FE fundinfo Alpha Manager Jeremy Podger, who runs the Fidelity Global Special Situations and Fidelity World funds, and Fidelity’s head of multi-asset Eugene Philalithis are both to retire in early 2024, the firm announced today.

While Fidelity has yet to announce Podger’s replacement, Jupiter’s Talib Sheikh (also formerly at JPMorgan) is to step in as lead portfolio manager across the platform’s multi-asset income solutions, currently run by Philalithis.

Podger, who will remain at the firm in a senior adviser role after he steps back from portfolio management at the end of March 2024, started his career at Investec and then Threadneedle before joining Fidelity in March 2012. Over the past 23 years, he has achieved an annualised total return of 7.7%.

Since his tenure, the Global Special Situations fund has significantly outperformed its index and peer group, as shown in the chart below.

Performance of fund vs sector and index since Podger’s tenure

Source: FE Analytics

Darius McDermott, managing director of FundCalibre, said the manager has had “a very successful career”, beating the average peer by almost 100 percentage points during his tenure of the Fidelity Global Special Situations fund.

“While we wait to hear who the successors on the fund will be, it is reassuring to know that Podger has been involved in the selection process and that he will be ensuring a smooth handover of responsibilities,” he said.

The fund will retain its FundCalibre Elite Rating until the team is able to meet the new managers.

Philalithis meanwhile will leave the firm at the end of March 2024 but is to step back from his fund management duties in January 2024. Like Podger, he will stay on as a senior adviser after his retirement.

He joined Fidelity in 2007, having previously been at Russell Investments where he was responsible for managing approximately $10bn in multi-manager fixed income mandates.

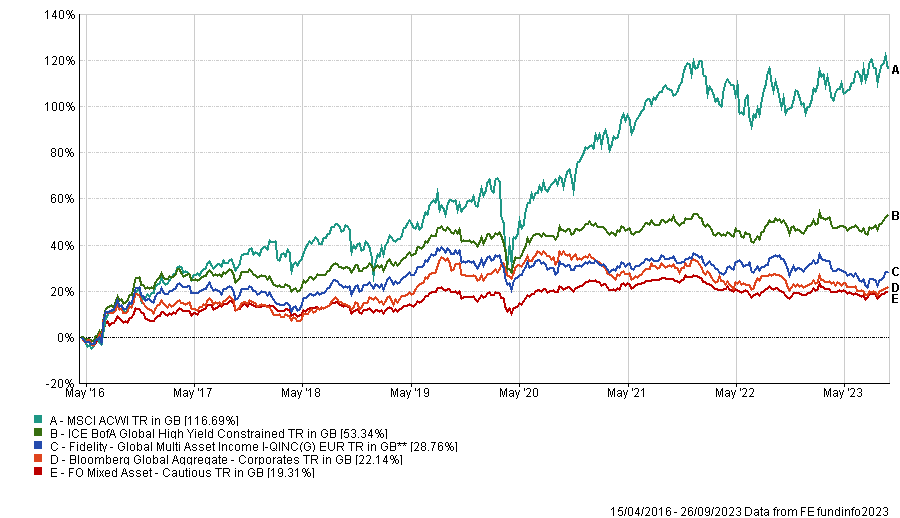

Today, Fidelity’s mixed-asset range reaches £8.6bn of cumulative assets, with the largest fund being the $5.9bn Fidelity Global Multi Asset Income, whose performance is highlighted below.

Performance of fund vs sector and indices since data availability

Source: FE Analytics

Stepping in will be Talib Sheikh, who most recently headed the multi-asset team at Jupiter Asset Management before his exit last year. Before this he was managing director and portfolio manager at JP Morgan Asset Management, growing its multi-asset solutions team over 20 years at the firm.

He will join Fidelity later this year, taking over the multi-asset income funds including Global Multi Asset Income and the Fidelity Multi Asset Income range, which includes three portfolios.

“I’m excited to be joining a team with such broad and deep investment capability and look forward to continuing to deliver income-oriented solutions for the global client base,” he said.

Mario Baronci has also been appointed portfolio manager and will join Fidelity in the autumn from Quaestio Capital Management in Italy, where he was head of multi-asset for nearly 10 years.

Henk-Jan Rikkerink, global head of solutions and multi-asset at Fidelity International, said: “The challenges facing investors over the coming years will require a more robust investment platform and broader range of expertise along with a team-based focus when it comes to our investment process and decision-making.”