It has been five years since the launch of the Mobius Investment Trust, which came to market with the aim of offering a differentiated emerging markets portfolio to investors.

Unlike most of its peers, the trust focuses on mid- and small-caps, with a bias towards the technology sector and a strong underweight to China, preferring instead Taiwan, India and South Korea.

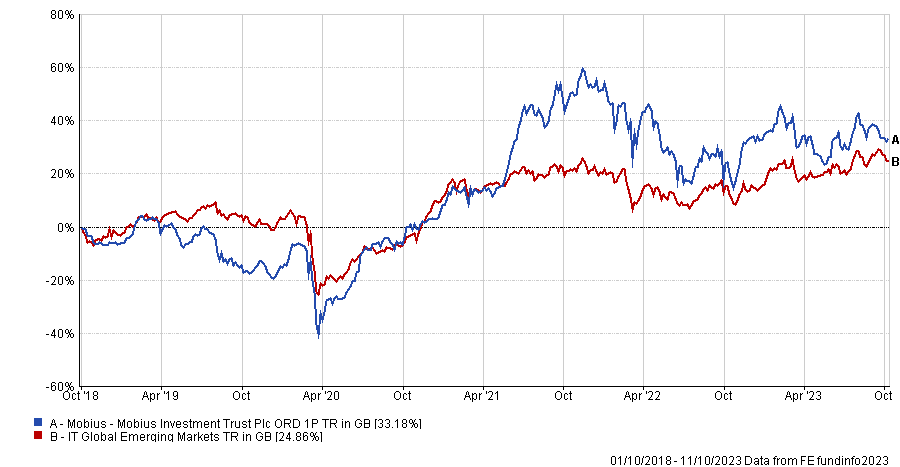

This approach has paid off until now, as the trust has beaten its peers of the IT Global Emerging Markets sector by more than 8 percentage points since launch.

Performance of trust since launch vs sector

Source: FE Analytics

Below, manager Carlos Hardenberg, tells how he manages the risks associated with emerging markets and small-caps, highlights the importance of environmental, social and governance and explains why he is optimistic about India.

Could you explain your investment process?

There are tens of thousands of listed businesses in emerging markets, which are not in the benchmark yet, so we provide access to them for our investors. We try to find the most exciting, performance-generating and overlooked companies with a particular edge.

We have the ability to invest across the entire market-cap spectrum but the sweet spot for us is businesses that have an average market capitalisation of $3bn to $5bn or what I would call medium-sized enterprises.

Our preference goes for conservative businesses that have a sustainable and robust balance sheet without excessive leverage.

Emerging markets and small-caps are considered to be riskier. How do you manage the combination of those two risks?

We spend at least 70% of the time focusing on the risks associated with our companies. We hate to lose money, so we're always asking ourselves where our thesis can go wrong.

The macroeconomic context is important to us and we take into consideration things such as the political situation, regulatory problems, currency-related risks or the robustness of the banking system within individual countries.

These guardrails have helped us to steer away from countries where you may find the occasional strong corporate but where there is too much to lose on the macro side. For example, we had no exposure to Russia when the war broke out.

We also have no direct exposure to China, although there are some very interesting trends in China such as alternative energy, electric vehicles and technology in general. Instead, we have chosen companies listed in other emerging markets that know how to cater for the Chinese market in order to participate and benefit from these trends.

Technology accounts for around 60% of the portfolio. Doesn’t it create a concentration risk?

You have to break down our technology weight, which is a mix between software and semiconductors. Within the semiconductors space, we focus on IC design, which is essentially the know-how or the libraries and the maps used to produce chips, but we do not hold hardware businesses.

Our semiconductor holdings are intellectual property-based businesses and, therefore, asset-light. They serve different clients and industries and are not tight to any sector or geography. That is a mitigating factor.

On the software side, we invest in businesses that are not facing any regulatory risk per se. Our software holdings draw a large portion of their revenue from subscriptions. They benefit from long-term and sticky relationships with their clients and are globally diversified.

The biggest risk for our portfolio in relative terms would be a substantial mean reversion in the Alibabas and Tencents of this world in the next 12-24 months. If there is suddenly an environment where everything is rosy again and these companies can double or triple in size with everybody getting greedy on Chinese assets, then we would probably suffer, but I'm okay with this.

What have been your best and worst performers in the past 12 months?

There are two areas that really worked well for us this year. The first one is India with Apollo Tubes, which is one of the leading lightweight steel part manufacturers for infrastructure in both the public and private sectors. This was a small company, but they have increased capacity and are generating consolidated market share.

Korea is the other area that delivered for us. We invested in a business called Classys, which is a leading producer of aesthetic medical devices based on ultrasound. They are exporting to Latin America, Europe and Asia. As supply chains normalised and global trade picked up, it has done extremely well.

The main detractor was Safaricom, a Kenyan telecommunications provider innovating financial transactions through its offering of M-Pesa. As a major constituent of the domestic stock market, its share price has been impacted by a difficult macroeconomic environment following the Covid-19 pandemic. Fuel and food price shocks, a historic drought, and mounting sovereign debt led to an overall negative view on the country by many investors and put significant pressure on the Kenyan shilling.

During a recent meeting on the ground in Nairobi, the company re-confirmed its investment case as customer sentiment in the country remains positive, and looking towards the upcoming opportunities in expanding M-Pesa beyond Kenya’s borders. As of last month, the payment systems has gone live in Ethiopia.

Are there holdings you have sold and new positions you have entered recently?

We had to take profits from some of our Indian names such as Persistent Systems and Apollo Tubes. We are mindful about position size and valuations and they have actually reached levels which are close to our target values.

We recycled some of the profit into new ideas such as Hitit, which is a leading airlines software developer based in Turkey. We have also introduced Park Systems (Korea) and MapMyIndia (India) in the portfolio.

How do you engage with your investee companies? Can you provide an example of when engagement worked and one when it didn’t?

We try to assist companies to become leaders in transparency and governance, ensuring they have optimal board compositions and that they ultimately obtain a robust ESG rating as this impacts a company’s cost of capital as well as its reputation and can make it more or less investable.

When we started investing in Apollo Tubes, it was a small company which needed more independent representation on the board. It also needed to improve the investor relations, the quality of its annual reports and it did not have an ESG report.

We pushed for those four areas to be addressed and the company answered positively. It has improved its independent board representation, hired an investor relations team, engaged with advisers to begin to report ESG goals and targets, and issued a comprehensive ESG report.

A company with whom engagement did not work was Brilliance China, which we had in the portfolio initially. We tried to push for the implementation of an independent board and for the company to put in place minority protections, but nothing worked. It actually got worse.

What is your view on ESG?

My view on ESG is irrelevant, because you can no longer ignore it whether you believe in it or not.

I've always believed in the importance of governance. That needs to be in place. You have plenty of examples of companies that went into catastrophes because of poor governance.

As for the social aspect, a company's culture is absolutely important. Why? Because you can only retain and attract the best talents in the industry if you have a robust cultural base. Nobody wants to work for a company with a toxic culture.

What is your outlook for emerging markets?

There's a lot of focus on risks such as inflation, the war in Ukraine, the slow recovery in China and industrial processes like friendshoring/nearshoring but there are opportunities in India and Southeast Asia.

India is benefiting and will continue to benefit from this situation as they are attracting more direct investments. A lot of the global industrial participants’ production capacity is being reallocated to friendlier nations. At the same time, India is benefiting from having access to cheap energy right now, but also from an infinite pool of talents, a pro-business government and very good policies in place.

Vietnam is also in the pole position to attract foreign direct investments. Then, Thailand is seeing a recovery in tourism and we expect more of that to come through in a post pandemic recovery environment.

Lastly, I continue to think Brazil will have an easier pathway over the next three to four years. There used to be political volatility, high interest rates, consumption and export markets were weak, but we Brazil is now gradually recovering.