Sometimes managers get a moment in their careers that really open their eyes, shaping their portfolio accordingly to take advantage of a once-in-a-lifetime opportunity.

For Mark Baribeau, manager of the $631.53m PGIM Jennison Global Equity Opportunities fund, his experience came in December 2022 courtesy of a trip to Silicon Valley.

“It was like going through Death Valley, it was like there was a recession in Silicon Valley, the only recession you could find in the world. Tech companies were laying off people, they had overbuilt during the pandemic – or at least demand was pulled forward. It was bleak,” he said.

“However, we had the opportunity to ask companies about ChatGPT and generative [artificial intelligence] AI, and they were all pivoting. Whatever their product roadmap was, they were switching. They would say: ‘We have to have these technology embedded in our applications and productivity processes’.”

One of the things that is underappreciated is all tech innovation is led by tech companies, Baribeau said. They are the early adopters of all new technology, which they embed in their own process first.

“That's why we gained confidence that this is going to be a big deal.”

But tech companies using AI was only one part of the equation. The second, and equally important, was the adoption by users around the world.

“When ChatGPT first came out, we were stunned by it. Of course we all downloaded it and tried it out. It's an amazing large language model that a user can interface with and was very powerful. Then we tracked the app downloads,” he said.

“ChatGPT is the fastest app in history to reach 100 million users, exponentially faster than Instagram, Spotify, Facebook, Twitter and Netflix.”

So after it came out on 29 November 2022, Baribeau realised that he and his co-managers had to take a hard look at their tech positioning, asking themselves: Are we in the right areas for what could happen?

It was then that they started undertaking the biggest rotation in their portfolio this year by reducing healthcare exposure and increase technology to take advantage of depressed valuations in tech.

“Number one reason was the US Chips Act and all the growth in semiconductor manufacturing that's going to occur in the US. Then depressed multiples in software and generative AI,” he said.

“There were a lot of factors at play and we were getting into a turn in the market where fundamentals were no longer deteriorating. So we were selling healthcare, which is more defensive, to align the tech portfolio with the new AI boom.”

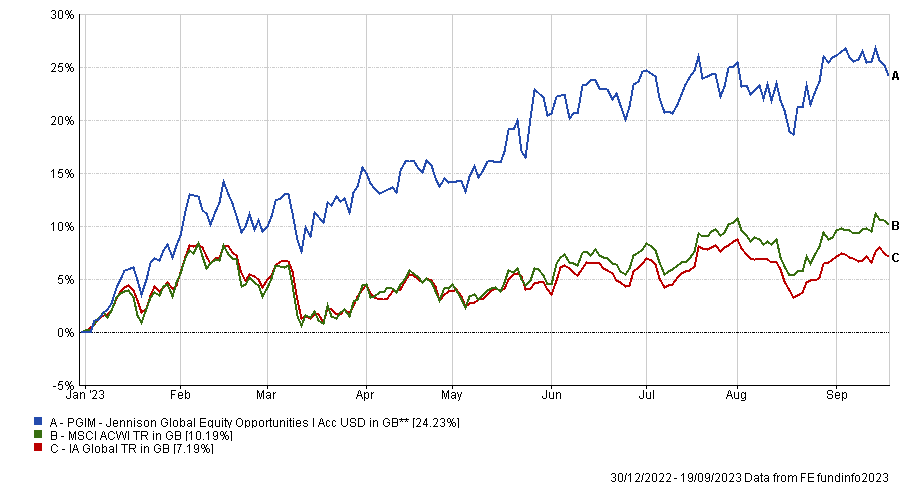

It has worked out for the fund, which he co-manages with Thomas Davis and Rebecca Irwin. It is the third-best performer of the whole IA Global sector so far this year, up 26% thanks in no small part to its largest holding, chip maker Nvidia, which makes up 9.3% of the portfolio.

Performance of fund vs sector and index over YTD

Source: FE Analytics

“We already owned it, but we had cut it back for the negative inventory cycle it was going through in gaming,” said Baribeau.

The stock is part of the roughly 46.6% invested in the telecom, media and technology sector, an allocation Baribeau said “didn’t happen by accident”.

Other stocks they bought included software firms Broadcom and Cadence Design Systems, as the new chips require “enormous complexity and design”, as well as online security firms Palo Alto Networks and Arista Networks, which benefited from a rise in cloud-based data traffic.

“We built an entire cluster around AI, and it's obviously worked year-to-date. That's a big reason for the performance this year,” the manager said.