The World Series is an annual major league baseball championship in which only American teams complete. The MSCI World index is going the same way: global by name but American by nature.

As Adam Norris, an investment manager in Columbia Threadneedle’s multi-manager team, said: “America First is proving to be representative of equity markets, not just presidential campaign rhetoric.”

With 74% of the benchmark now in US stocks, a central question for global equity managers as they prepare for 2025 is whether US exceptionalism can continue.

Jeffrey Schulze, head of economic and market strategy at Clearbridge, votes yes. “We believe that three of the four key components of exceptional relative US economic growth – the consumer, productivity gains and a solid fiscal impulse – remain intact, while the fourth, growing labour supply, will likely come under pressure, though not enough to derail the expansion in 2025,” he explained.

“We are bullish on the US economy in the year ahead and expect GDP growth to deliver an upside surprise relative to current consensus forecasts.”

James Thomson, who manages Rathbone Global Opportunities, thinks Donald Trump’s pro-growth, America First agenda is “all sugar and no vegetables” for the stock market. “In the short term, investor giddiness will continue as a wave of liquidity goes into US equities,” he predicted.

Trump’s unpredictability is, however, a problem. “Trump’s passions are fickle. Mania may evaporate for stocks deemed to benefit from regulatory rollbacks, uninhibited M&A and big tariff increases that manage to somehow avoid causing a trade war,” the FE fundinfo Alpha Manager warned.

“To mitigate the impact of upcoming whack-a-mole markets, we want to maintain balance and diversity by sector, demand drivers and growth volatility.”

Nonetheless, the future looks bright. “Bull markets are derailed by recessions, irrational exuberance, or an uncooperative Federal Reserve. None of these are in evidence at the moment, so the bull market will likely continue,” Thomson concluded.

Peter Branner, chief investment officer of abrdn, agreed that Trump is a wildcard. “Moving into 2025 there is significant uncertainty about the precise contours of the coming policy shifts under the president-elect,” he said.

“There is a substantial risk that the Trump administration proves much more disruptive than we are expecting, both to the upside and downside in terms of economic and market outcomes. And there are scenarios in which Trump’s policy agenda proves even more supportive for growth and market sentiment.”

Natasha Ebtehadj, co-manager of Artemis Global Select, believes 2025 will be a good year for US domestic plays and expects industrial activity to pick up.

Although concerns about US equities being too expensive are rife, she thinks investors are underestimating corporate earnings growth. “Earnings growth has explained nearly half of the US market’s returns [in 2024] so the rally has been justified by improving fundamentals. Investors may be underestimating the US and its ability to grow into its valuation,” she argued.

Naomi Fink, chief global strategist at Nikko Asset Management, made a similar point. “It is undeniable that US equity markets, which are highly concentrated, are richly valued when historical and geographical comparisons are made. Despite this, there are few apparent catalysts to bring equity prices immediately lower. This is largely due to double-digit earnings growth that continues to exceed expectations alongside accommodative financial conditions,” she explained.

“Our overall outlook for US earnings remains upbeat but we believe valuations may have peaked and we expect index gains to lag earnings growth in 2025.”

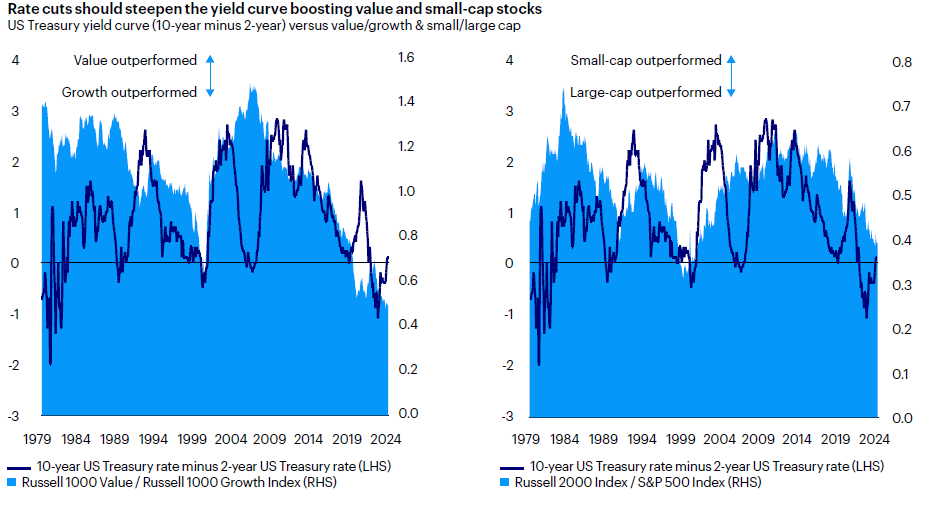

Improving revenues, monetary policy easing, tax cuts and deregulation should result in greater earnings growth for value and small-cap companies in particular, leading to a market rotation into these areas, said Kristina Hooper, chief global market strategist at Invesco.

Lower rates should encourage a rotation within US stock market leadership

Sources: Bloomberg and Invesco as of 31 Oct 2024

In a similar vein, Stephen Auth, chief investment officer for global equities at Federated Hermes, is tilting towards large-cap value and small-caps, in light of Trump’s pro-growth, low tax, America First agenda.

Performance broadening out from under the mantle of the Magnificent Seven is a key theme, agreed Jon Brachle, co-manager of JPMorgan US Smaller Companies.

“While the Magnificent Seven had dominated market returns in 2023 and early 2024, in the second half of the year, 90% of the S&P 500’s return has come from stocks outside these seven names (through November). Over the same period, the Russell 2000 index has outperformed the S&P 500 index by more than 8%,” he said.

Despite that strong run, Capital Group portfolio manager Julian Abdey observed that the “valuation disconnect between small and larger stocks is one of the highest we’ve seen”.

This year could see a resurgence of geographic underdogs as well.

Melda Mergen, Columbia Threadneedle’s global head of equities, said investors who are questioning the sustainability of US equity returns could look at developed Europe and China, which are relatively inexpensive compared with the past 10 years.

Xavier Baraton, global chief investment officer at HSBC Asset Management, went so far as to say that investors should expect market rotations in 2025.

“We think cross-country growth rates are coming together in 2025. For the US, this means that the recent period of US exceptionalism could fade, however we see little risk of an economic downturn in the next six to 12 months,” he said.

“Meanwhile, Europe is recovering from the cost-of-living shock but we expect GDP and profits growth will pick up in the euro zone and the UK.

“However, the world’s premium growth rates will likely be in Asia and in frontier economies. In China, ongoing policy support should ensure that the economic slowdown is less significant than many forecasters fear. We anticipate India will be the fastest growing large economy in the world and see improving macro fundamentals in south-east Asia and in MENA in 2025.”