20 years due to their competitive advantage.

This is because the barriers to entry in this sector are high, with a significant amount of capital expenditure required to start and scale up a business in the manufacturing segment.