Cyclical companies are out of favour with investors who dislike their volatile nature but they have become far more stable than investors are giving them credit for, according to TB Saracen Global Income and Growth managers Graham Campbell & Bettina Edmondston.

Sectors such as industrials have an outdated reputation as being extremely cyclical, yet many of these companies have “fundamentally changed” in recent years.

“We have clients that tell us they don't want us investing in that space because it's too cyclical and too highly leveraged, but that just tells you they haven't looked at these companies in years,” Edmondston said.

Rather than being cyclical, Campbell argued that these types of businesses could actually deliver some of the fund’s strongest returns over the coming years.

“Growth is too expensive, defensives are too expensive, and the part that has been left behind is the cyclical industrials,” he explained, “What the markets have missed more than anything is that many of these businesses have fundamentally changed their model over the past five years.

“The multiples of these companies are worth about the same, but they now earn a higher return on capital, have higher margins and are less cyclical. That's really just starting to come through, so has a long way to run as people haven't realised they’ve changed.”

Campbell and Edmondston are so confident in the investment case for these cyclical businesses that they dedicated 68% of the £145m portfolio to them.

Indeed, their 28.1% weighting towards industrials alone is 14.7 percentage points higher than the IA Global Equity Income sector average, with the managers stating that markets have been slow to realise their long-term potential.

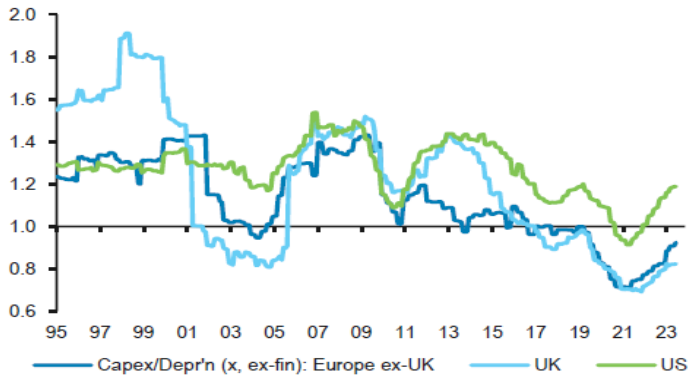

One of the key reasons for their bullishness is capital expenditure (capex), which has steadily been on the decline for the decade following the 2008 financial crash, so Campbell and Edmondston expect a reversal of this in the coming years.

Ratio of capex to depreciation in major regions since 1995

Source: Saracen

“There was no capex spending, interest or inflation over the past 10 years, so it's a very different environment we’re coming into,” Edmondston said.

This lack of spending has caused a mass of outdated assets that need replacing or upgrading, but Edmondston said this could take longer than expected.

He noted that many will have an energy transition element to their spending, which should drive greater efficiency over time and those at the forefront will have greater market share, pricing power, and will become much less cyclical over time”.

This was echoed by Zehrid Osmani, who invested 10.8% of the Martin Currie Global Portfolio Trust into industrial companies. He said the mass of spending needed for the green energy transition puts these areas in a prime position to do well in the coming years.

“It is important to look at that sector on a long-term basis,” he said. “There will be down years through the cycles, but generally those industrial companies can more than cover their cost of capital, have solid balance sheets that can see them through and have exposure to long-term structural growth themes of infrastructure spending.”

Edmondston also stressed the importance of taking a long-term view in this area. These types of cyclical businesses are very cheap, but that is likely to change once the large volumes of capex spending take effect.

Investors became excited about these companies when Joe Biden unveiled the Inflation Reduction Act last year, which committed $500bn towards clean energy infrastructure, but became disheartened when they didn’t see immediate results.

“We can see it coming but we know it's not going to come this year – and it's probably not going to come next year either – but it will eventually,” Edmondston said.

“That’s why you have to be invested ahead of time, because you wait to see the numbers coming through, the market has already moved on. If you have a really solid company that can give you sustainable growth at an attractive valuation, it doesn't matter when you buy it so long as you’re in it for the long term.”

If the economic environment is more strained over the coming years as Campbell and Edmondston anticipate, investors will want to be in these businesses and eschew the consumer staples, which have been a go-to for safety over the past 10 years.

“As things are slowing down, people are buying more defensives to hold up them up in that environment,” Campbell explained.

“We used to own lots of those defensive names – things like Colgate and McDonald’s – but we sold them because they became much more expensive without growing any faster. During a recovery, do you buy more Pepsi? I wouldn’t have thought so.”

Just as markets have failed to update their view on cyclicals, they have not renewed their perception of consumer stocks. Known as ‘bond proxies’ these companies rocketed over the past 10 years during the era of low interest rates, when investor coveted their relatively high dividends and consistent (albeit mediocre) growth.

“The risk is that as things get tougher and investors have an option to invest somewhere else for yield, their high valuations will come down,” said Edmondston.