Taking risks is a natural part of the investment process, but some strategies and asset classes can be riskier than others. While there is value to be found in the more cautious strategies, some investors may prefer a more aggressive approach, in the hope that higher risks may result in even greater rewards.

Below, Trustnet asked experts for their adventurous fund picks for 2025, targeting a range of opportunities that might be able to deliver substantial returns in exchange for higher risks.

Blue Whale Growth

Fairview Investing’s Ben Yearsley identified the £1.2bn Blue Whale Growth fund, led by the FE fundinfo Alpha Manager Stephen Yiu, as an attractive opportunity for adventurous investors.

Yearsley said: “It has been a mainstay for many years now, despite the odd wobble along the way."

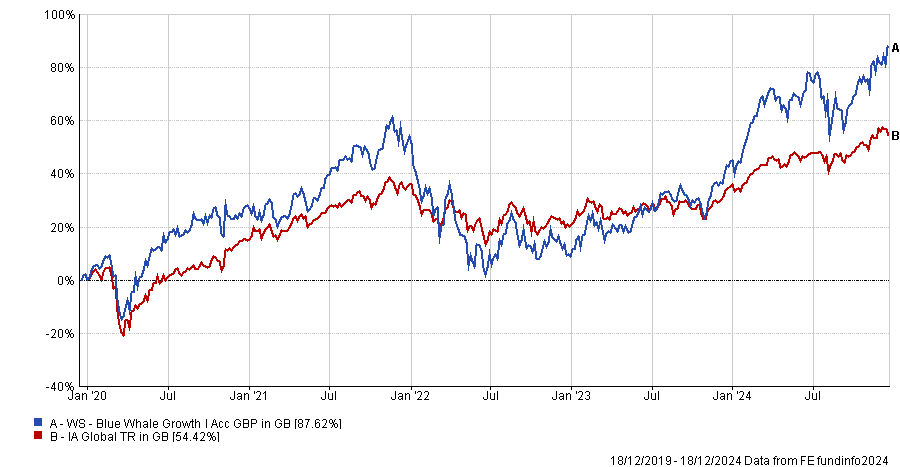

Over five years, the fund has delivered a top-quartile performance of 87.6% in the highly competitive IA Global sector. While a poor 2022 caused a decline to the second quartile over three years, it has since rallied back into the top quartile.

Performance of the fund vs the sector over 5yrs

Source: FE Analytics

Yearsley explained that part of the fund’s appeal came from its “unashamed growth focus”, with a highly concentrated portfolio of 30 stocks, a large portion of which are weighted towards quality technology companies such as Nvidia.

Moreover, Yearsley argued that the strategy benefitted from a “hungry young team” willing to take some risks to deliver supranormal results. For example, despite being in the bottom quartile for volatility, it achieved a second-quartile Sharpe ratio, indicating strong risk-adjusted returns.

Additionally, while still an aggressive strategy, Yearsley noted that it has gradually begun to diversify into other high-growth industries, such as fashion through holdings such as Moncler.

Fiera Atlas Global Companies

Sticking to global equities, Jason Hollands, managing director at BestInvest, suggested the £1bn Fiera Atlas Global Companies fund.

This is another concentrated portfolio, which holds around 25-35 “exceptional” stocks, leading to a wide divergence from the MSCI All Country World index.

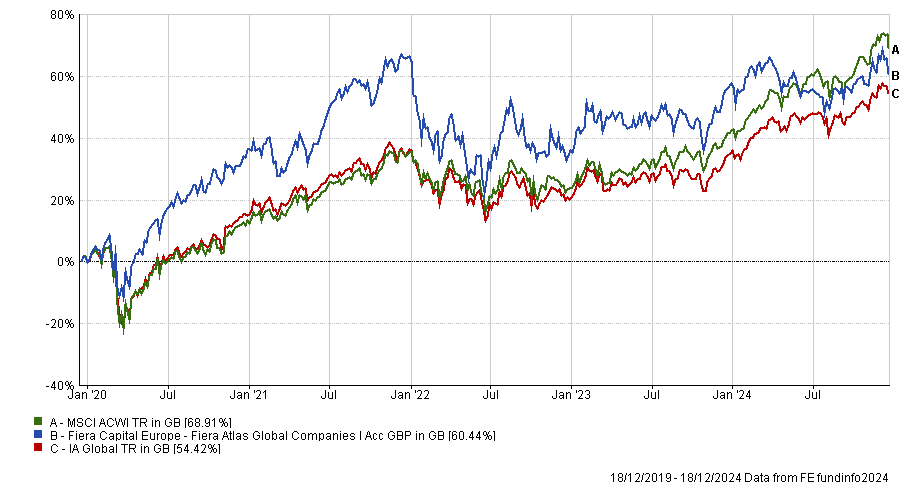

Following a second-quartile five-year return of 64%, the portfolio fell to the bottom quartile over the past three years, due to limited exposure to the ‘Magnificent Seven’ firms, Hollands added.

Performance of the fund vs the sector and benchmark over 5yrs

Source: FE Analytics

However, Hollands argued that this lack of exposure to the ‘Magnificent Seven’ was part of the strategy's appeal, making it well-suited as an additional holding for investors who already have exposure to the mega-tech stocks, or those who are concerned about their valuations moving into 2025.

Moreover, he explained that the fund “has strong risk-adjusted returns, so it should be considered high conviction rather than aggressive”. Indeed, with a five-year volatility of 17.6%, it has posted a second-quartile Sharpe ratio of 0.4 in this period.

WS Amati UK Listed Smaller Companies

For those UK investors who were a bit more optimistic about the home market, Darius McDermott, managing director at Chelsea Financial Services, pointed towards the £306m WS Amati UK Listed Smaller Companies strategy, which was also a favourite choice for experts last year.

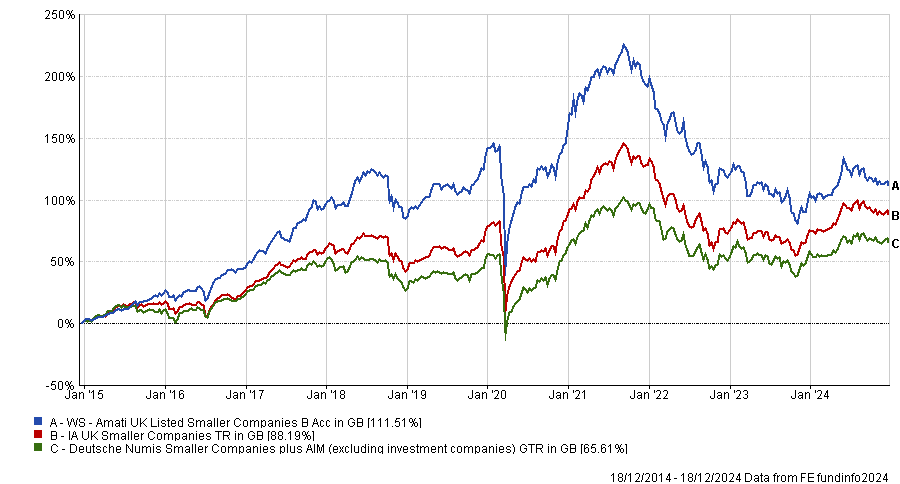

While the fund returned a second-quartile 10-year performance of 111.5%, it has struggled more recently, falling to the bottom quartile over five, three and one year, due to the various headwinds which have faced the UK since 2021.

Performance of the fund vs the sector and benchmark over 10yrs

Source: FE Analytics

While the resurgence of UK small-caps did not manifest this year, McDermott argued that “history tells a different story – over most long-term horizons, small caps consistently outperform their larger counterparts”.

McDermott noted that due to the recent underperformance of UK small- and mid-cap companies, a variety of high-quality UK businesses are being “dramatically undervalued” compared to their fundamentals.

He concluded that for those investors with a high-risk appetite and a long-term time horizon, Amati's strategy would make for an attractive addition to their portfolios.

Seraphim Space Investment Trust

For investors hoping to play on a specific industry, Emma Bird, head of investment trust research at Winterflood, identified the £131m Seraphim Space Investment Trust as an interesting opportunity.

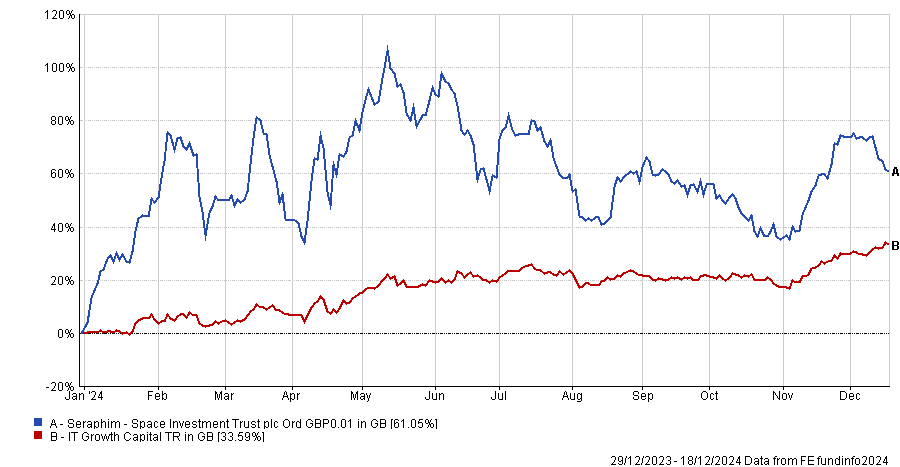

While the portfolio has slid by 55.3% over three years, its recent record proved more positive. Year-to-date, this space tech trust has rocketed in value by 61%, which Bird added made it the “best-performing investment trust YTD from a total return perspective”.

Performance of the trust vs the sector in 2024

Source: FE Analytics

Bird attributed this surge in performance to the substantial undervaluation of its assets by the market, primarily because of the higher interest rate environment.

Moreover, she explained that the trust was fundamentally stronger than these valuations suggested, with many of its companies growing significantly this year in line with macro trends such as geopolitical tensions and the push for global connectivity.

Moreover, she argued that it was an extremely effective play for the long-term macro environment. President-elect Donald Trump’s policy is expected to consist of heightened defence spending and Elon Musk, founder of SpaceX, operates in “close cooperation” with Trump, all of which should provide a favourable backdrop for the trust.