After an August where no clear winners or losers emerged in the investment arena, investors have come back from the holidays to find their portfolios barely changed since the start of last month.

Also unchanged is the uncertainty around the economy, making for a rather uninspiring return from the summer break.

But actually, this could be an exciting entry point, according to Peel Hunt’s head of investment trusts sales Alex Howe.

“I firmly believe that today represents one of the best entry points you are likely to see for some high-quality names, with the average trust trading on a 16% discount and interest rates looking as though they’re peaking out,” he said.

“Investors might be forgiven for not piling into trusts, but history tells us that these stretched levels represent a compelling entry point.”

Unicorn’s Peter Walls agreed and told Trustnet he is “dancing on the table with excitement over trust discounts”.

One sector where Howe sees the most value is private equity, including strategies that blend listed and unlisted equity exposure such as Scottish Mortgage (currently on a 19% discount), Syncona (29%), Augmentum Fintech (40%) and HarbourVest Global Private Equity (42%).

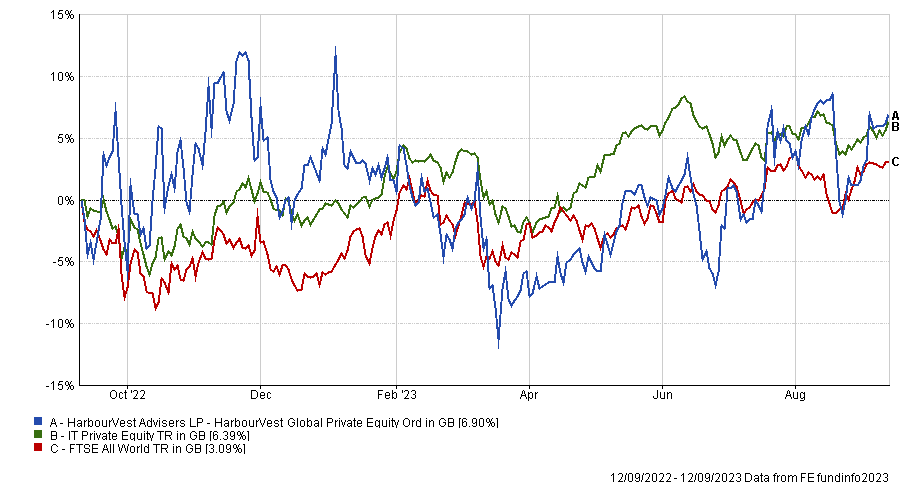

Performance of fund vs sector and index over 1yr

Source: FE Analytics

These remain on “statistically-significant” discount levels and Howe’s analysis of historical data suggests that these uncomfortable moments have a habit of providing “outsized upsize”.

He particularly highlighted HarbourVest Global Private Equity for having delivered 5.4% annualised outperformance of the FTSE All World index over the past decade and for its highly diversified approach.

“It invests in more than 1,000 material private companies around the world and the team has a demonstrable track record of capturing more outperformers whilst helping to reduce risk,” he said.

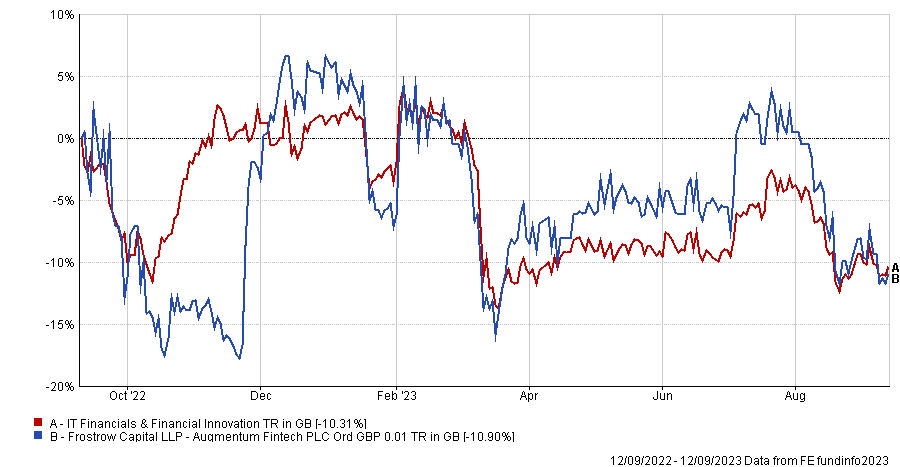

Performance of fund vs sector and index over 1yr

Source: FE Analytics

Meanwhile, Augmentum Fintech’s net asset value (NAV) grew 2.4% in the 2023 financial year, driven by “strong underlying investee company revenue growth” and is another worthy of consideration.

“The market has been indiscriminate in its de-rating of private equity strategies but on a 40% discount this stock looks cheap,” said Howe.

Mick Gilligan, head of managed portfolio services at Killik, said people looking to make moves now may wish to focus on UK small caps.

“Investors have very low expectations of UK smaller company performance, but this weakness is likely to be temporary if valuation is anything to go by,” he said.

“The FTSE Small Cap ex Investment Trust Index trades on a price-to-earnings (P/E) ratio of 11.7x this year’s expected earnings, falling to 7.1x next year’s and 6.3x the following. Profits are expected to grow by 80% over this period, according to consensus forecasts. These are very low valuations and levels from which we would normally see decent share price performance over the subsequent 5-10 years.”

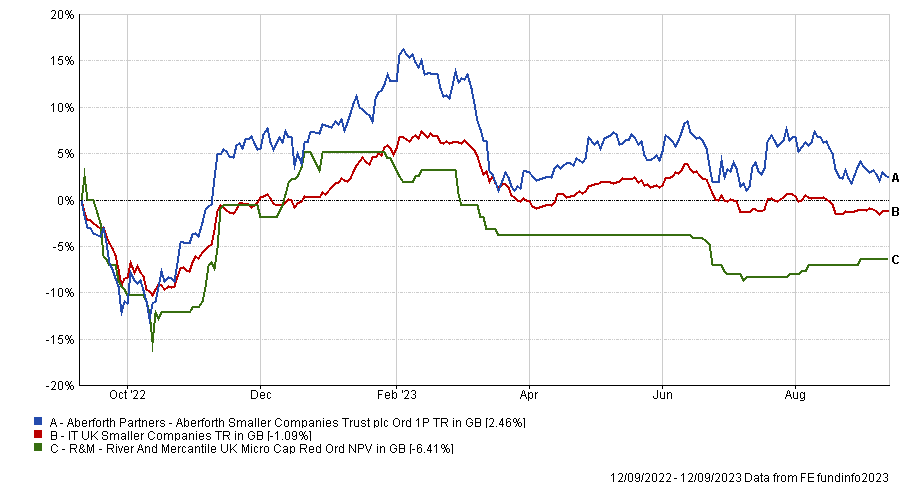

Performance of funds vs sector over 1yr

Source: FE Analytics

In particular, he would focus on the value-driven Aberforth Smaller Companies, which trades on a P/E of 8.6x and is currently on a 14% discount, and River & Mercantile UK Micro Cap, which invests in niche businesses valued at less than £100m. Its portfolio currently trades on an average P/E of 6.3x, whilst the investment trust itself is on a discount of 19%.

For similar reasons to Gilligan, head of investment partnerships at AJ Bell Ryan Hughes picked Fidelity Special Values.

It has an “excellent” long-term track record of being able to exploit the environment Gilligan described with manager Alex Wright “making full use of the deep analyst team at Fidelity and, in particular, the input from Jonathan Winton on smaller company exposure gives the trust a tilt away from the traditional big index holdings”.

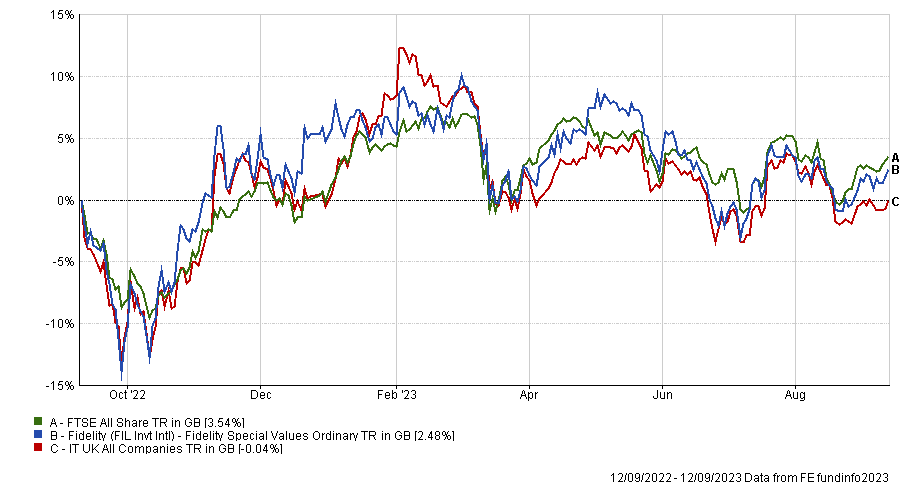

Performance of fund vs sector over 1yr

Source: FE Analytics

“The discount on the trust has drifted out to over 8%, notably wider than its five-year average, which may represent an attractive entry point,” said Hughes.

“With a proven long-term track record, lower than average costs and a stable management team, the trust looks interesting, although investors may well need to be patient given the style of buying out of favour companies.”

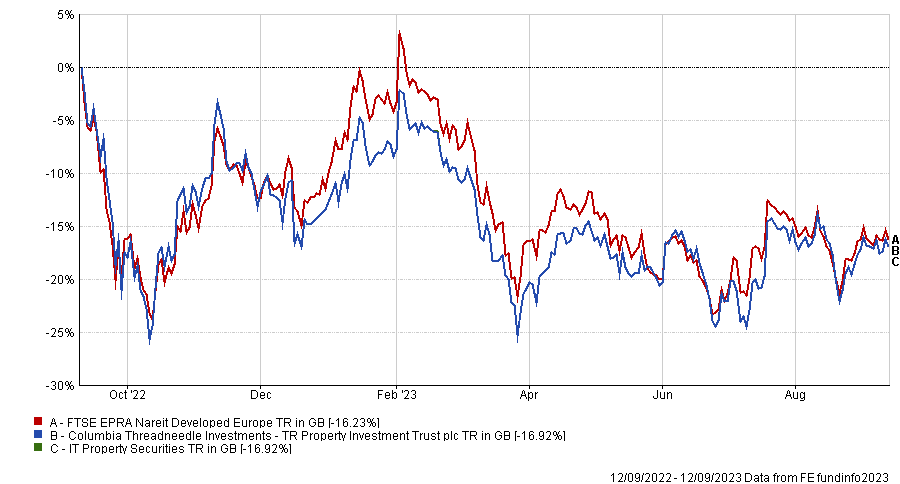

Finally, Hughes also selected the TR Property Investment Trust. Commercial property has had a tough time amid a backdrop of rapidly rising interest rates and slowing economic growth. Add in a tarnished investment structure from the open-ended market and it’s understandable why many investors are shunning the asset class.

Performance of fund vs sector over 1yr

Source: FE Analytics

However, these risks have been priced in for some time and, as we edge closer to the end of the interest rate rising cycle, there may be value starting to emerge in the asset class, according to Hughes.

“TR Property has a high-class manager in Marcus Phayre-Mudge, who knows the property market inside out and has proven over many years that he is capable of navigating challenging conditions,” he said.

“The trust increased its dividend over the past year and is now yielding well over 5% all while sitting on a discount of close to 10%. While there will no doubt be some bumps on the road, using Warren Buffett’s approach of being ‘greedy when others are fearful’ could well prove to be beneficial for those prepared to take a long-term view.”