The UK market remains one of the most unloved in the world, with investors pulling money from domestic stocks. But that could all be about to change in November if chancellor Jeremy Hunt makes good on his stance to get more cash investing in UK businesses.

That is the view of Gervais Williams, manager of the Miton MicroCap Trust, among other portfolios. The firm has been the driving force behind a potential UK ISA, which would allow investors to ring-fence their savings, allowing tax-free investments into domestic stocks.

“Specifically, when it comes to ISAs, why do we allow tax-free investments to go into the likes of Tesla and nothing goes to the UK? Perhaps we can bring that back so we have a portion of ringfenced money for UK companies,” he said.

While some have been sceptical of the proposal, Williams said he is confident there will be “something substantial” in the upcoming November Budget around the issue, particularly after the chancellor’s comments in a recent article in the Financial Times (FT).

“As we saw over the weekend in the FT, Hunt has said he is inclined to do something about ISAs – he is not going to do nothing. He wants more capital to go to UK companies from ISA investments, which is a sea-change potential,” said Williams.

“If that happens, most ongoing sellers will pause to see how much of an effect this will have. If we do find that the ongoing international buying continues and the local selling stops, I would expect the FTSE 100 to break out on the upside like Japan has this year.”

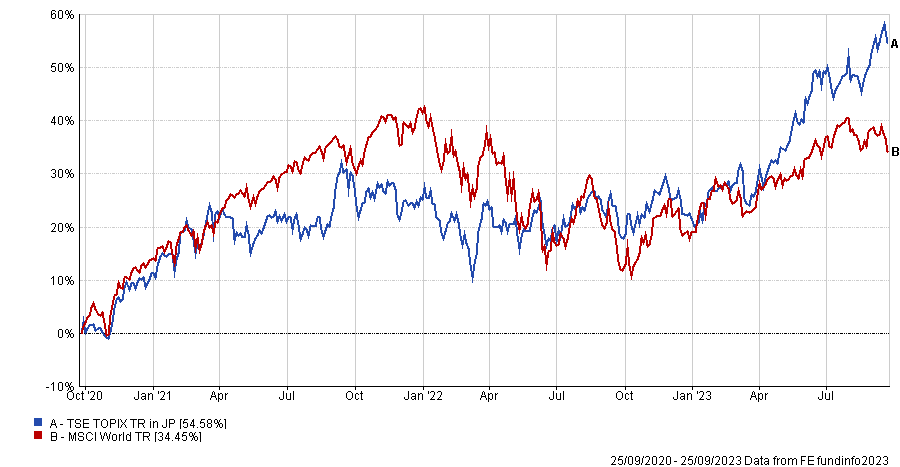

Indeed, the Japanese market has rocketed over the past three years. In local currency terms, it has made 54.6%, beating the MSCI World by around 20 percentage points, as the below chart shows.

Performance of indices over 3yrs in local currency terms

Source: FE Analytics

Williams said he has been engaging with the Treasury and the London Stock Exchange to push forward the UK ISA proposal and that, while he does not know for sure that it will happen, he believes it is “on the cards”.

“I think there is something of a substantial nature coming,” he said.

This is on top of proposals to get pension funds to stop cutting weightings to the UK and start increasing them – something that would have “quite the effect” on the UK market.

This might take three or five years before anything gets done, he noted, adding that he wanted to see something “a bit quicker”.

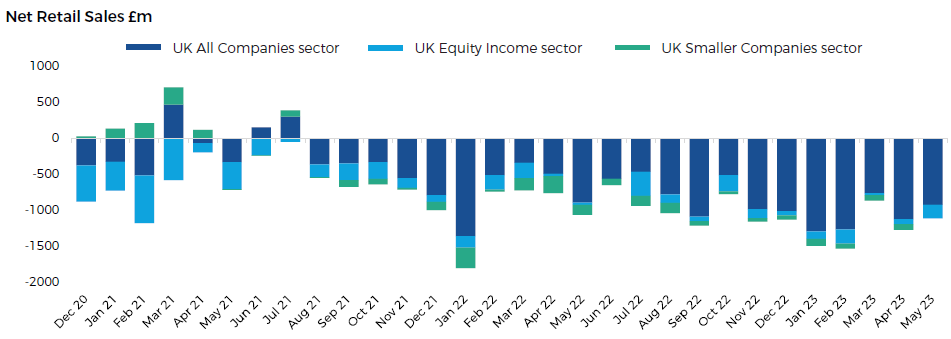

Something clearly needs to be done, he argued, as UK funds have haemorrhaged money over the past few years, as the below chart shows.

Net retail sales of UK fund sectors since December 2020

Source: Premier Miton

However, this is a trend that has gone on for much longer than the past few years. Williams said over the past 20 years investors have used the UK as a “piggy bank”, putting cash in until they have “something more exciting” to put their savings into.

“Since the Brexit referendum that pattern has got worse,” he said, particularly among domestic investors, who have pulled money out in their droves.

Yet over the past three years the FTSE 100 has been one of the best performing markets in the world – something that he attributes to overseas investors.

“International investors have been increasing their weightings to income strategies. They’re not thinking they need the UK, they want to buy global income, which has US and European stocks but has loads of UK equity income as well,” the Premier Miton manager said.

“Tiny bits of change have meant international investors are buying faster than we are selling locally and that has led to the outperformance.”